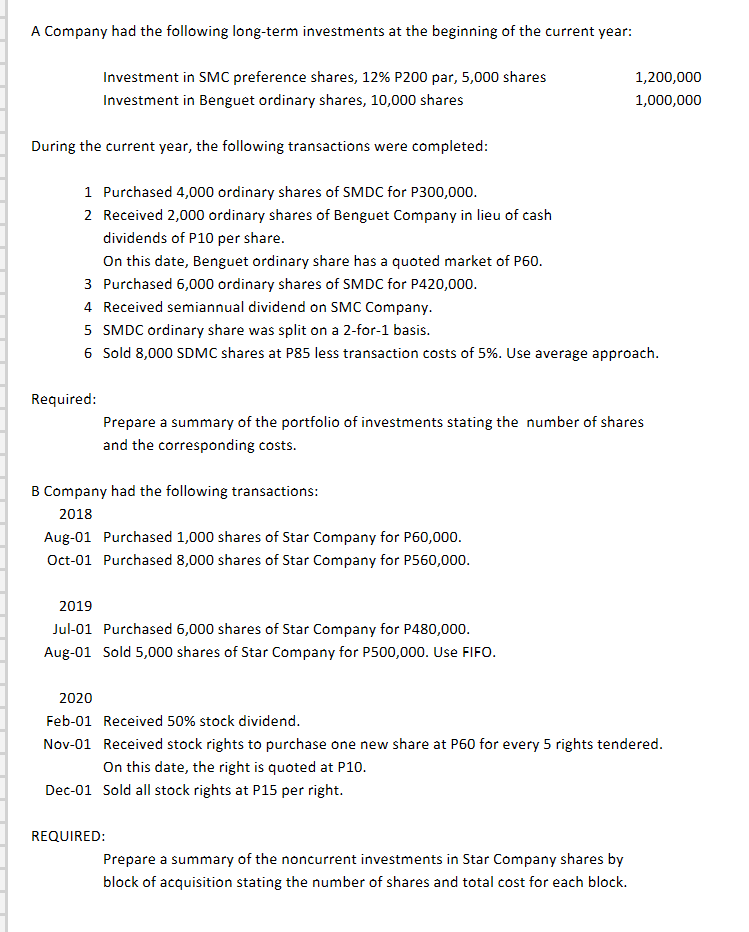

A Company had the following long-term investments at the beginning of the current year: Investment in SMC preference shares, 12% P200 par, 5,000 shares 1,200,000 Investment in Benguet ordinary shares, 10,000 shares 1,000,000 During the current year, the following transactions were completed: 1 Purchased 4,000 ordinary shares of SMDC for P300,000. 2 Received 2,000 ordinary shares of Benguet Company in lieu of cash dividends of P10 per share. On this date, Benguet ordinary share has a quoted market of P60. 3 Purchased 6,000 ordinary shares of SMDC for P420,000. 4 Received semiannual dividend on SMC Company. 5 SMDC ordinary share was split on a 2-for-1 basis. 6 Sold 8,000 SDMC shares at P85 less transaction costs of 5%. Use average approach. Required: Prepare a summary of the portfolio of investments stating the number of shares and the corresponding costs.

A Company had the following long-term investments at the beginning of the current year: Investment in SMC preference shares, 12% P200 par, 5,000 shares 1,200,000 Investment in Benguet ordinary shares, 10,000 shares 1,000,000 During the current year, the following transactions were completed: 1 Purchased 4,000 ordinary shares of SMDC for P300,000. 2 Received 2,000 ordinary shares of Benguet Company in lieu of cash dividends of P10 per share. On this date, Benguet ordinary share has a quoted market of P60. 3 Purchased 6,000 ordinary shares of SMDC for P420,000. 4 Received semiannual dividend on SMC Company. 5 SMDC ordinary share was split on a 2-for-1 basis. 6 Sold 8,000 SDMC shares at P85 less transaction costs of 5%. Use average approach. Required: Prepare a summary of the portfolio of investments stating the number of shares and the corresponding costs.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter21: Corporations: Taxes, Earnings, Distributions, And The Statement Of Retained Earnings

Section: Chapter Questions

Problem 9SPB: CASH DIVIDENDS, STOCK DIVIDEND, AND STOCK SPLIT During the year ended December 31, 20--, Baggio...

Related questions

Question

Transcribed Image Text:A Company had the following long-term investments at the beginning of the current year:

Investment in SMC preference shares, 12% P200 par, 5,000 shares

1,200,000

Investment in Benguet ordinary shares, 10,000 shares

1,000,000

During the current year, the following transactions were completed:

1 Purchased 4,000 ordinary shares of SMDC for P300,000.

2 Received 2,000 ordinary shares of Benguet Company in lieu of cash

dividends of P10 per share.

On this date, Benguet ordinary share has a quoted market of P60.

3 Purchased 6,000 ordinary shares of SMDC for P420,000.

4 Received semiannual dividend on SMC Company.

5 SMDC ordinary share was split on a 2-for-1 basis.

6 Sold 8,000 SDMC shares at P85 less transaction costs of 5%. Use average approach.

Required:

Prepare a summary of the portfolio of investments stating the number of shares

and the corresponding costs.

B Company had the following transactions:

2018

Aug-01 Purchased 1,000 shares of Star Company for P60,000.

Oct-01 Purchased 8,000 shares of Star Company for P560,000.

2019

Jul-01 Purchased 6,000 shares of Star Company for P480,000.

Aug-01 Sold 5,000 shares of Star Company for P500,000. Use FIFO.

2020

Feb-01 Received 50% stock dividend.

Nov-01 Received stock rights to purchase one new share at P60 for every 5 rights tendered.

On this date, the right is quoted at P10.

Dec-01 Sold all stock rights at P15 per right.

REQUIRED:

Prepare a summary of the noncurrent investments in Star Company shares by

block of acquisition stating the number of shares and total cost for each block.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning