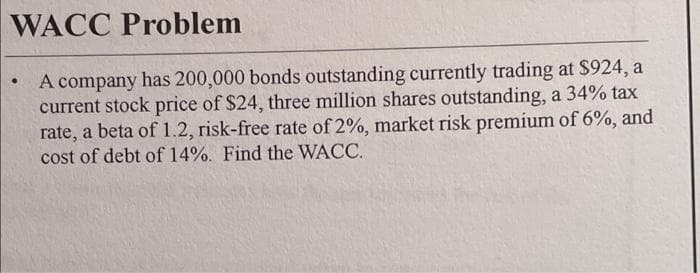

A company has 200,000 bonds outstanding currently trading at $924, a current stock price of $24, three million shares outstanding, a 34% tax rate, a beta of l1.2, risk-free rate of 2%, market risk premium of 6%, and cost of debt of 14%. Find the WACC.

Q: Sketch the NPV profile for projects A & B. Determine the crossover point for these projects’ NPV…

A: NPV refers to the net present value. It is the sum of present values of all cash flows occuring in…

Q: 5.1 Frasier needs £250,000 to set up his business. Bank A is willing to lend him the money under the…

A: Hi There, Thanks for posting the questions. As per our Q&A guidelines, must be answered only one…

Q: can you do the spreedsheet solution of this?

A:

Q: just sold your house for $1,000,000 in cash. Your mortgage was originally a 30-year mortgage with…

A: Mortgages are paid by equal monthly payments and these payments carry the payment of principal…

Q: . Inflation is expected to average 2.4% per year for the next 44 years. How much money will be…

A: Inflation rate = 2.4% Period = 44 Years Value of goods and service today = $1

Q: lden Bling, an aged jewellery distributor, issues dividends semi-annually. The most recent divided…

A: Recent Dividend = $0.90 Growth rate = 9% Cost of equity = 12% Special Dividend = $1.70

Q: IN Capital Asset Pricing Model a) how is it used in practice b) how important is this model c)…

A: Risk and return are the two inseparable parts of the investment. Before investing in any security,…

Q: Technical Analysis (the practice of analyzing past stock price and volume data in order to predict…

A: The efficient market hypothesis (EMH), also known as the efficient market theory, claims that stock…

Q: 11. Consider the actual dollar CFs of a project below. The real MARR is 3% and the general inflation…

A: Here, MARR is 3% Inflation Rate is 5% Actual Dollar means cashflows without the adjustments of…

Q: 1. Determine the amount of money invested today at 12% interest can provide the following…

A: Future Value: The future value is the amount that will be received at the end of a certain period.…

Q: (b) ABC plc and DEF plc have exactly the same risk, and both have a current stock price of £150. ABC…

A: Given: Current stock price of ABC is 150 Current stock price of DEF is 150 Stock price of ABC, 1…

Q: V Corporation has debt with market value of $97 million, common equity with a book value of $97…

A: For Calculation of WACC, the market value of each source of finance is considered Market Value of…

Q: Jimmy and Mickey are interested to purchase their first boat. They have decided to borrow the boat's…

A: Purchase price Boat = $100,000 Income tax = 28% Cost of borrowing from boat dealer = 8% Cost of…

Q: 8. You expect to have $8,000 in one year. A bank is offering loans at 4.5% interest per year. How…

A: Amount after 1 year (FV) = $8000 Interest rate (r) = 4.5%

Q: What is the cash conversion cycle of JFC? Note: don’t use excel and show your solution.

A: Here, Accounts Receivables is 7,621 Inventories is 5,972 Accounts Payable is 2,455 Cost of Goods…

Q: How much money be invested today in order to withdraw P1500 per year at the end of each year for 8…

A: Annual withdrawal (P) = P1500 Interest rate (r) = 8% Number of withdrawals (n) = 8

Q: 1. Let's assume that a loan of $100,000 with an annual interest rate of 6% over 30 years pays…

A: Accumulation rate is the increase in size of asset, position or overall buying activity of…

Q: Capital Asset Pricing Model a) describe the model b) what are the assumptions in the model c)…

A: a) CAPM Model CAPM model ideally portrays the relationship between systematic risk and the expected…

Q: b) The new shares which are issued in a rights issue are offered to the existing shareholders at…

A: Right Shares are those shares which are issued to the existing shareholder of the company instead of…

Q: 11. Suppose that a young couple has just had their first baby and they wish to ensure that enough…

A: In order to find the cost of the tuition after a certain period we are required to calculate the…

Q: The par value of 10% debenture is $1,000 with maturity is 3 years. What would be the price if…

A: Given: Particulars Amount Par value (FV) 1000 Debenture interest 10% Years(NPER) 3

Q: Assume that a company’s beginning-of-period price is $17 per common share, its dividends are $1 per…

A: Beginning price of stock = Dividend / ( 1 + Cost of Equity capital) + end of period price / ( 1 +…

Q: NC Corp. holds three stocks in her portfolio: A, B, and C. The portfolio beta is 1.40. Stock A…

A: The new portfolio beta can be calculated by subtracting the beta contribution of Stock A in the…

Q: Davis Co. sells watches for $115 apiece. The variable cost per watch is $89. Davis has fixed…

A: Selling price = $115 Variable cost = $89 Number of units sold = 10,000 Fixed operating cost = $12000…

Q: An entity has an investment which analyst think that there will be a 40% probability that the…

A: The following information has been provided in the question: Probability that expected return will…

Q: 6c. An initial $2000 investment is made that returns profits of $1000 and 1500 in the first and…

A: Present Value: It is the current worth of a future amount of cash or stream of income given a…

Q: Machine A Machine B R100 000 R110 000 Initial cost 5 years 5 years Expected economic life R10 000 0.…

A: Payback period- It represents the time period required for recovery of the initial investment made…

Q: XYZ Inc., the Calapan-based computer manufacturer, has developed a new all-in-one device: phone,…

A: Here, Cost of Real Estate in Year zero is $100,000 R&D Expenses in Year 0 is $175,000 Cost of…

Q: payback period? What ar

A: Cashflows refer to the movement of cash as inflow and outflow in the company. It shows the company's…

Q: What does it mean for markets to be efficient? What are the differences in the degree of efficiency,…

A: The markets are considered to be efficient if the information related to various aspects that create…

Q: you mean by payback period? What are their significano:s and drawbacks? Find the payback periods of…

A: Payback period is a tool of capital budgeting that enables a company to determine the duration…

Q: -28,800 20,400 Assuming a cost of capital of 14%, which of these projects should be accepted?…

A: To determine which project should be accepted we can compute the NPV of each project. NPV refers to…

Q: Explain each of the investment instruments stated below that offered by financial institutions.…

A: Investment instruments Investment instruments also known as financial instruments is a document that…

Q: The Sebastinian Arts Guild wants P5,000 at the end of each 2-months theater season for renovations.…

A: Given, The payments required is P5000 Rate is 9% compounded annually

Q: The difference between the forward rate and the expected future spot rate is called:

A: The forward rate is a price at which the transaction or settlement will take place in the future. It…

Q: Explain whether it is better for an investor to buy a discount bond and pay a price below its face…

A: Bond Issued at premium If coupon rate is higher than the prevailing interest rates. , it is called…

Q: You are going to value Lauryn's Doll Co. using the FCF model. After consulting various sources, you…

A: Calculation of Asset Beta: Asset Beta = Equity Beta/1+1-Tax*Debt - Equity ratioAsset Beta =…

Q: w (inputting a similar table, with related work shown above or below, is suggested). Payment EOY…

A: Loan are paid by equal amount but the amount of interest and principal amount paid are different for…

Q: Shinn Co. sells custom markers for $3.00 apiece. The variable cost per marker is $0.83. Shinn has…

A: Solution: Degree of operating leverage (DOL) measures the ratio of a company's contribution margin…

Q: At a base sales level of R400,000, a firm has a degree of operating leverage of 2 and a degree of…

A: Sales level = R400,000 Degree of operating leverage = 2 Degree of financial leverage = 1.5

Q: The risk-free rate of interest, kRF, is 6 percent. The overall stock market has an expected return…

A: The required return on the stock can be calculated as per the CAPM equation

Q: Oswego Plumbing Works (ticker: OPW) just announced that it will cut next year's dividend, D1, from…

A: Given, Share price = 24.5 Dividend = 2.25 per share with 4% growth As per Gordon Growth Model,…

Q: e NYSE? firm. To buy or sella stock listed on the NYSE, the investor contacts th vestors who trade…

A: NYSE refers to the New York Stock Exchange. It is one of the biggest stock exchanges in the world…

Q: Inflation

A: Inflation means increase in prices of different products.

Q: areq is about to make his dream of a house of his own ome true. For years he has been saving for…

A: Down Payment = 1,500,000 * 10% = 150,000 Loan Taken = House Price - Down-payment = 1,500,000 -…

Q: Consider a European Call Option with a strike of 82. The current price of the underlying asset is…

A: Here, Strike Price is $82 Current Price is $80 Time To Expiry is 5 months Value of Call Option is…

Q: 2) Since must be 1. The measures the stock's reactions to movements in the market, the beta for the…

A: Beta is measure of change in stock price with regard to change in market. There are 2 types of…

Q: (Expected rate of return and risk) B. J. Gautney Enterprises is evaluating a security. One-year…

A: The expected return for a portfolio is the weighted average of return for the individual securities.…

Q: Could I Industries just paid a dividend of $1.25 per share. The dividends are expected to grow at a…

A: Dividend discount model refers to a stock valuation model which is used by the company for…

Q: Despite his extravagant clothing purchases, Mr Hypebeast was unable to impress his crush. Dejected…

A: Here, Note: In the second stage, as the growth rate is given annually, Semi-Annual dividends are…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

- You have the following balance sheet and information about FedEx: Balance Sheet: Assets Liabilities & Shareholders’ Equity Current Assets $31,000,000 Current Liabilities $28,000,000 PP&E $197,000,000 Long-term Debt (Corporate Bonds) $105,000,000 Equity $95,000,000 Total $228,000,000 Total $228,000,000 FedEx has 16 million shares outstanding. FedEx’s shares have a beta of 1.6 and are currently trading for $15 per share. The expected market risk premium is 7%. The risk-free rate is 1%. The debt is trading at 101% of book value. The coupon rate on existing debt is 5% The yield to maturity on existing debt is 3%. The corporate tax rate is 21%. Compute FedEx’s weighted-average cost of capital (WACC).Levy's company has the following information about its capital structures: Debt - 1,500, 5 percent coupon bonds outstanding, $1,000 par value, 7 years to maturity, selling for 80 percent of par, the bonds make semi-annual payments Common Stock - 100,000 shares outstanding, selling for $45 per share; the beta is 0.80 Preferred Stock - 25,000 shares of 6 percent preferred stock outstanding, currently selling for $150 per share Market Information - 6 percent market risk premium and 4 percent risk-free rate. Calculate the following if the company has a tax rate of 36 percent: Total Market Value for the Firm , After-tax cost of Debt, Cost of Equity , Cost of Preferred Stock, Weighted Average Cost of Capital. Please note that the total market value, After-tax cost of Debt, Cost of Equity and Cost of Preferred Stock should all be calculated in dollar value and NOT percentages. do not use excel formulas. show all workingsGiven the following information for a corporation, find the WACC. Assume the company's tax rate is 21%. Debt 24,000 bonds with a 5 percent coupon rate, $1,000 par value, 25 years to maturity, selling for 100 percent of par; the bonds make annual coupon payments. Equity 575,000 shares outstanding, selling for $80 per share; the beta is 1.04. Market 7 percent market risk premium and 3.22 percent risk-free rate

- Given the following information for Watson Power Co., find the WACC. Assume the company’s tax rate is 21%. Debt: 15,000 bonds with a 5.8 percent coupon outstanding, $1,000 par value, 25 years to maturity, selling for 108 percent of par; the bonds make semiannual payments Common Stock: 575,000 shares outstanding, selling for $64 per share; the beta is 1.09. Preferred Stock: 35,000 shares of 2.8 percent preferred stock outstanding, currently selling for $65 per share. Market: 7 percent market risk premium and 3.2 percent risk-free rate. Please complete on excel and show excel formulas!Given the following information for Magrath Power Co., find the WACC. Assume the company’s tax rate is 35%. Debt: 10,000 6.4% coupon bonds outstanding, $1,000 par value, 25 years to maturity, selling for 108% of par; the bonds make semiannual payments. Common stock: 495,000 shares outstanding, selling for $63 per share; the beta is 1.15. Preferred stock: 35,000 shares of 3.5% preferred stock outstanding, currently selling for $72 per share. Market: 7% market risk premium and 3.2% risk-free rate.Roxie Epoxy’s balance sheet shows a total of $50 million long-term debt with a coupon rate of 8.00% and a yield to maturity of 7.00%. This debt currently has a market value of $55 million. The balance sheet also shows that that the company has 20 million shares of common stock, and the book value of the common equity (common stock plus retained earnings) is $65 million. The current stock price is $8.50 per share; stockholders' required return, rs, is 12%; and the firm's tax rate is 25%. Based on market value weights, and assuming the firm is currently at its target capital structure, what WACC should Roxie use to evaluate capital budgeting projects?

- consider huggins product has the following information about its capital structures: Debt - 1,500, 5 percent coupon bonds outstanding, $1,000 par value, 7 years to maturity, selling for 80 percent of par, the bonds make semi-annual payments Common Stock - 100,000 shares outstanding, selling for $45 per share; the beta is 0.80 Preferred Stock - 25,000 shares of 6 percent preferred stock outstanding, currently selling for $150 per share Market Information - 6 percent market risk premium and 4 percent risk-free rate. Calculate the following if the company has a tax rate of 36 percent: Total Market Value for the Firm , After-tax cost of Debt, Cost of Equity , Cost of Preferred Stock, Weighted Average Cost of Capital. showing both percentages and dollar value for After-tax cost of Debt, Cost of Equity and Cost of Preferred Stock should all be calculated in dollar value and NOT percentages.JS Corporation has 9 million shares of common stock outstanding, 250,000 shares of RM6 annual dividend preferred stock outstanding, and 105,000 of 7.5% semi-annual bond outstanding. The common stock is currently sells for RM34 per share and has a beta of 1.25, the preferred stock currently sells for RM91 per share, and the bonds have 15 years to maturity and sell for 93% of par. The market risk premium is 8.5%, T-bills are yielding 5%, and corporate tax rate is 35%. Calculate the cost of debt and Weighted Average Cost of Capital (WACC).Corp has $120, 000, 000 bonds outstanding that are selling at par. Bonds with similar characteristics are yielding 10.0 percent. The company also has 2, 000, 000 shares of preferred stock which pays dividend of $9 every year and 3, 000, 000 shares of common stock outstanding. The preferred stock sells for $60 a share. The common stock has a beta of 1.5 and sells for $50 a share. The risk - free rate is 2.2 percent and the return on the market is 11.2 percent. The corporate tax rate is 40 percent. What is the firm's weighted average cost of capital? (solve with excel)

- Higgins Production has the following information about its capital structures: Debt - 1,500, 5 percent coupon bonds outstanding, $1,000 par value, 7 years to maturity, selling for 80 percent of par, the bonds make semi-annual payments Common Stock - 100,000 shares outstanding, selling for $45 per share; the beta is 0.80 Preferred Stock - 25,000 shares of 6 percent preferred stock outstanding, currently selling for $150 per share Market Information - 6 percent market risk premium and 4 percent risk-free rate. Calculate the following if the company has a tax rate of 36 percent: Total Market Value for the Firm ii. After-tax cost of Debt iii. Cost of Equity iv. Cost of Preferred Stock v. Weighted Average Cost of CapitalHiggins Production has the following information about its capital structures: Debt - 1,500, 5 percent coupon bonds outstanding, $1,000 par value, 7 years to maturity, selling for 80 percent of par, the bonds make semi-annual payments Common Stock - 100,000 shares outstanding, selling for $45 per share; the beta is 0.80 Preferred Stock - 25,000 shares of 6 percent preferred stock outstanding, currently selling for $150 per share Market Information - 6 percent market risk premium and 4 percent risk-free rate. Calculate the following if the company has a tax rate of 36 percent: Cost of Preferred Stock and Weighted Average Cost of CapitalSuppose Westerfield Co. has the following financial information: Debt: 900,000 bonds outstanding with a face value of $1,000. The bonds currently trade at 85% of par and have 12 years to maturity. The coupon rate equals 7%, and the bonds make semiannual interest payments. Preferred stock: 600,000 shares of preferred stock outstanding; currently trading for $108 per share, paying a dividend of $9 annually. Common stock: 25,000,000 shares of common stock outstanding; currently trading for $185 per share. Beta equals 1.22. Market and firm information: The expected return on the market is 9%, the risk-free rate is 5%, and the tax rate is 21%. Calculate the cost of preferred stock. (Enter percentages as decimals and round to 4 decimals)