On December 1, Daw Co. accepts a $10,000, 45-day, 6% note from a customer. (1) Prepare the year-end adjusting entry to record accrued interest revenue on December 31. (2) Prepare the entry required on the note's maturity date assuming it is honored. (Use 360 days a year.) View transaction list Journal entry worksheet 1 Record the year-end adjustment related to this note, if any. Note: Enter debits before credits.

On December 1, Daw Co. accepts a $10,000, 45-day, 6% note from a customer. (1) Prepare the year-end adjusting entry to record accrued interest revenue on December 31. (2) Prepare the entry required on the note's maturity date assuming it is honored. (Use 360 days a year.) View transaction list Journal entry worksheet 1 Record the year-end adjustment related to this note, if any. Note: Enter debits before credits.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter17: Accounting For Notes And Interest

Section: Chapter Questions

Problem 6SEB: JOURNAL ENTRIES (ACCRUED INTEREST RECEIVABLE) At the end of the year, the following interest is...

Related questions

Question

7

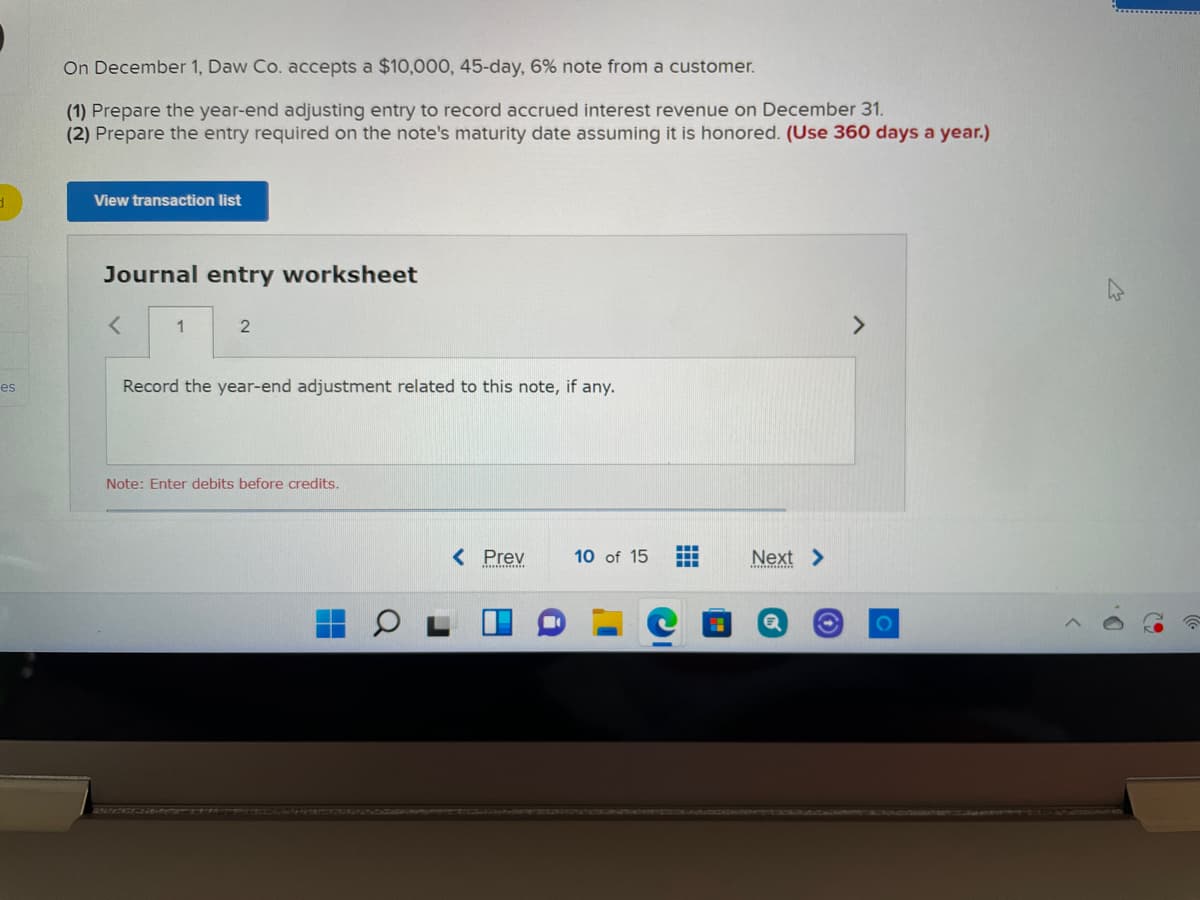

Transcribed Image Text:On December 1, Daw Co. accepts a $10,000, 45-day, 6% note from a customer.

(1) Prepare the year-end adjusting entry to record accrued interest revenue on December 31.

(2) Prepare the entry required on the note's maturity date assuming it is honored. (Use 360 days a year.)

View transaction list

Journal entry worksheet

1

<>

Record the year-end adjustment related to this note, if any.

es

Note: Enter debits before credits.

< Prev

10 of 15

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning