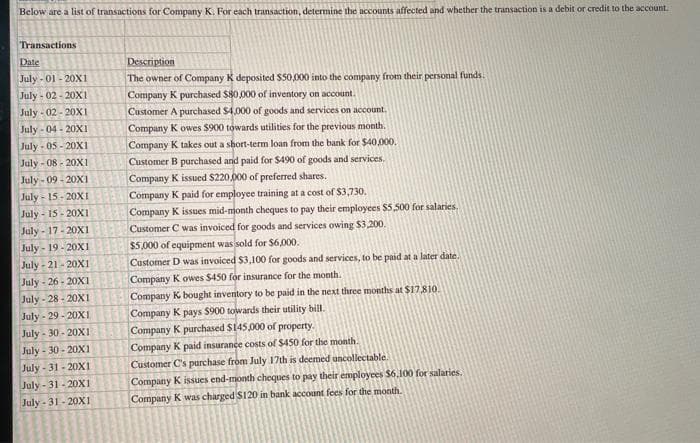

Transactions Date Description July -01 - 20XI The owner of Company K deposited $50,000 into the company from their personal funds. July - 02 - 20XI Company K purchased $80,000 of inventory on account. July - 02 - 20XI Customer A purchased $4,000 of goods and services on account. July - 04- 20XI Company K owes $900 towards utilities for the previous month. July - 05 - 20XI Company K takes out a sbort-term loan from the bank for $40,000. July - 08 - 20X1 Customer B purchased and paid for $490 of goods and services. July - 09 - 20XI Company K issued $220,000 of preferred shares. July - 15- 20XI Company K paid for employee training at a cost of $3,730. Company K issues mid-month cheques to pay their employees $5 500 for salaries. Customer C was invoiced for goods and services owing $3,200. $5,000 of equipment was sold for $6,000. Customer D was invoiced $3,100 for goods and services, to be paid at a later date. July- 15-20XI July - 17- 20X1 July - 19-20XI July - 21- 20X1 July - 26 - 20X1 Company K owes $450 for insurance for the month. July - 28 - 20XI Company K bought inventory to be paid in the next three months at $17.810. July - 29 - 20XI Company K pays $900 towards their utility bill. July - 30 - 20X1 Company K purchased $145,000 of property. July - 30 - 20X1 Company K paid insurance costs of $450 for the month. Customer C's purchase from July 17th is deemed uncollectable. Company K issues end-month cheques to pay their employees $6,100 for salaries. July - 31- 20XI July - 31 - 20XI July - 31- 20XI Company K was charged $120 in bank account fees for the month.

Transactions Date Description July -01 - 20XI The owner of Company K deposited $50,000 into the company from their personal funds. July - 02 - 20XI Company K purchased $80,000 of inventory on account. July - 02 - 20XI Customer A purchased $4,000 of goods and services on account. July - 04- 20XI Company K owes $900 towards utilities for the previous month. July - 05 - 20XI Company K takes out a sbort-term loan from the bank for $40,000. July - 08 - 20X1 Customer B purchased and paid for $490 of goods and services. July - 09 - 20XI Company K issued $220,000 of preferred shares. July - 15- 20XI Company K paid for employee training at a cost of $3,730. Company K issues mid-month cheques to pay their employees $5 500 for salaries. Customer C was invoiced for goods and services owing $3,200. $5,000 of equipment was sold for $6,000. Customer D was invoiced $3,100 for goods and services, to be paid at a later date. July- 15-20XI July - 17- 20X1 July - 19-20XI July - 21- 20X1 July - 26 - 20X1 Company K owes $450 for insurance for the month. July - 28 - 20XI Company K bought inventory to be paid in the next three months at $17.810. July - 29 - 20XI Company K pays $900 towards their utility bill. July - 30 - 20X1 Company K purchased $145,000 of property. July - 30 - 20X1 Company K paid insurance costs of $450 for the month. Customer C's purchase from July 17th is deemed uncollectable. Company K issues end-month cheques to pay their employees $6,100 for salaries. July - 31- 20XI July - 31 - 20XI July - 31- 20XI Company K was charged $120 in bank account fees for the month.

Chapter3: Analyzing And Recording Transactions

Section: Chapter Questions

Problem 18EB: Krespy Corp. has a cash balance of $7,500 before the following transactions occur: A. received...

Related questions

Question

Make a t chart(balancing) Asset, Liabilty, and equity

Transcribed Image Text:Below are a list of transactions for Company K. For each transaction, determine the accounts affected and whether the transaction is a debit or credit to the account.

Transactions

Date

Description

July - 01 - 20XI

The owner of Company K deposited $50,000 into the company from their personal funds.

July - 02 - 20XI

Company K purchased $80,000 of inventory on account.

July - 02 - 20XI

Customer A purchased $4,000 of goods and services on account.

July - 04- 20XI

Company K owes $900 towards utilities for the previous month.

July - 05 - 20XI

Company K takes out a sbort-term loan from the bank for $40,000.

July - 08 - 20X1

Customer B purchased and paid for $490 of goods and services.

July - 09 - 20XI

Company K issued $220,000 of preferred shares.

July - 15- 20XI

Company K paid for employee training at a cost of $3,730.

Company K issues mid-month cheques to pay their employees $5,500 for salaries,

July - 15- 20X1

July - 17- 20XI

Customer C was invoiced for goods and services owing $3,200.

July - 19- 20XI

$5,000 of equipment was sold for $6,000.

July - 21 - 20XI

Customer D was invoiced $3,100 for goods and services, to be paid at a later date.

July - 26 - 20X1

Company K owes $450 for insurance for the month.

Company K bought inventory to be paid in the next three months at $17.810.

Company K pays $900 towards their utility bill.

Company K purchased $145,000 of property.

Company K paid insurance costs of $450 for the month.

Customer C's purchase from July 17th is deemed uncollectable.

July - 28 - 20XI

July - 29 - 20XI

July- 30 - 20X1

July - 30 - 20X1

July - 31 - 20XI

July - 31 - 20XI

Company K issues end-month cheques to pay their employees $6,100 for salaries.

July - 31- 20XI

Company K was charged S120 in bank account fees for the month.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 2 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,