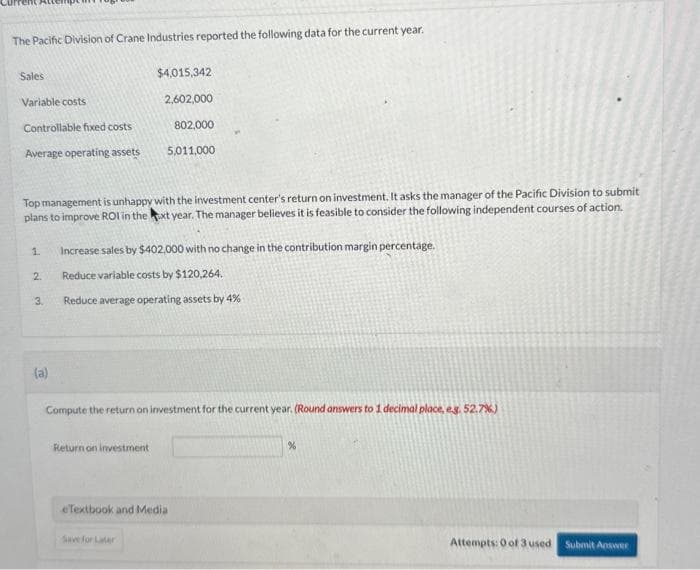

(a) Compute the return on investment for the current year. (Round answers to 1 decimal place, e.g. 52.7%) Return on investment %

Q: Sales ( $63 per unit) Cost of goods sold ($29 per unit) Gross margin Selling and administrative…

A: Absorption costing entails allocating fixed overhead costs to all units produced for an accounting…

Q: Skyline Florists uses an activity-based costing system to compute the cost of making floral bouquets…

A: Introduction:- ABC costing means Activity based costing. It is used to allocation of manufacturing…

Q: During 2024, a company sells 270 units of inventory for $94 each. The company has the following…

A: In case of FIFO method beginning inventory/ first purchased goods will be sold first.

Q: The following selected transactions relate to investment activities of Ornamental Insulation…

A: Debt securities are referred to as those financial instruments which are bought by investors,…

Q: Blossom Airways, Inc., a small two-plane passenger airline, has asked for your assistance in some…

A: Break Even Point :— It is the point of production where total cost is equal to total revenue. At…

Q: Required information Eckert Company uses the absorption costing approach to cost plus pricing to set…

A: Answer:- Formula:- Markup percentage on absorption cost = {(Required rate of return x Investment)…

Q: displayed below.] The following data were provided by Mystery Incorporated for the year ended…

A: Lets understand the basics. Income statement can be prepared using either single step method or…

Q: Seif Company sells many products. chairs is one of its popular items. Below is an analysis of the…

A: Lets understand the basics. Inventory refers to the amount of goods or merchandise which the company…

Q: Problem: Module 6 Textbook Problem 2 Learning Objective: 6-1 Identify the characteristics of…

A: Opportunity cost refers to the value of the next best alternative that must be given up or…

Q: 3-a. Prepare Wells Technical Institute's income statement for the year. 3-b. Prepare Wells Technical…

A: A financial statement known as an income statement lists a company's sales, costs, and net income…

Q: The company borrowed $762,000 on a construction loan at 12% interest on January 1, 2024. This loan…

A: When calculating interest using the specific interest method, the capitalization of interest refers…

Q: Net income or loss is transferred from the income statement to the: < Trial Balance General Journal…

A: Financial statement are very important statement for any entity to review the status that how much…

Q: On January 1, 2021, Tonge Industries had outstanding 760,000 common shares ($1 par) that originally…

A: Answer:- Formula:- Earnings per share = (Net income - Preferred dividends) / Weighted average of…

Q: Blossom Construction's manufacturing costs for August when production was 1,120 units are as…

A: Variable cost will change per unit where's fixed cost will remain constant in total.

Q: SAPE Ltd. manufactures speciality meat pies, which it sells in bulk to delicatessen shops. The only…

A: Budgeted total contribution = Budgeted sales revenue – Budgeted COGS Actual COGS = Actual cost of…

Q: Finch Company is considering the replacement of some equipment and the potential replacement…

A: A replacement decision refers to a business decision where a company must decide whether to replace…

Q: Required: a. Compute the unit costs for the two products, Standard and Premium, using the current…

A: The current costing system represents the traditional costing method in which the total overheads…

Q: Listed below in alphabetical order are selected financial statement items of Pharoah Company at…

A: Account payable is the current liability insurance expense is part of the income statement. service…

Q: 6.6% coupons. You hold the bond for four years, an ell it immediately after receiving the fourth…

A: Bonds are source of finance for the companies and bonds are paid annual coupon payments and par…

Q: Crane Company sold 10,800 Super-Spreaders on December 31, 2025, at a total price of $1,004,400, with…

A: Amounts Reported in income: Sales Revenue = $1,004,400 Since super spreaders are sold at $1,004,400,…

Q: Required: Prepare an entry to allocate the over- or underapplied overhead.

