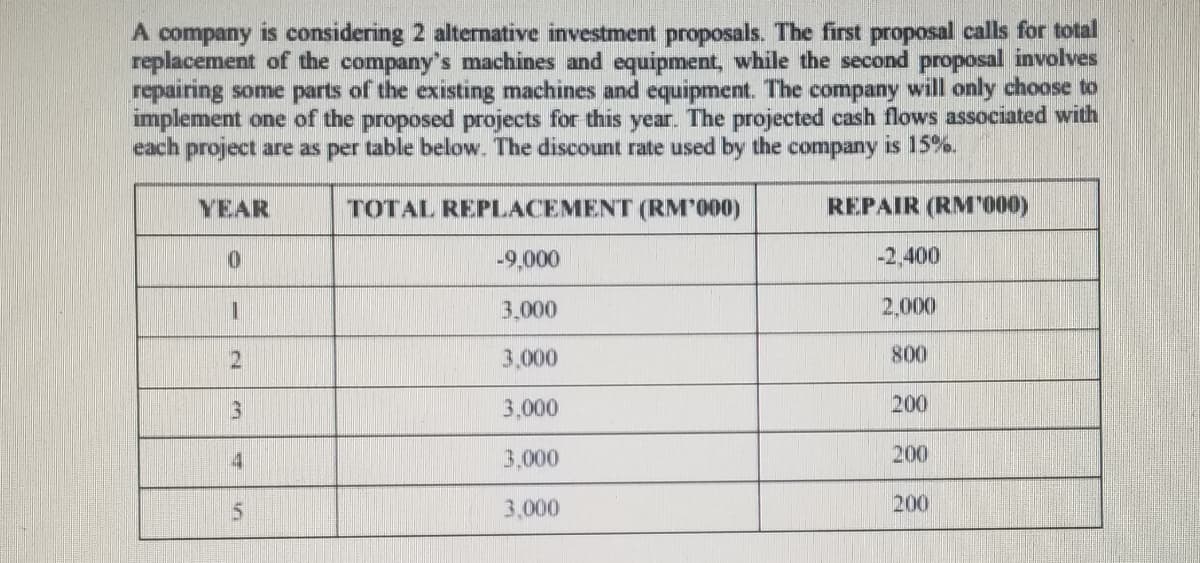

A company is considering 2 alternative investment proposals. The first proposal calls for total replacement of the company's machines and equipment, while the second proposal involves repairing some parts of the existing machines and equipment. The company will only choose to implement one of the proposed projects for this year. The projected cash flows associated with each project are as per table below. The discount rate used by the company is 15%. YEAR TOTAL REPLACEMENT (RM'000) REPAIR (RM'000) -9,000 -2,400 3,000 2,000 3,000 800 3 3,000 200 4 3,000 200 3,000 200

A company is considering 2 alternative investment proposals. The first proposal calls for total replacement of the company's machines and equipment, while the second proposal involves repairing some parts of the existing machines and equipment. The company will only choose to implement one of the proposed projects for this year. The projected cash flows associated with each project are as per table below. The discount rate used by the company is 15%. YEAR TOTAL REPLACEMENT (RM'000) REPAIR (RM'000) -9,000 -2,400 3,000 2,000 3,000 800 3 3,000 200 4 3,000 200 3,000 200

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section10.A: Mutually Exclusive Investments Having Unequal Lives

Problem 1P

Related questions

Question

i) Calculate the profitability index of each project

Transcribed Image Text:A company is considering 2 alternative investment proposals. The first proposal calls for total

replacement of the company's machines and equipment, while the second proposal involves

repairing some parts of the existing machines and equipment. The company will only choose to

implement one of the proposed projects for this year. The projected cash flows associated with

each project are as per table below. The discount rate used by the company is 15%.

YEAR

TOTAL REPLACEMENT (RM'000)

REPAIR (RM"000)

-9,000

-2,400

3,000

2,000

3,000

008

3,000

200

4

3,000

200

3,000

200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning