Use the following information for the questions below. Frank Company produces sporting equipment. In 2021, the first year of operations, Frank produced 24,000 units and sold 19,000 units. In 2022, the production and sales results were exactly reversed. In each year, selling price was $100, variable manufacturing costs were $40 per unit, variable selling expenses were $8 per unit, fixed manufacturing costs were $540,000, and fixed administrative expenses were $200,000. Instructions a)Prepare an income statement for 2021 using variable costing. costing. b)Prepare an income statement for 2021 using absorptic c)Reconcile the differences each year in income from operations under the two costing approaches.

Use the following information for the questions below. Frank Company produces sporting equipment. In 2021, the first year of operations, Frank produced 24,000 units and sold 19,000 units. In 2022, the production and sales results were exactly reversed. In each year, selling price was $100, variable manufacturing costs were $40 per unit, variable selling expenses were $8 per unit, fixed manufacturing costs were $540,000, and fixed administrative expenses were $200,000. Instructions a)Prepare an income statement for 2021 using variable costing. costing. b)Prepare an income statement for 2021 using absorptic c)Reconcile the differences each year in income from operations under the two costing approaches.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter2: Basic Cost Management Concepts

Section: Chapter Questions

Problem 4CE: Refer to Cornerstone Exercises 2.2 and 2.3. Next year, Pietro expects to produce 50,000 units and...

Related questions

Question

Please do not give solution in image format thanku

Transcribed Image Text:ments

QUESTION #1

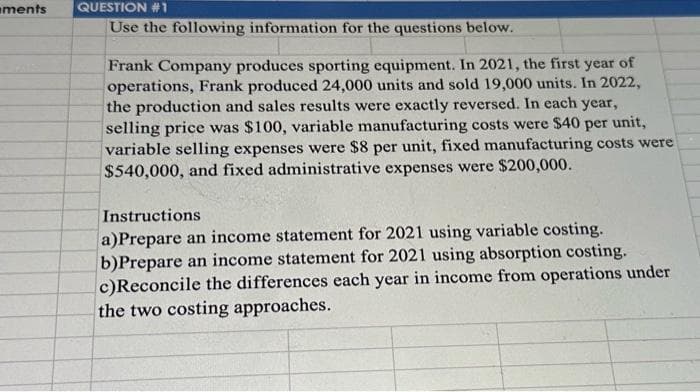

Use the following information for the questions below.

Frank Company produces sporting equipment. In 2021, the first year of

operations, Frank produced 24,000 units and sold 19,000 units. In 2022,

the production and sales results were exactly reversed. In each year,

selling price was $100, variable manufacturing costs were $40 per unit,

variable selling expenses were $8 per unit, fixed manufacturing costs were

$540,000, and fixed administrative expenses were $200,000.

Instructions

a)Prepare an income statement for 2021 using variable costing.

b)Prepare an income statement for 2021 using absorption costing.

c)Reconcile the differences each year in income from operations under

the two costing approaches.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning