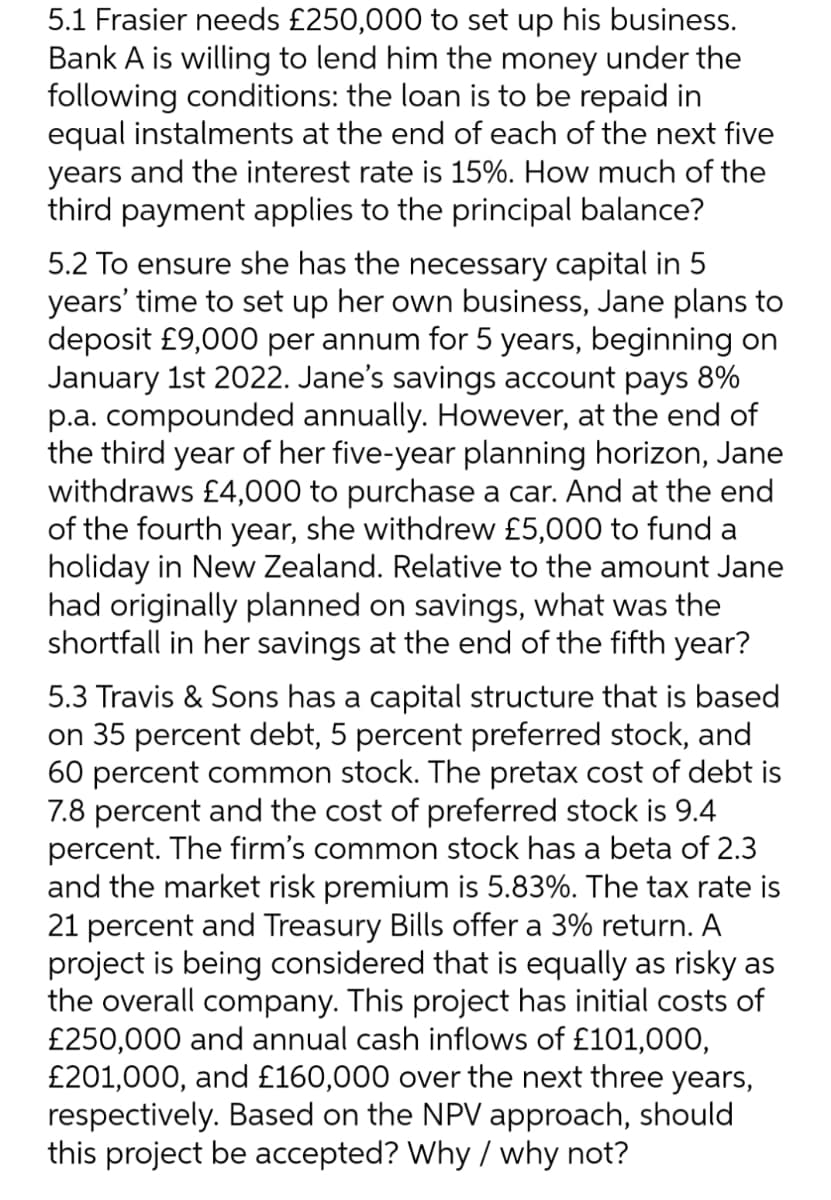

5.1 Frasier needs £250,000 to set up his business. Bank A is willing to lend him the money under the following conditions: the loan is to be repaid in equal instalments at the end of each of the next five years and the interest rate is 15%. How much of the third payment applies to the principal balance?

5.1 Frasier needs £250,000 to set up his business. Bank A is willing to lend him the money under the following conditions: the loan is to be repaid in equal instalments at the end of each of the next five years and the interest rate is 15%. How much of the third payment applies to the principal balance?

Chapter4: Time Value Of Money

Section: Chapter Questions

Problem 28P

Related questions

Question

please answer within 30 minutes. make sure you answer all three parts else i will give negative ratings. Either solve all 3 parts or pass it so that other person can solve .

Transcribed Image Text:5.1 Frasier needs £250,000 to set up his business.

Bank A is willing to lend him the money under the

following conditions: the loan is to be repaid in

equal instalments at the end of each of the next five

years and the interest rate is 15%. How much of the

third payment applies to the principal balance?

5.2 To ensure she has the necessary capital in 5

years' time to set up her own business, Jane plans to

deposit £9,000 per annum for 5 years, beginning on

January 1st 2022. Jane's savings account pays 8%

p.a. compounded annually. However, at the end of

the third year of her five-year planning horizon, Jane

withdraws £4,000 to purchase a car. And at the end

of the fourth year, she withdrew £5,000 to fund a

holiday in New Zealand. Relative to the amount Jane

had originally planned on savings, what was the

shortfall in her savings at the end of the fifth year?

5.3 Travis & Sons has a capital structure that is based

on 35 percent debt, 5 percent preferred stock, and

60 percent common stock. The pretax cost of debt is

7.8 percent and the cost of preferred stock is 9.4

percent. The firm's common stock has a beta of 2.3

and the market risk premium is 5.83%. The tax rate is

21 percent and Treasury Bills offer a 3% return. A

project is being considered that is equally as risky as

the overall company. This project has initial costs of

£250,000 and annual cash inflows of £101,000,

£201,000, and £160,000 over the next three years,

respectively. Based on the NPV approach, should

this project be accepted? Why / why not?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning