The Adam Corporation had the following transactions during the year: Jan. 15 Purchased 1,500 shares of LMN stock at S10 per share. Purchased 3,000 shares of KJL stock at $20 per share. Received dividends of SI per share of LMN stock. Purchased $20,000 of XYZ bonds for $20,000. Interest of 9% is paid on April 15 and October 15. Sold 1,000 shares of KJL stock for $22,000. Received a $2 dividend per share for KJL stock. Received interest on XYZ bond. Sold the bonds for $21,000. Sold 500 shares of LMN stock for S5,000. On this day, LMN stock is selling for S19 per share and KJL stock is selling for S12 per share. Record th reflect the fair market value of the stock. Feb 15 Mar 15 Apr 15 Aug 15 Sep 15 Oct 15 Oct 15 Nov 15 Dec 31 Instructions: a. Record the transactions for the year in general journal format. b. Show how the stock investment would appear on the balance sheet on December 31.

The Adam Corporation had the following transactions during the year: Jan. 15 Purchased 1,500 shares of LMN stock at S10 per share. Purchased 3,000 shares of KJL stock at $20 per share. Received dividends of SI per share of LMN stock. Purchased $20,000 of XYZ bonds for $20,000. Interest of 9% is paid on April 15 and October 15. Sold 1,000 shares of KJL stock for $22,000. Received a $2 dividend per share for KJL stock. Received interest on XYZ bond. Sold the bonds for $21,000. Sold 500 shares of LMN stock for S5,000. On this day, LMN stock is selling for S19 per share and KJL stock is selling for S12 per share. Record th reflect the fair market value of the stock. Feb 15 Mar 15 Apr 15 Aug 15 Sep 15 Oct 15 Oct 15 Nov 15 Dec 31 Instructions: a. Record the transactions for the year in general journal format. b. Show how the stock investment would appear on the balance sheet on December 31.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter11: Stockholders' Equity

Section: Chapter Questions

Problem 11.13MCP

Related questions

Question

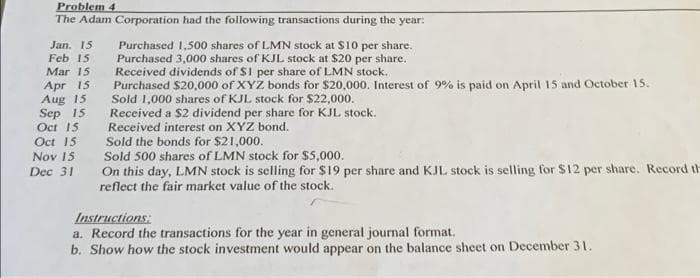

Transcribed Image Text:Problem 4

The Adam Corporation had the following transactions during the year:

Jan. 15

Feb 15

Purchased 1,500 shares of LMN stock at S10 per share.

Purchased 3,000 shares of KJL stock at $20 per share.

Received dividends of $1 per share of LMN stock.

Purchased $20,000 of XYZ bonds for $20,000. Interest of 9% is paid on April 15 and October 15.

Sold 1,000 shares of KJL stock for $22,000.

Received a $2 dividend per share for KJL stock.

Received interest on XYZ bond.

Sold the bonds for $21,000.

Sold 500 shares of LMN stock for $5,000.

Mar 15

Apr 15

Aug 15

Sep 15

Oct 15

Oct 15

Nov 15

On this day, LMN stock is selling for $19 per share and KJL stock is selling for $12 per share. Record th

reflect the fair market value of the stock.

Dec 31

Instructions:

a. Record the transactions for the year in general journal format.

b. Show how the stock investment would appear on the balance sheet on December 31.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning