"Consider the following 4 options on TSLA: (1) 1-year 30-delta call, (2) 1-year 30-delta put, (3) 2-year 70-delta put, (4) 2-year 70-delta call. (a) Which of the 4 option's strike price is the closest to the strike price of a 1-year 70-delta call? to neutralize the delta exposure of each option contract separately with TSLA stock, which of the 4 option contracts needs the most long stock position to neutralize its delta? (d) What's the total delta of the portfolio that includes 1 million shares long position in each of the 4 option contracts (b) If we are long 1 million shares on each of the options and want and (c) which of the 4 option contracts needs the most short stock position to neutralize its delta? (Answer the questions using a clean integer number with no decimal, no dots, no parentheses)"

"Consider the following 4 options on TSLA: (1) 1-year 30-delta call, (2) 1-year 30-delta put, (3) 2-year 70-delta put, (4) 2-year 70-delta call. (a) Which of the 4 option's strike price is the closest to the strike price of a 1-year 70-delta call? to neutralize the delta exposure of each option contract separately with TSLA stock, which of the 4 option contracts needs the most long stock position to neutralize its delta? (d) What's the total delta of the portfolio that includes 1 million shares long position in each of the 4 option contracts (b) If we are long 1 million shares on each of the options and want and (c) which of the 4 option contracts needs the most short stock position to neutralize its delta? (Answer the questions using a clean integer number with no decimal, no dots, no parentheses)"

Fundamentals of Financial Management (MindTap Course List)

14th Edition

ISBN:9781285867977

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter18: Derivatives And Risk Management

Section18.A: Valuation Of Put Options

Problem 1P

Related questions

Question

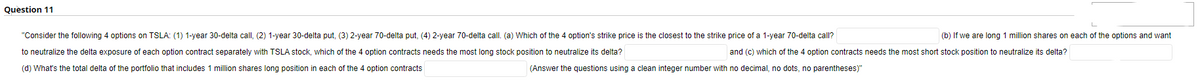

Transcribed Image Text:Question 11

"Consider the following 4 options on TSLA: (1) 1-year 30-delta call, (2) 1-year 30-delta put, (3) 2-year 70-delta put, (4) 2-year 70-delta call. (a) Which of the 4 option's strike price is the closest the strike price of a 1-year 70-delta call?

to neutralize the delta exposure of each option contract separately with TSLA stock, which of the 4 option contracts needs the most long stock position to neutralize its delta?

(d) What's the total delta of the portfolio that includes 1 million shares long position in each of the 4 option contracts

(b) If we are long 1 million shares on each of the options and want

and (c) which of the 4 option contracts needs the most short stock position to neutralize its delta?

(Answer the questions using a clean integer number with no decimal, no dots, no parentheses)"

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 6 steps

Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning