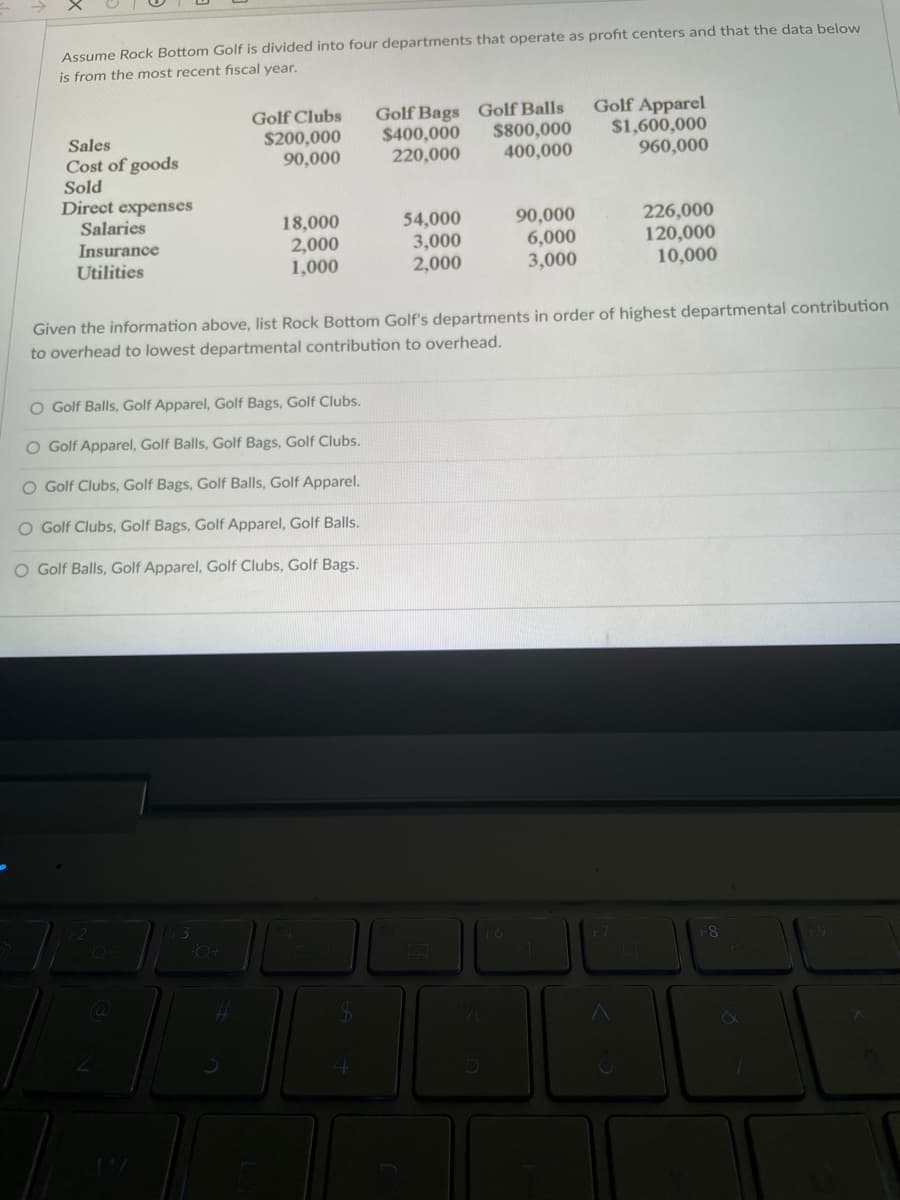

Assume Rock Bottom Golf is divided into four departments that operate as is from the most recent fiscal year. Sales Cost of goods Sold Direct expenses Salaries Insurance Utilities Golf Clubs $200,000 90,000 18,000 2,000 1,000 Golf Bags $400,000 220,000 O Golf Balls, Golf Apparel, Golf Bags, Golf Clubs. O Golf Apparel, Golf Balls, Golf Bags, Golf Clubs. O Golf Clubs, Golf Bags, Golf Balls, Golf Apparel. O Golf Clubs, Golf Bags, Golf Apparel, Golf Balls. O Golf Balls, Golf Apparel, Golf Clubs, Golf Bags. 54,000 3,000 2,000 Golf Balls $800,000 400,000 90,000 6,000 3,000 Golf Apparel $1,600,000 960,000 226,000 120,000 10,000 Given the information above, list Rock Bottom Golf's departments in order of highest departmental contribution to overhead to lowest departmental contribution to overhead.

Assume Rock Bottom Golf is divided into four departments that operate as is from the most recent fiscal year. Sales Cost of goods Sold Direct expenses Salaries Insurance Utilities Golf Clubs $200,000 90,000 18,000 2,000 1,000 Golf Bags $400,000 220,000 O Golf Balls, Golf Apparel, Golf Bags, Golf Clubs. O Golf Apparel, Golf Balls, Golf Bags, Golf Clubs. O Golf Clubs, Golf Bags, Golf Balls, Golf Apparel. O Golf Clubs, Golf Bags, Golf Apparel, Golf Balls. O Golf Balls, Golf Apparel, Golf Clubs, Golf Bags. 54,000 3,000 2,000 Golf Balls $800,000 400,000 90,000 6,000 3,000 Golf Apparel $1,600,000 960,000 226,000 120,000 10,000 Given the information above, list Rock Bottom Golf's departments in order of highest departmental contribution to overhead to lowest departmental contribution to overhead.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter10: Decentralization: Responsibility Accounting, Performance Evaluation, And Transfer Pricing

Section: Chapter Questions

Problem 11E: Xenold, Inc., manufactures and sells cooktops and ovens through three divisions: Home, Restaurant,...

Related questions

Question

Transcribed Image Text:Assume Rock Bottom Golf is divided into four departments that operate as profit centers and that the data below

is from the most recent fiscal year.

Sales

Cost of goods

Sold

Direct expenses

Salaries

Insurance

Utilities

Golf Clubs

$200,000

90,000

18,000

2,000

1,000

0+

O Golf Balls, Golf Apparel, Golf Bags, Golf Clubs.

O Golf Apparel, Golf Balls, Golf Bags, Golf Clubs.

O Golf Clubs, Golf Bags, Golf Balls, Golf Apparel.

O Golf Clubs, Golf Bags, Golf Apparel, Golf Balls.

O Golf Balls, Golf Apparel, Golf Clubs, Golf Bags.

Golf Bags

$400,000

220,000

54,000

3,000

2,000

Golf Balls

$800,000

400,000

90,000

6,000

3,000

Given the information above, list Rock Bottom Golf's departments in order of highest departmental contribution

to overhead to lowest departmental contribution to overhead.

F6

Golf Apparel

$1,600,000

960,000

226,000

120,000

10,000

F7

-8

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning