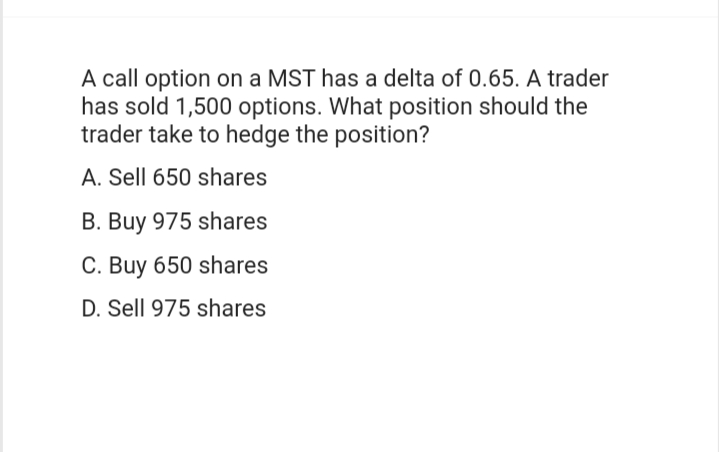

A call option on a MST has a delta of 0.65. A trader has sold 1,500 options. What position should the trader take to hedge the position? A. Sell 650 shares B. Buy 975 shares C. Buy 650 shares D. Sell 975 shares

Q: a) What is the price of a European put option on the same stock that expires in 8months and has a…

A: Using Put Call Parity formula, we can determine the price of the put option. The formula is as…

Q: A3-2 A project has costs and incomes as shown on the diagram in thousands of dollars. C = Capital,…

A: C = Capital Cost I = Income OC = Operating Cost L = Salvage Value Time period is 6 years and minimum…

Q: nvestors choose deri tives

A: derivatives are financial instruments whose value is derived from an underlying asset such as bonds…

Q: Calculate the rate of return on a price-weighted index of the three stocks for the first period (t =…

A: A price-weighed index represents a stock index where each firm included makes up for part of the…

Q: A firm is considering the project who have following cash flows Aways Year Rs. Year Rs. 3 4 5 0 1 2…

A: Net Present Value (NPV) of the project is the sum of the present value of all expected cash flows.…

Q: You've collected the following information from your favorite financial website. 52-Week Price Lo…

A: Required return refers to the minimum return to be earned on the amount of investment made by the…

Q: a) A firm has sales of R23, total assets of R39 and total debt of R7. The net profit margin is 4%.…

A: Return on Equity A company's net income is divided by the equity of its shareholders to calculate…

Q: The ultimate authority of a fund's track record is its current profile prospectus.

A: the ultimate authority of a funds track record is not its current profile prospectus but includes…

Q: Who is the minister of finance

A: Introduction: Ministry of finance is concerned with financial legislation, Union budget, taxation,…

Q: You buy an annuity that will pay you $24,000 annually for 25 years. The payments are paid on the…

A: This problem belongs to finding out the present value of annuity due. When annuity occurs in the…

Q: Future Motors recently paid $3.30 a share annual dividend. Dividends are expected to increase by…

A: Dividend paid = $3.30 Growth rate = 2.75% Required rate of return = 15%

Q: man acquires a loan of P500,000. He will amortize his loan by 10 annual payments but will commenc…

A: Loans are paid equal annual payments and these payments carry the payment for interest and also…

Q: Sam Long anticipates he will need approximately $225,100 in 10 years to cover his 3-year-old…

A: we need to discount future value into present value by applying the discount factor given in table…

Q: Which market activity is greater than the others? O Primary issuance in global debt markets O…

A: Buying and selling shares from other investors takes place on the secondary market, which is similar…

Q: Estimating Share Value Using the DCF Model Following are forecasted sales, NOPAT, and NOA for…

A: DCF stands for Discounted Cash Flow, which is a financial valuation method used to estimate the…

Q: Year 2004 2005 2006 2007 2008 C. d. Stock A's Returns, ra (18.00%) 33.00 15.00 (0.50) 27.00 Stock…

A: As per our guidelines, we are supposed to answer only 3 sub-parts (if there are multiple sub-parts…

Q: Melissa was supposed to pay Erik $4,100, 6 months ago, and $1,760, 5 months from now. If she wants…

A: The PV of an investment refers to the value of the cash flows of the investment at present after…

Q: Profile Co has the following assets and liabilities: Assets: Cash $100 , account receivable,$150 ;…

A: The long term Assets are said to be the assets which will have longer lifespan and these will…

Q: Projects associated with a business plan will require funding. The funding request is a critical…

A: An extensive document that describes the objectives, plans, and daily operations of a business is a…

Q: Calculate the estimated price of the bond, using the first-order

A: The first-order modified approximation formula is used to estimate the change in the price of a bond…

Q: The bonds issued by United Corp. bear a coupon of 5 percent, payable semiannually. The bond matures…

A: Compound = Semiannually = 2 Coupon rate = 5 / 2 = 2.5% Time = nper = 19 * 2 = 38 Face value = fv =…

Q: 3) Imagine that you can borrow or lend at a risk-free rate of 3.20% in the US, and you can borrow or…

A: As per the Honor code of Bartleby we are bound to give the answer of first three sub part only,…

Q: Rework Table 7.4 for horizon years 1, 2, 3, and 10, assuming that investors expect the dividend and…

A: The value of a share represents the current worth to the buyer and seller & is determined by the…

Q: Sheryl’s Shipping had sales last year of $18,000. The cost of goods sold was $8,100, general and…

A: The EBIT refers to the measure of the profitability of the company. It accounts for all the expenses…

Q: Westchester Water Works Systems is considering a project that has the following cash flow and cost…

A: The MIRR refers to the measure of a project’s profitability where the rate of financing the project…

Q: "Consider the following 4 options on TSLA: (1) 1-year 30-delta call, (2) 1-year 30-delta put, (3)…

A: Delta represents a measure for analyzing risk and is primarily used by traders. It shows the change…

Q: Q7: A father wants to save for his eight-year-old son's college expenses. The son will enter college…

A: Amount needed in 10 years = 40000 ( 1+0.06)^10 = $71,633 Year Amount needed in Constant $…

Q: Laura wants to buy a delivery truck. The her to increase her after tax profits by $3 She will horrow…

A: The difference between the current value of cash inflows and outflow of cash over a period of time…

Q: Given below is the financial information for Tesla, a uniquely French all-natural artisanal soda.…

A: Degree of operating leverage helps in understanding how much the operating income of the company…

Q: y”. The product would incur a total variable cost of P18 per unit to manufacture and sell. The plant…

A: Formulas are as shown below. Breakeven point=Fixed cost+Interest expensePrice per unit-Variable…

Q: The current USD/GBP exchange rate is 1.8 dollars per pound. The six-month forward exchange rate is…

A: Interest Rate Parity refers to the concept in the foreign exchange where any investor have an…

Q: 3. Given the monthly payment as shown with interest as 1 % per month. Month 100 110 B 121 1 133.1 Up…

A: Value of money increases with time due to compounding of interest but there is much larger growth…

Q: Find the ratio of the present value of B's share to D's share.

A: Let's denote the payment amount as P, and the present value of A's share as V_A, B's share as V_B,…

Q: Calculate the annual interest that you will receive on the described bond. A $500 Treasury bond with…

A: A treasury bond is a kind of debt security issued by the government and private companies for…

Q: Green Foods currently has $500,000 of equity and is planning an $200,000 expansion to meet…

A: The net income refers to the actual profit that the company makes after it has paid all its…

Q: You are considering investing in a project with an initial outlay of $50,000 and the following year…

A: Internal Rate of Return better known as IRR is a discounting capital budgeting technique. IRR is the…

Q: Compute the total and annual returns on the described investment. Six years after buying 200 shares…

A: Total Return = [ Sale value - Purchase value ] / Purchase value Annual Return = [ Total return *…

Q: Country Bank has $350,000 of 6% debenture bonds outstanding. The bonds were issued at 106 in 2021…

A: Debenture issued at premium of 106 Total amount = $350000 Interest rate = 6% Maturity = 20 years

Q: 7. Complete the last four columns of the table below using an effective tax rate of 40% for an asset…

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: What price must you pay

A: To determine the price you should pay for the stock now, we can use the dividend discount model…

Q: What will be the value of common stock if you hold the stock for two years and sell it for $60?…

A: To calculate the value of the common stock, we can use the dividend discount model (DDM). The DDM…

Q: the internal rate of return for this investment opportunity is closest to?

A: To calculate the internal rate of return (IRR) for the investment opportunity, we need to find the…

Q: Bramble Corporation had net credit sales of $14100000 and cost of goods sold of $9370000 for the…

A: Here, Net Credit Sales is $14100000 Cost of Goods Sold is $9370000 Average Inventory is $1171250

Q: What will be the profit/loss to an investor who buys the call for $4 in the following scenarios for…

A: a. To calculate the profit/loss for an investor who buys the call for $4, we need to consider the…

Q: How much should a company deposit now to get the following annual revenues from a project (at i-10…

A: Here, Year Amount ($ in thousands) Interest rate 1 $500.00 10% 2 $540.00 10% 3 $580.00…

Q: 3.70 percent coupon municipal bond has 15 years left to maturity and has a price quote of 95.65. The…

