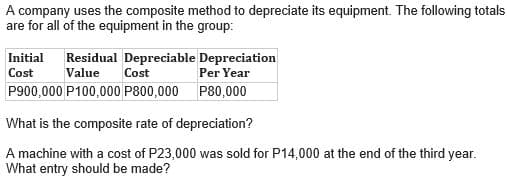

A company uses the composite method to depreciate its equipment. The following totals are for all of the equipment in the group: Initial Cost Residual Depreciable Depreciation Value Cost Per Year P80,000 P900,000 P100,000 P800,000 What is the composite rate of depreciation? A machine with a cost of P23,000 was sold for P14,000 at the end of the third year. What entry should be made?

A company uses the composite method to depreciate its equipment. The following totals are for all of the equipment in the group: Initial Cost Residual Depreciable Depreciation Value Cost Per Year P80,000 P900,000 P100,000 P800,000 What is the composite rate of depreciation? A machine with a cost of P23,000 was sold for P14,000 at the end of the third year. What entry should be made?

Chapter8: Depreciation And Sale Of Business Property

Section: Chapter Questions

Problem 6MCQ: Which of the following is not true about the MACRS depreciation system: A salvage value must be...

Related questions

Question

Transcribed Image Text:A company uses the composite method to depreciate its equipment. The following totals

are for all of the equipment in the group:

Initial Residual Depreciable Depreciation

Cost

Value Cost

Per Year

P900,000 P100,000 P800,000

P80,000

What is the composite rate of depreciation?

A machine with a cost of P23,000 was sold for P14,000 at the end of the third year.

What entry should be made?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning