A company reports the Information below. Days' sales in accounts receivable Days' sales in inventory Days' payable outstanding 40 24 31 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the number of days in the company's cash conversion cycle. Cash conversion cycle days Required 2 > A company reports the Information below. Days' sales in accounts receivable Days' sales in Inventory Days' payable outstanding 40 24 31 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Competitors report a cash conversion cycle of 36 days. Is the company more effective in managing cash based on the conversion cycle in comparison to its competitors? Is the company more effective than its competitors in managing cash?

A company reports the Information below. Days' sales in accounts receivable Days' sales in inventory Days' payable outstanding 40 24 31 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the number of days in the company's cash conversion cycle. Cash conversion cycle days Required 2 > A company reports the Information below. Days' sales in accounts receivable Days' sales in Inventory Days' payable outstanding 40 24 31 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Competitors report a cash conversion cycle of 36 days. Is the company more effective in managing cash based on the conversion cycle in comparison to its competitors? Is the company more effective than its competitors in managing cash?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter11: The Statement Of Cash Flows

Section: Chapter Questions

Problem 23CE: Cash Receipts from Customers Singleton Inc. had accounts receivable of $22,150 at January 1, 2019,...

Related questions

Question

need

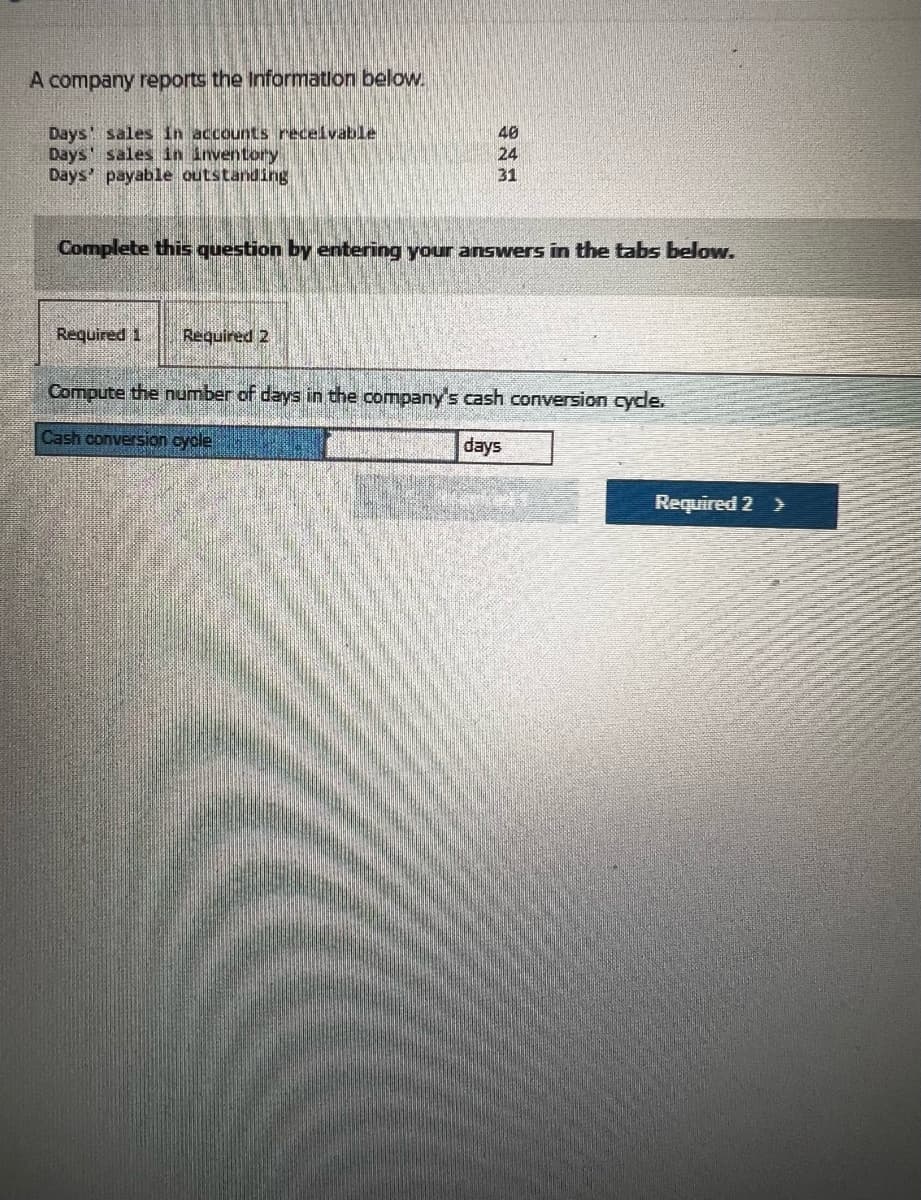

Transcribed Image Text:A company reports the Information below.

