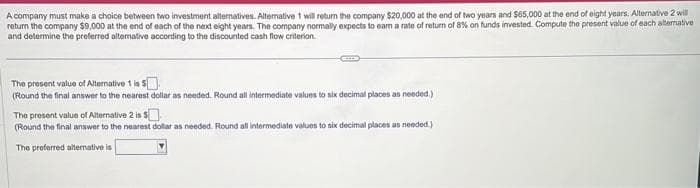

A company must make a choice between two investment alternatives. Alternative 1 will return the company $20,000 at the end of two years and $65,000 at the end of eight years. Alternative 2 will return the company $9,000 at the end of each of the next eight years. The company normally expects to eam a rate of return of 8% on funds invested. Compute the present value of each alternative and determine the preferred altermative according to the discounted cash flow criterion The present value of Alternative 1 is $ (Round the final answer to the nearest dollar as needed. Round all intermediate values to six decimal places as needed.) The present value of Alternative 2 is $ (Round the final answer to the nearest dollar as needed. Round all intermediate values to six decimal places as needed.) The preferred alternative is

A company must make a choice between two investment alternatives. Alternative 1 will return the company $20,000 at the end of two years and $65,000 at the end of eight years. Alternative 2 will return the company $9,000 at the end of each of the next eight years. The company normally expects to eam a rate of return of 8% on funds invested. Compute the present value of each alternative and determine the preferred altermative according to the discounted cash flow criterion The present value of Alternative 1 is $ (Round the final answer to the nearest dollar as needed. Round all intermediate values to six decimal places as needed.) The present value of Alternative 2 is $ (Round the final answer to the nearest dollar as needed. Round all intermediate values to six decimal places as needed.) The preferred alternative is

Chapter4: Financial Planning And Forecasting

Section: Chapter Questions

Problem 6P

Related questions

Question

Transcribed Image Text:A company must make a choice between two investment alternatives. Alternative 1 will return the company $20,000 at the end of two years and $65,000 at the end of eight years. Alternative 2 will

return the company $9,000 at the end of each of the next eight years. The company normally expects to eam a rate of return of 8% on funds invested. Compute the present value of each alternative.

and determine the preferred alterative according to the discounted cash flow criterion.

COTE

The present value of Alternative 1 is $

(Round the final answer to the nearest dollar as needed. Round all intermediate values to six decimal places as needed.)

The present value of Alternative 2 is $

(Round the final answer to the nearest dollar as needed. Round all intermediate values to six decimal places as needed.)

The preferred alternative is

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College