A company pays $881,600 cash to acquire an iron mine on January 1. At that same time, it incurs additional costs of $69,600 cash to access the mine, which is estimated to hold 116,000 tons of iron. The estimated value of the land after the iron is removed is $23,200. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 1. Prepare the January 1 entry to record the cost of the iron mine. 2. Prepare the December 31 year-end adjusting entry if 24,800 tons of iron are mined but only 21,200 tons are sold this first year. View transaction list Journal entry worksheet < 1 2 Prepare the January 1 entry to record the cost of the iron mine. >

A company pays $881,600 cash to acquire an iron mine on January 1. At that same time, it incurs additional costs of $69,600 cash to access the mine, which is estimated to hold 116,000 tons of iron. The estimated value of the land after the iron is removed is $23,200. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 1. Prepare the January 1 entry to record the cost of the iron mine. 2. Prepare the December 31 year-end adjusting entry if 24,800 tons of iron are mined but only 21,200 tons are sold this first year. View transaction list Journal entry worksheet < 1 2 Prepare the January 1 entry to record the cost of the iron mine. >

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 7E: Loban Company purchased four cars for 9,000 each and expects that they will be sold in 3 years for...

Related questions

Question

Mn1.

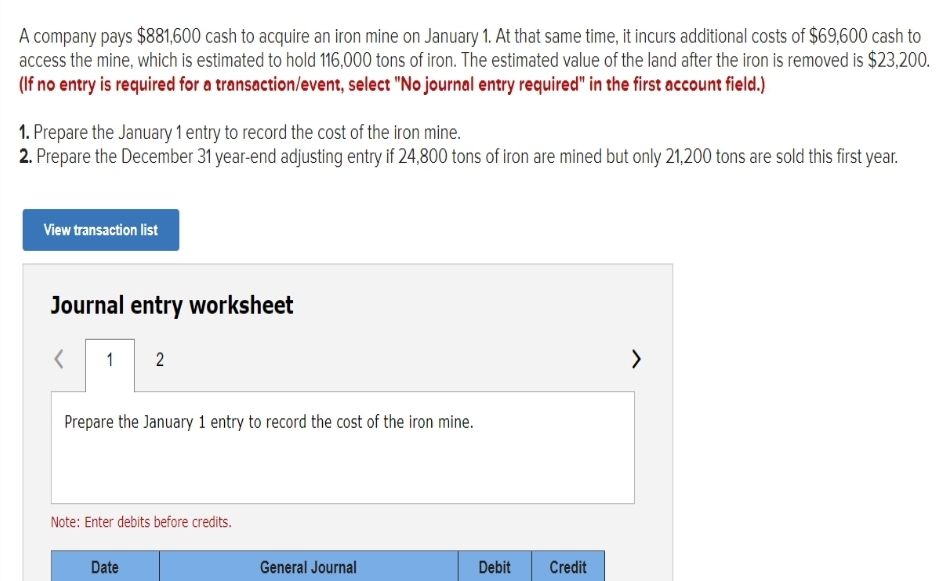

Transcribed Image Text:A company pays $881,600 cash to acquire an iron mine on January 1. At that same time, it incurs additional costs of $69,600 cash to

access the mine, which is estimated to hold 116,000 tons of iron. The estimated value of the land after the iron is removed is $23,200.

(If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

1. Prepare the January 1 entry to record the cost of the iron mine.

2. Prepare the December 31 year-end adjusting entry if 24,800 tons of iron are mined but only 21,200 tons are sold this first year.

View transaction list

Journal entry worksheet

<

1 2

Prepare the January 1 entry to record the cost of the iron mine.

Note: Enter debits before credits.

Date

General Journal

Debit Credit

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning