e NYSE? firm. To buy or sella stock listed on the NYSE, the investor contacts th vestors who trade stock have accounts at a y or sell to the NYSE. There a computer matches up orders and communicates the executed order to the * some transactions, the brokerage firm submits a message to one of its mplete, the floor trader sends a confirmation to the brokerage, which forwards it to the investor. (Select from the drop-down me por traders: (Select the best answer below.) who negotiates a price with another tra O A. execute trades on the floor for themselves or someone else. O B. help make a market in one or more stocks by taking the position consistent with orders placed by clients. O C. execute trades on the floor for bankers. O D. help make a market in one or more stocks by taking the position opposite of orders placed by clients.

e NYSE? firm. To buy or sella stock listed on the NYSE, the investor contacts th vestors who trade stock have accounts at a y or sell to the NYSE. There a computer matches up orders and communicates the executed order to the * some transactions, the brokerage firm submits a message to one of its mplete, the floor trader sends a confirmation to the brokerage, which forwards it to the investor. (Select from the drop-down me por traders: (Select the best answer below.) who negotiates a price with another tra O A. execute trades on the floor for themselves or someone else. O B. help make a market in one or more stocks by taking the position consistent with orders placed by clients. O C. execute trades on the floor for bankers. O D. help make a market in one or more stocks by taking the position opposite of orders placed by clients.

Chapter14: Corporation Accounting

Section: Chapter Questions

Problem 13PB: You are a consultant working with various companies that are considering incorporating and listing...

Related questions

Question

12

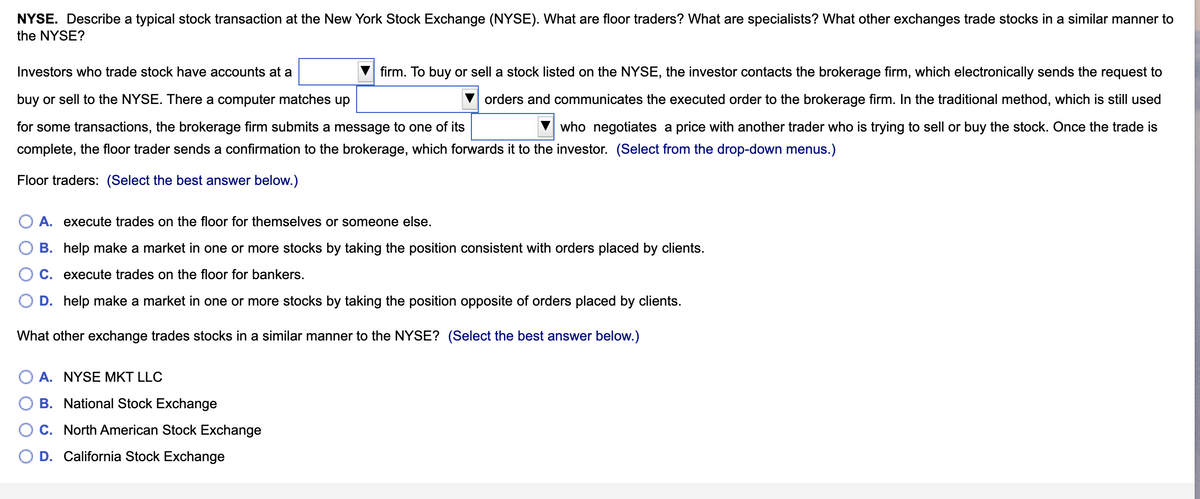

Transcribed Image Text:NYSE. Describe a typical stock transaction at the New York Stock Exchange (NYSE). What are floor traders? What are specialists? What other exchanges trade stocks in a similar manner to

the NYSE?

Investors who trade stock have accounts at a

firm. To buy or sell a stock listed on the NYSE, the investor contacts the brokerage firm, which electronically sends the request to

buy or sell to the NYSE. There a computer matches up

orders and communicates the executed order to the brokerage firm. In the traditional method, which is still used

for some transactions, the brokerage firm submits a message to one of its

who negotiates a price with another trader who is trying to sell or buy the stock. Once the trade is

complete, the floor trader sends a confirmation to the brokerage, which forwards it to the investor. (Select from the drop-down menus.)

Floor traders: (Select the best answer below.)

A. execute trades on the floor for themselves or someone else.

B. help make a market in one or more stocks by taking the position consistent with orders placed by clients.

C. execute trades on the floor for bankers.

D. help make a market in one or more stocks by taking the position opposite of orders placed by clients.

What other exchange trades stocks in a similar manner to the NYSE? (Select the best answer below.)

A. NYSE MKT LLC

B. National Stock Exchange

C. North American Stock Exchange

D. California Stock Exchange

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT