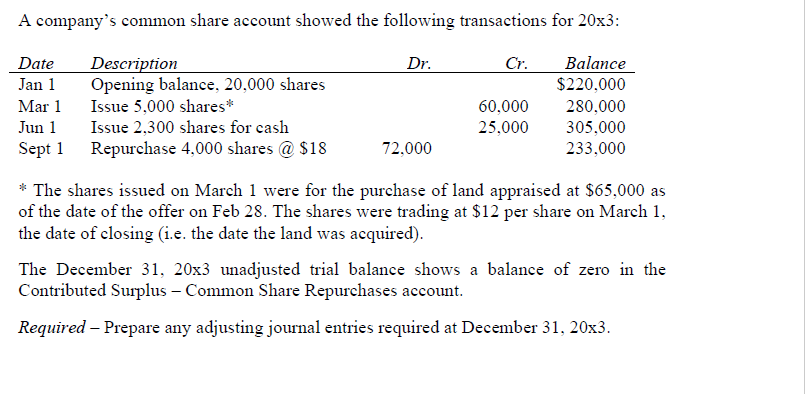

A company's common share account showed the following transactions for 20x3: Date Jan 1 Description Opening balance, 20,000 shares Balance $220,000 Dr. Cr. Mar 1 Issue 5,000 shares* 60,000 280,000 Jun 1 Issue 2,300 shares for cash 25,000 305,000 Sept 1 Repurchase 4,000 shares @ $18 72,000 233,000 * The shares issued on March 1 were for the purchase of land appraised at $65,000 as of the date of the offer on Feb 28. The shares were trading at $12 per share on March 1, the date of closing (i.e. the date the land was acquired). The December 31, 20x3 unadjusted trial balance shows a balance of zero in the Contributed Surplus – Common Share Repurchases account. Required – Prepare any adjusting journal entries required at December 31, 20x3.

A company's common share account showed the following transactions for 20x3: Date Jan 1 Description Opening balance, 20,000 shares Balance $220,000 Dr. Cr. Mar 1 Issue 5,000 shares* 60,000 280,000 Jun 1 Issue 2,300 shares for cash 25,000 305,000 Sept 1 Repurchase 4,000 shares @ $18 72,000 233,000 * The shares issued on March 1 were for the purchase of land appraised at $65,000 as of the date of the offer on Feb 28. The shares were trading at $12 per share on March 1, the date of closing (i.e. the date the land was acquired). The December 31, 20x3 unadjusted trial balance shows a balance of zero in the Contributed Surplus – Common Share Repurchases account. Required – Prepare any adjusting journal entries required at December 31, 20x3.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter10: Stockholder's Equity

Section: Chapter Questions

Problem 57E: Outstanding Stock Lars Corporation shows the following information in the stockholders equity...

Related questions

Question

Please answer complete and properly

Transcribed Image Text:A company's common share account showed the following transactions for 20x3:

Cr.

Balance

$220,000

Date

Dr.

Description

Opening balance, 20,000 shares

Issue 5,000 shares*

Issue 2,300 shares for cash

Jan 1

Mar 1

60,000

25,000

280,000

Jun 1

305,000

Sept 1

Repurchase 4,000 shares @ $18

72,000

233,000

* The shares issued on March 1 were for the purchase of land appraised at $65,000 as

of the date of the offer on Feb 28. The shares were trading at $12 per share on March 1,

the date of closing (i.e. the date the land was acquired).

The December 31, 20x3 unadjusted trial balance shows a balance of zero in the

Contributed Surplus – Common Share Repurchases account.

Required – Prepare any adjusting journal entries required at December 31, 20x3.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College