A: Yield to maturity is rate of return realized when bond is held till maturity of bond and all…

Q: Compute the total and annual returns on the following investmen Six years after purchasing shares in…

A: Initial value=$7,800 Final value of investment=$11,400 Time period=6years Required: Total return=?…

Q: the amount borrowed, the annual interest rate, the number of payments per year, the loan term, and…

A: In case of mortgage loan, a series of equal periodic payment is made at equal interval for a…

Q: Save Answer ABC common stock is expected to have extraordinary growth in earnings and dividends of…

A: In the given case, we have provided the most recent paid dividend (D0), growth rate for next 2 years…

Subject: algebra

Step by step

Solved in 3 steps

- One of the categories of options available to investors and speculators is LEPOs. Assuming 7.00 per cent margin, what would be the percentage return and dollar profit to an investor who purchased one LEPO (for 1000 shares) for a premium of $26 220 and later closed out the position when the LEPO premium was $28 430?A call option on a stock has a delta of 0.3. A trader has sold 1,000 options. What position such as buy or sell and many shares should the trader take to hedge the position and why?The stock price of BAC is currently $120 and a put option with strike price of $120 is $5. A trader goes long 300 shares of BAC stock and long 3 contracts of the put options. a. What is the maximum potential loss for the trader ? b. When the stock price is $140, what is the trader’s net profit

- You bought a $50 strike call option on a stock XYZ for $8.20 and then sold/wrote a $65 call option for $4.35. If the stock closes at $63 on expiration day, how much did you make from all transactions?For each of the 100-share options shown in the following table below; use the underlying stock price at expiration and other information to determine the amount of profit or loss an investor would have had. Option Type of option Cost of option Strike price per share Underlying stock price per share at expiration A Call $214 $48 $53 B Call $372 $45 $48 C Put $537 $63 $54 D Put $297 $32 $36 E Call $495 $27 $24 The profit (loss) experienced on option A is $ ? (Round to the nearest dollar. Enter a negative number for loss.)A collar is established by buying a share of stock for $54, buying a 6-month put option with exercise price $47, and writing a 6-month call option with exercise price $61. On the basis of the volatility of the stock, you calculate that for a strike price of $47 and expiration of 6 months, N(d1) = 0.7298, whereas for the exercise price of $61, N(d1) = 0.6374. Required: What will be the gain or loss on the collar if the stock price increases by $1? What happens to the delta of the portfolio if the stock price becomes very large? What happens to the delta of the portfolio if the stock price becomes very small?

- A stock is trading at $46.96 per share, and the 47.5 option is quoted at $5.60 bid and $6.00 ask. The next day the stock is up $2.87 on strong earnings. You see that the option had a theta of -.02 and a delta of .56. Based only on this information, how much extrinsic value should you expect the option's ask price to have? (Answer in dollars per share of option, i.e., 2.87 not 287).A stock has a current price of $267. A trader writes 9 naked option contracts on the stock, each contract covering 100 shares. The option price is $2, the strike price is $260, and the time to maturity is 4 months 1. What is the margin requirement if the options are call options (in $)? 2. What is the margin requirement if the options are put options (in $)?The stock price of BAC is currently $150 and a put option with strike price of $150 is $10. A trader goes long 300 shares of BAC stock and long 3 contracts of the put options with strike price of $150. a. What is the maximum potential loss for the trader?[x](sample answer: $105.75)b. When the stock price is $161 on the expiration, what is the trader’s net profit?[y](sample answer: $105.75)

- A collar is established by buying a share for 50, buying a 6-month put option with exercise price 45, and writing a call option with exercise price 55. On the basis of the volatility of the stock, you calculate that at a strike price of 45 and expiration of 6 months, N(d1) =0.6 whereas for the exercise price of 55, N(d1) = 0.35 What will be the gain or loss on the collar if the stock price increases by 1? What happens to the delta of the portfolio if the stock price becomes very large?A collar is established by buying a share of stock for $50, buying a 6-month put option with exercise price $45, and writing a 6-month call option with exercise price $55. On the basis of the volatility of the stock, you calculate that for a strike price of $45 and expiration of 6 months, N(d1) = .60, whereas for the exercise price of $55, N(d1) = .35.a. What will be the gain or loss on the collar if the stock price increases by $1?b. What happens to the delta of the portfolio if the stock price becomes very large?c. What happens to the delta of the portfolio if the stock price becomes very small?The share price of XYZ on April 24 is $124. A trader sells 200 put options on the stock with astrike price of $120 when the option price is $5. The options are exercised when the stock price is $110. What will be the trader’s result? Выберите один ответ: a. 1000$ gain b. 1500 loss c. 1000$ loss d. 1500$ gain e. 2000$ loss