Days' sales in accounts receivable

Days' sales in inventory

Days' payable outstanding

40

24

31

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Compute the number of days in the company's cash conversion cycle.

Cash conversion cycle

days

Required 2 >

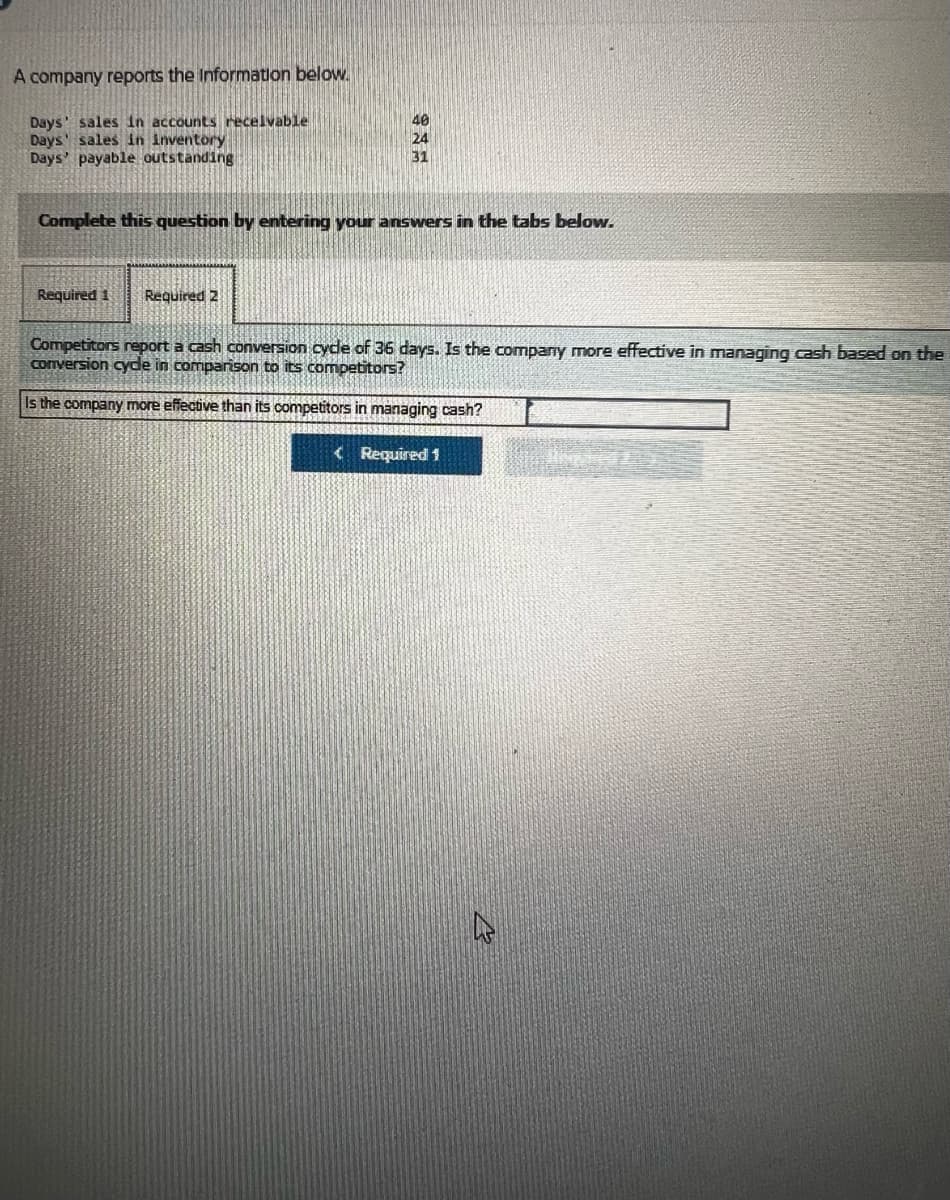

Transcribed Image Text:A company reports the Information below.

Days' sales in accounts receivable

Days' sales in Inventory

Days' payable outstanding

40

24

31

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Competitors report a cash conversion cycle of 36 days. Is the company more effective in managing cash based on the

conversion cycle in comparison to its competitors?

Is the company more effective than its competitors in managing cash?

<Required 1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub