A company plans to own and operate a storage rental faclity, For the first month of operations, the company has the following transactions. 1 January 1 Issue 10,000 shares of common stock in exchange for $31,000 in cash. 2January 5 Purchase Tand for $18,500. A note payable is signed for the full amount. 3.January 9 Purchase storage container equipeent for $7,900 cash. 4. January 12 Hire three ceployees for $1,900 per month. 5. January 1s Receive cash of $11,980 in rental fees for the current eonth. 6. January 21 Purchase office supplies for $1,900 on account. Y.January 31 Pay employees $5,700 for the first eonth's salaries. 2. Post each transaction to T-accounts and calculate the ending balance for each account. For each posting, Indicate the corresponding transaction number and the appropriate transaction amount. Since this is the first month of operations, all T-accounts have a beginning balance of zero.

A company plans to own and operate a storage rental faclity, For the first month of operations, the company has the following transactions. 1 January 1 Issue 10,000 shares of common stock in exchange for $31,000 in cash. 2January 5 Purchase Tand for $18,500. A note payable is signed for the full amount. 3.January 9 Purchase storage container equipeent for $7,900 cash. 4. January 12 Hire three ceployees for $1,900 per month. 5. January 1s Receive cash of $11,980 in rental fees for the current eonth. 6. January 21 Purchase office supplies for $1,900 on account. Y.January 31 Pay employees $5,700 for the first eonth's salaries. 2. Post each transaction to T-accounts and calculate the ending balance for each account. For each posting, Indicate the corresponding transaction number and the appropriate transaction amount. Since this is the first month of operations, all T-accounts have a beginning balance of zero.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter3: Processing Accounting Information

Section: Chapter Questions

Problem 3.15MCE: Journal Entries Following is a list of transactions entered into during the first month of...

Related questions

Question

I need the answer as soon as possible

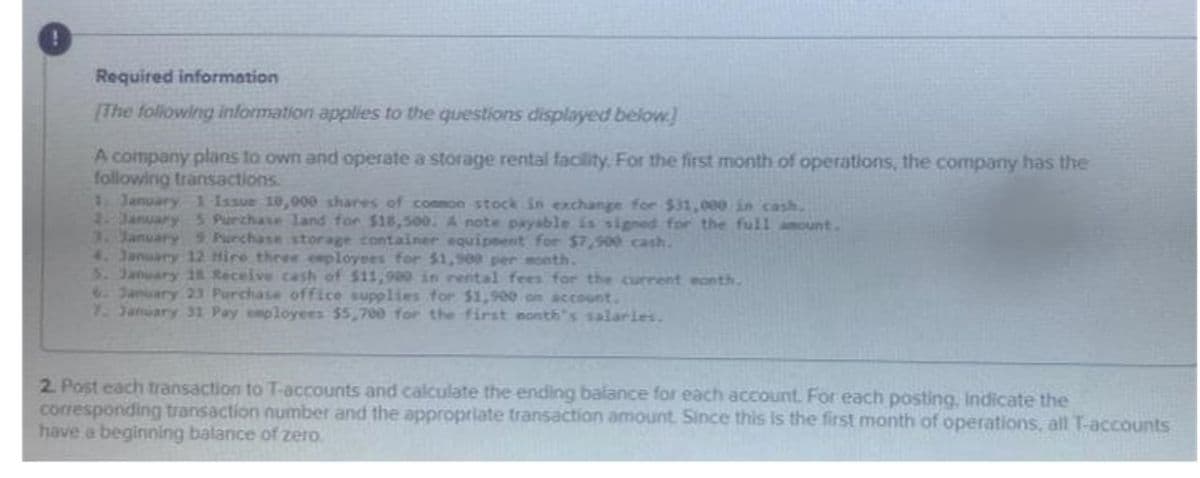

Transcribed Image Text:Required information

[The following information applies to the questions displayed below)

A company plans to own and operate a storage rental facility, For the first month of operations, the company has the

following transactions.

1 January 1 Issue 10,000 shares of conson stock in exchange for $31,000 in cash.

2January5 Purchase 1and for $18,500. A note payable is signed for the full amount.

3. January 9 Purchase storage container equipeent for $7,900 cash.

4. January 12 Hire three ceployees for $1,900 per month.

5. January 18 Receive cash of $11,990 in rental fees for the current eonth.

6January 23 Purchase office supplies for $1,900 on account.

1.January 31 Pay employees $5,700 for the first nonth"s salarles.

2. Post each transaction to T-accounts and calculate the ending balance for each account. For each posting, Indicate the

corresponding transaction number and the appropriate transaction amount. Since this is the first month of operations, all T-accounts

have a beginning balance of zero.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning