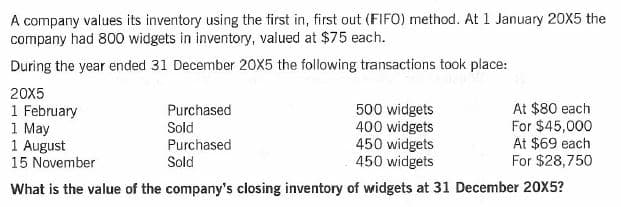

A company values its inventory using the first in, first out (FIFO) method. At 1 January 20X5 the company had 800 widgets in inventory, valued at $75 each. During the year ended 31 December 20X5 the following transactions took place: 20X5 1 February 1 May 1 August 15 November Purchased Sold Purchased Sold 500 widgets 400 widgets 450 widgets 450 widgets At $80 each For $45,000 At $69 each For $28,750 What is the value of the company's closing inventory of widgets at 31 December 20X5?

A company values its inventory using the first in, first out (FIFO) method. At 1 January 20X5 the company had 800 widgets in inventory, valued at $75 each. During the year ended 31 December 20X5 the following transactions took place: 20X5 1 February 1 May 1 August 15 November Purchased Sold Purchased Sold 500 widgets 400 widgets 450 widgets 450 widgets At $80 each For $45,000 At $69 each For $28,750 What is the value of the company's closing inventory of widgets at 31 December 20X5?

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 67P

Related questions

Topic Video

Question

Transcribed Image Text:A company values its inventory using the first in, first out (FIFO) method. At 1 January 20X5 the

company had 800 widgets in inventory, valued at $75 each.

During the year ended 31 December 20X5 the following transactions took place:

20X5

1 February

1 May

1 August

15 November

500 widgets

400 widgets

450 widgets

450 widgets

At $80 each

For $45,000

At $69 each

For $28,750

Purchased

Sold

Purchased

Sold

What is the value of the company's closing inventory of widgets at 31 December 20X5?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub