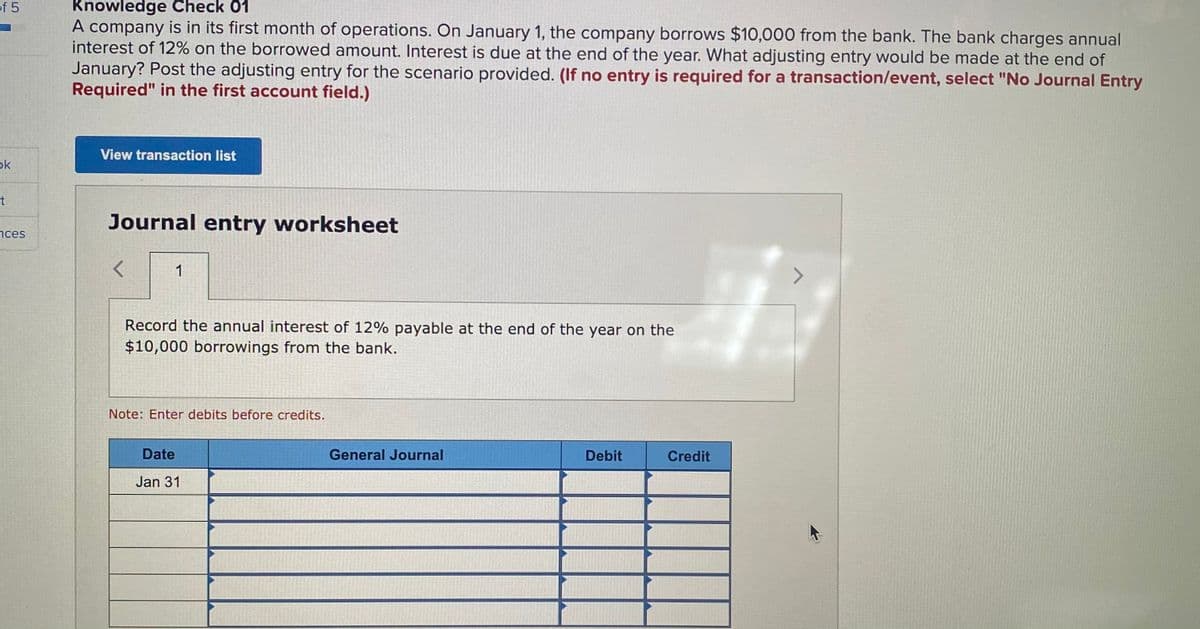

A company is in its first month of operations. On January 1, the company borrows $10,000 from the bank. The bank charges annual interest of 12% on the borrowed amount. Interest is due at the end of the year. What adjusting entry would be made at the end of January? Post the adjusting entry for the scenario provided. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 Record the annual interest of 12% payable at the end of the year on the $10,000 borrowings from the bank. Note: Enter debits before credits. Date General Journal Debit Credit Jan 31

A company is in its first month of operations. On January 1, the company borrows $10,000 from the bank. The bank charges annual interest of 12% on the borrowed amount. Interest is due at the end of the year. What adjusting entry would be made at the end of January? Post the adjusting entry for the scenario provided. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 Record the annual interest of 12% payable at the end of the year on the $10,000 borrowings from the bank. Note: Enter debits before credits. Date General Journal Debit Credit Jan 31

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter4: Income Measurement And Accrual Accounting

Section: Chapter Questions

Problem 4.18E: Interest Payable—Quarterly Adjustments Glendive takes out a 12%, 90-day, $100,000 loan with Second...

Related questions

Question

Transcribed Image Text:of 5

Knowledge Check 01

A company is in its first month of operations. On January 1, the company borrows $10,000 from the bank. The bank charges annual

interest of 12% on the borrowed amount. Interest is due at the end of the year. What adjusting entry would be made at the end of

January? Post the adjusting entry for the scenario provided. (If no entry is required for a transaction/event, select "No Journal Entry

Required" in the first account field.)

View transaction list

ok

t

Journal entry worksheet

nces

1

Record the annual interest of 12% payable at the end of the year on the

$10,000 borrowings from the bank.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

Jan 31

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College