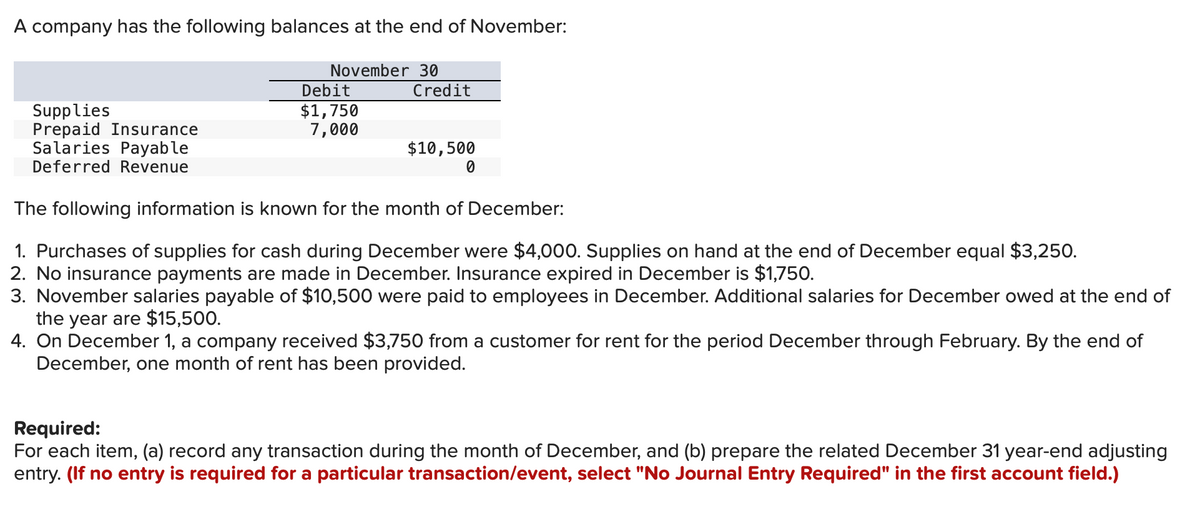

A company has the following balances at the end of November: Supplies Prepaid Insurance Salaries Payable Deferred Revenue November 30 Debit $1,750 7,000 Credit $10,500 0 The following information is known for the month of December: 1. Purchases of supplies for cash during December were $4,000. Supplies on hand at the end of December equal $3,250. 2. No insurance payments are made in December. Insurance expired in December is $1,750. 3. November salaries payable of $10,500 were paid to employees in December. Additional salaries for December owed at the end of the year are $15,500. 4. On December 1, a company received $3,750 from a customer for rent for the period December through February. By the end of December, one month of rent has been provided. Required: For each item, (a) record any transaction during the month of December, and (b) prepare the related December 31 year-end adjusting entry. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)

A company has the following balances at the end of November: Supplies Prepaid Insurance Salaries Payable Deferred Revenue November 30 Debit $1,750 7,000 Credit $10,500 0 The following information is known for the month of December: 1. Purchases of supplies for cash during December were $4,000. Supplies on hand at the end of December equal $3,250. 2. No insurance payments are made in December. Insurance expired in December is $1,750. 3. November salaries payable of $10,500 were paid to employees in December. Additional salaries for December owed at the end of the year are $15,500. 4. On December 1, a company received $3,750 from a customer for rent for the period December through February. By the end of December, one month of rent has been provided. Required: For each item, (a) record any transaction during the month of December, and (b) prepare the related December 31 year-end adjusting entry. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 5PB: Review the following transactions and prepare any necessary journal entries. A. On January 5, Bunnet...

Related questions

Question

Transcribed Image Text:A company has the following balances at the end of November:

Supplies

Prepaid Insurance

Salaries Payable

Deferred Revenue

November 30

Debit

$1,750

7,000

Credit

$10,500

0

The following information is known for the month of December:

1. Purchases of supplies for cash during December were $4,000. Supplies on hand at the end of December equal $3,250.

2. No insurance payments are made in December. Insurance expired in December is $1,750.

3. November salaries payable of $10,500 were paid to employees in December. Additional salaries for December owed at the end of

the year are $15,500.

4. On December 1, a company received $3,750 from a customer for rent for the period December through February. By the end of

December, one month of rent has been provided.

Required:

For each item, (a) record any transaction during the month of December, and (b) prepare the related December 31 year-end adjusting

entry. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 1 steps with 2 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,