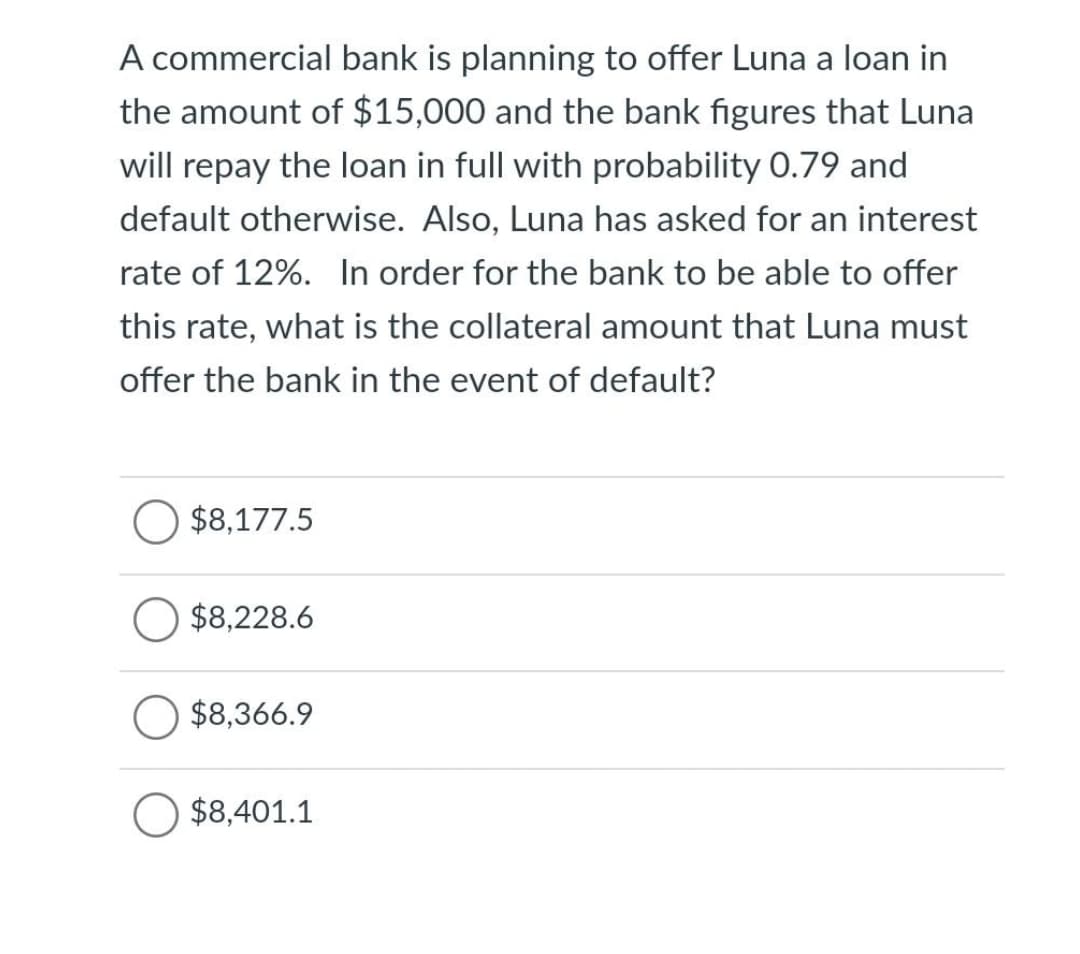

A commercial bank is planning to offer Luna a loan in the amount of $15,000 and the bank figures that Luna will repay the loan in full with probability 0.79 and default otherwise. Also, Luna has asked for an interest rate of 12%. In order for the bank to be able to offer this rate, what is the collateral amount that Luna must offer the bank in the event of default? O $8,177.5 O $8,228.6 O $8,366.9 $8,401.1

Q: What deposit made at the beginning of each month will accumulate to P120,000 at 8% compounded semi-a...

A: Future Value = P 120,000 Interest Rate = 8% compounded semi-annually Time Period = 10 Years

Q: Bon Chance, Inc., has an odd dividend policy. The company has just paid a dividend of $5.85 per shar...

A: Current dividend = $5.85 Future dividends Year Last dividend Dividend for the period A B=A+1...

Q: A delivery company is evaluating an investment to purchase vehicles. This is expected to generate a ...

A: we can calculate the present value of the cash flow using the discount rate 10%. We will multiply th...

Q: The tuition and fees for an in-state full-time student at the University of Hawaii at Manoa increase...

A: The change in the price of a commodity purchased by urban consumers is measured by CPI-U (consumer p...

Q: sub=26(Determine the promissory note to amortize (pay off) a $150,000 mortgage at 5.99% APR compound...

A: Solution:- Future value or the pay off value means the amount to be paid at maturity along with the ...

Q: a. Calculate the initial value of the index if a price-weighting scheme is used. Indes value b. What...

A: Price-Weighted Index: In the price-weighted index, each security is weighted by the relevant price ...

Q: The government issued a 15 year bond offering an interest rate of 12 per cent 10 years ago. Since th...

A: Government Bonds Government bonds are referred to as the debt security issued by the government to a...

Q: 1. Which of the following is not a way in which banks lend short-term unsecured loans? Choices: By...

A: “Since you have asked multiple questions, we will solve the one question for you. If you want any sp...

Q: 22: Greg Brown borrowed $1,700,000 to purchase a house. He agreed to repay the loan vith equal month...

A: The housing loans are paid by the equal monthly installments and these installments carry the paymen...

Q: If you have been hired at an annual salary of $23000and expeck to receive annual increases of 5% wha...

A: Your annual wage is the amount of money paid to you by your employer over the course of a year in ex...

Q: Exercise 2 (Basic Present Value Concepts) Each of the following parts is independent. (Ignore income...

A: Note: Since you have specified 2 questions out of 3 multiple questions, we can solve only the first ...

Q: 200,000, a fast food corporation may purchase the building and land required to open a new shop. Ins...

A: The monthly payment are done considering the interest and value of the building and value of buildin...

Q: Arnold Inc. is considering a proposal to manufacture high-end protein bars used as food supplements...

A: Free Cash Flows: The objective of financial managers is to maximize shareholders' wealth. In financ...

Q: Compute the Terminal cash flow. Compute the FCF for years 1 through 5 Compute the project’s NPV and ...

A: Companies only invest in positive NPV projects. NPV method is a method of project appraisal. It disc...

Q: The M.I.R.R. is based on a Cash flows being reinvested at a rate always different from WACC b ...

A: Modified internal rate of return is an improvement on the internal rate of return method.

Q: Convert the following cash flows to a uniform payment series, where n=3 starting at year 3 and i=3%....

A: The value of same amount of money will be different at various point of time. This is because, the v...

Q: Bulldogs Inc. is considering whether to pursue a restricted or relaxed current asset investment poli...

A: EBIT = P 40000 Interest rate = 10% Fixed assets = P 200000 Sales = P 500000

Q: Stanton Co. has 7 milhou conmon shares outstanding with a market price of $11 per s has $12 million ...

A: Value of the firm operation is value of equity and amount of cash available with company.

Q: What do entrepreneurs do that distinguishes them from any other person involved in the business?

A: A business is an enterprise entity or an organisation which is present to carry out a variety of act...

Q: 4 (a) Evaluate the cash flow diagram given by the figure below. Determine a Net Present Value and a ...

A: First, we will calculate the NPV using the rates provided and cash flows then we will calculate the ...

Q: unknown variable

A: “Since you have posted a question with multiple sub-parts, we will solve the first three subparts fo...

Q: Please show full working a. What is the portfolio mean & variance (arithmetic only): i. For an equal...

A: Given: Date YUM ZTS AAPL Market 31/01/18 84.59 76.73 87.3 1251.42 28/02/18 81.38 80.86 75.74 ...

Q: 8.14 (LG 8.5, 8.10) What is the after-tax present worth of a chip placer if it costs $55 000 and sav...

A: With the help of the given data we will first make a table representation for showing up the computa...

Q: A man invested P50,000 now for the college education of his 2-year old son. If the fund earns 14% ef...

A: Future value can be calculated using FV (rate, nper, pmt, [Pv], [type]) Rate The interest rate Nper...

Q: what is the bond rate of return over the year?

A: Bond Rate of Return: It refers to the gain or loss of a security/investment for a certain period. I...

Q: NEKO Inc. wants to analyze its variances in its actual and budgeted operation. · There is no ...

A: Budgeted sales- 10,000Actual sales- 1,500Budgeted cost of goods sold- 8000Actual cost of goods sold-...

Q: You are constructing a simple portfolio using two stocks A and B. Both have the same expected return...

A:

Q: On January 1,2020, Cookie Company leased an equipment from Sydney Company for 8 years with annual le...

A: The lease is recorded at the present value of the minimum lease payment. Interest expense is calcula...

Q: Weekly (Feb 21-27) Projected Actual Difference Food Cost $6,971 $7,842 +$871 (over) Beverage Cost $3...

A: Solution:- When an entity is unable to achieve what it has projected, it reviews the standards and a...

Q: a. What is the APR on this loan? (Do not round intermediate calculations and enter your answer as a...

A: Effective annual rate (EAR) refers to a real interest rate which an investor is expect from his inve...

Q: ensure adequate liquidity

A: Adequate liquidity refers to the sufficient amount that a business should have to meet its liabili...

Q: You are asked to evaluate the following project for a corporation with profitable ongoing operations...

A: Net present value is a capital budgeting techniques which makes the decision making process easier f...

Q: 53 Tucker Corporation's manager believes that the economic environment during the next year can b...

A: Probability Return 0.5 15% 0.2 0% 0.3 -5%

Q: 38) In Walker's taxonomy identification with a company's long term stock approach usually, but not a...

A: Unit incentives are those units having rights, duties, obligations, privileges given by the company ...

Q: Don Adams Breweries is considering an expansion project with an investment of P1,500,000. The equipm...

A: Investment = 1,500,000 Salvage value = 0 N = 5 years Depreciation per year = Investment / N = 1,500,...

Q: 1. What is the present worth of P 5 000 for 2 years at 12% compounded quarterly?

A: “Since you have asked multiple questions, we will solve the one question for you. If you want any sp...

Q: Inc. expects to use 48,000 boxes of chocolate per year costing P12 per box. Inventory carrying cost ...

A: Solution:- Carrying cost of inventory means the holding cost of inventory paid in order to store and...

Q: frequency of deposits, annual interest rate, and time period are given. amount: $125; monthly; 10%; ...

A: Future Value of Annuity: It represents the future value of the present stream of annuity cash flows...

Q: Bulldogs Inc. sells on term 3/20, net 40. Total sale for the year are P1,200,000 on which 40% is cas...

A: Total Sales = P1,200,000 Cash Sales = 40%

Q: Which of the following pairs of financial statement analysis tool will be given more emphasis by a f...

A: Solution:- Granting trade credit or selling on account to a new client are short term decisions and ...

Q: In 2012 TabaSue had a $500 savings bond that had reached maturity and she invested $5,500 in a savin...

A: Interest rate on investment = 5.4% A(t) = 500 + 5500(1.054)^t where t = Years after 2012

Q: You are considering two ways of financing a spring break vacation. You could put it on your credit c...

A: Answer- a. The effective annual rate for your credit card isFormula for Effective Annual Rate - EAR ...

Q: 7. Options A. How does the price of a call option respond to the following changes, other things equ...

A: As per our guidelines we are supposed to answer only one question (if there are multiple questions a...

Q: Dufner Co. issued 14-year bonds one year ago at a coupon rate of 6.4 percent. The bonds make semiann...

A: Par value (FV) = $1000 Coupon rate = 6.4% Semi annual coupon amount (C) = 1000*0.064/2 = $32 Years t...

Q: Compute the principal (in $) for the loan. Use ordinary interest when time is stated in days. Princi...

A: Data given: Rate = 7% Time= 112 years = 32years Interest = $ 735 Required:: Principal (in $) For...

Q: Use the ordinary interest method to compute the time (in days) for the loan. Round your answer up to...

A: Given Principal is $7100 Rate is 10.4% Interest $225.

Q: haac has analyzed two mutualy exclusive projects of simlar sire and has compled the following inform...

A: Solution:- While analyzing two mutually exclusive projects, the decision regarding which project to ...

Q: ABC Inc. has $2 million in current assets, its current ratio is 1.6, and its quick ratio is 1.2. The...

A: The question is related to Ratio Analysis. The Current Ratio and quick ratio is measure of short ter...

Q: A 5-year project will require an investment of $100 million. This comprises of plant and machinery w...

A: Cashflows means movement of cash. Cash movement can be positive and negative. Positive movement mean...

Step by step

Solved in 2 steps

- Bank Phoenix gives two one-year loans of N$ 20 million loan to Mr A, and N$ 85 million to Mrs B. The joint probability of default for Mr A and Mrs B is 0.095. Mr A probability of default and LGD are respectively 0.3 and 35%. Mrs B probability of default and LGD are respectively 0.35 and 55 %. Calculate bank PHOENIX one-year expected loss of default.From the banker’s point of view, when the banker quotes a floating interest, in doingso, the banker is passing on the interest rate risk to the borrower.• What if the banker has to quote a fixed interest rate but his cost of funds are floating?In this case, the customer/borrower faces no risk but the banker does.• Example: As a Credit Officer bank you have agreed to provide a customer with a fixedrate, 3-month, RM 20 million loan 90 days from today. You had priced the loan at 12%annual interest rate.• The following quotes are available in the market.3-month KLIBOR = 9 %3-month KLIBOR futures = 90.0 (matures in 90 days) How would you protect yourself from a rise interest rates?ABC is inclined to take a bank loan that has a face amount of P5,000,000, a term of 6 months, interest of 10%, and required compensating balance of P700,000. How much is the simple effective annual interest of the loan? Should ABC accept this loan if another loan has similar terms but has a simple effective cost of 11%?

- A bank has made a 3-year $10 million dollar loan that pays annual interest of 8%. The principal is due at the end of the third year. A. The bank is willing to sell this loan with recourse at 8.5% discount rate. What should it expect for selling this loan? B. It also has the option of selling this loan without recourse at a discount rate of 8.75%. What should it expect for selling this loan? C. If the bank expects a ½% probability of default on this loan, is it better off selling this loan with or without recourse? It expects to receive no interest payments or principal if the loan is defaulted. D. Why do you think that the interest rate in part A is different from the interest rate in part B?Cerise Company would record a note payable of_____, if the terms of the loan with a bank are as follows: Cersie Company would have to make one $102,000 payment in two years. Assume the market interest rate is 10% per year and the company rounds to the nearest dollar. (The present value of $1 for two periods at 10% is 0.82645). a.) $94,498 b.) $84,298 c.) $10,200 d.) $74,098ABC is inclined to take a bank loan that has a face amount of P5,000,000, a term of 6 months, interest of 10%, and required compensating balance of P700,000. Compute for the following: 1. How much is the simple effective annual interest of the loan? 2. Should ABC accept this loan if another loan has similar terms but has a simple effective cost of 11%?

- NTA Co. needs to borrow P300,000 for the next 6 months. The company has a line of credit with a bank that allows the company to borrow funds with a 10% interest rate subject to a 20% of loan compensating balance. Currently, NTA Co. has no funds on deposit with the bank and will need the loan to cover the compensating balance as well as their other financing needs. How much will NTA Co. need to borrow?A bank offers your firm a revolving credit arrangement for up to $86 million at an interest rate of 2.15 percent per quarter. The bank also requires you to maintain a compensating balance of 2 percent against the unused portion of the credit line, to be deposited in a non-interest-bearing account. Assume you have a short-term investment account at the bank that pays 1.50 percent per quarter, and assume that the bank uses compound interest on its revolving credit loans. a. What is your effective annual interest rate (an opportunity cost) on the revolving credit arrangement if your firm does not use it during the year? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Effective annual interest rate % b. What is your effective annual interest rate on the lending arrangement if you borrow $50 million immediately and repay it in one year? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2…National Co. needs to borrow P300,000 for the next 6 months. The company has a line of credit with a bank that allows the company to borrow funds with a 10% interest rate subject to a 20% of loan compensating balance. Currently, National Co. has no funds on deposit with the bank and will need the loan to cover the compensating balance as well as their other financing needs. How much will National Co. need to borrow?

- Company, a financial institution, allows Integrity Company to borrow P1,300,000 with 8% interest. Honesty would require a compensating balance of 8% of the face value of the loan.What is the effective interest rate of the loan (round off your answer to two decimal places)?Maris Bank has analyzed the accounts receivable of Anthony Software, Inc. The bank has chosen eight accounts totaling $134,000 that it will accept as collateral. The bank’s terms include a lending rate set at prime 3% and a 2% commission charge. The prime rate currently is 8.5%. Show Solutions and Explanation. A. The bank will adjust the accounts by 10% for returns and allowances. It then will lend up to 85% of the adjusted acceptable collateral. What is the maximum amount that the bank will lend to Anthony Software? (Format: 111,111) B. What is Anthony Software’s effective annual rate of interest if it borrows $100,000 for 12 months? (Note: Assume a 365-day year and a prime rate that remains at 8.5% during the life of the loan.) (Format: 11.1%)A bank is offering a loan of $20,000 with an interest rate of 9%, payable with monthly payments over a 4-year period. a. Calculate the monthly payment required to repay the loan. b. This bank also charges a loan fee of 4% of the amount of the loan, payable at the time of the closing of the loan (that is, at the time the borrower receives the money). What effective interest rate is the bank charging?