A: The overhead is applied to the production on the basis of predetermined overhead rate. The…

Q: John Rivera owns a $300,000 level-term life policy which he purchase five years ago. He has paid…

A: Level term insurance policy is type of term insurance in which annual payment are made and person…

Q: Use the following information for the Exercises below. (Algo) [The following information applies to…

A: Calculation of overhead volume variance and controllable variance are as follows. An Overhead…

Q: Blossom Corporation operates a retail computer store. To improve delivery services to customers, the…

A: Journal entry: It implies to the recording or accounting of the day-to-day financial transactions of…

Q: For financial reporting. Clinton Poultry Farms has used the declining-balance method of depreciation…

A: The depreciation expense is charged on fixed assets as reduced value of the fixed asset with usage…

Q: When does a company record an asset related to a gain contingency? a. When future events will…

A: A contingency, in general, is an uncertain future event or condition that may result in a gain or a…

Q: For each independent situation below, calculate the missing values. Revenues $1,150 104,820 ✔…

A: Solution: Net income (Loss) = Revenue - Expenses + Gains - Losses Net income (Loss) in situation 1 =…

Q: 3 ces ! Required information [The following information applies to the questions displayed below.]…

A: Current asset is an cash and cash equivalent and other assets which can be realized in normal…

Q: Mr. Fuentes has $15,000 to invest. He is undecided about putting the money into tax-exempt municipal…

A: To determine which investment Mr. Fuentes should make, we need to compare the after-tax returns of…

Q: the adjusted trial balance of skysong at december 31 shows inventory $24,600, Sales Revenue…

A: Closing entries are used to close the temporary accounts. These are expense revenue accounts. The…

Q: Hoya Corporation reports the following amounts: Assets = $22,500; Liabilities = $2,500;…

A: Income Statement Is One Of The Three Financial Statement. It Shows The Revenue, Expenses And…

Q: Ryan Ltd holds a 75% interest in Tully Ltd. On 30 June 2021 Tully Ltd transferred a depreciable…

A: NCI profit stands for non-controlling interest share of profit and refers to the percentage of…

Q: The following transactions occurred during 2025. Assume that depreciation of 10% per year is charged…

A: Formula : Straight line method : Depreciation = Cost of asset x rate of depreciation

Q: The following data were provided by Mystery Incorporated for the year ended December 31: Cost of…

A: Gross profit is the amount of sales revenue over and above cost of goods sold. Gross Profit = Net…

Q: mpany is expecting to have 1000units sales in next quarter. Find out the Budgeted profit for next…

A: Companies tries to obtain good return on investment due to which they try to increase profits and…

Q: Equivalent Units of Conversion Costs The Rolling Department of Jabari Steel Company had 2,814 tons…

A: Calculation completed % of Beginning WIP DM= ( 100% -100% complete)=00% Conversion = ( 100% - 20%…

Q: What is the breakeven point, in dollars, for Zippy Dippy Swimwear, maker of bathing suits and…

A: Break even is the point at which the entity is in a position of no profit and no loss. At this…

Q: Exercise 8-3 (Algo) Direct Materials Budget [LO8-4] Two grams of musk oil are required for each…

A: Calculation of direct materials budget for Year 2 as follows: The transcript of above image is as…

Q: Required: a. Benton currently applies overhead on the basis of direct labor cost. What is the…

A: The overhead rate is based on the estimated overhead cost and estimated total usage for the period.…

Q: Prepare an incremental analysis of Twilight Hospital. (In the first two columns, enter costs and…

A: The company has some assets to run the business, before buying the assets company should compare the…

Q: Calculate the missing information for each of the following independent cases: Cases A B C D…

A: Cost of goods sold calculated by using opening inventory plus purchase less closing inventory.…

Q: On June 1, 2020, Vaughn Company sells $193,000 of shelving units to a local retailer, ShopBarb,…

A: Recognition of revenue in a bill-and-hold arrangement depends on the circumstances. Vaughn…

Q: The Field, Brown & Snow are partners and share income and losses equality. The partner decide to…

A: Liquidation is the process of closing down a business or a formation by selling all of its property…

Q: Use the following information for #4 - 5: Motown Corporation has the following transactions: Common…

A: Equity shares holders fund includes common share capital, paid up capital in excess of par value,…

Q: What are the criteria for classifying a lease as operating or capital? Why is there a difference…

A: A lease is a contract between a lessor (owner of an asset) and a lessee (user of the asset) that…

Q: During the month of June, Ace Incorporated purchased goods from two suppliers. The sequence of…

A: INVENTORY VALUATION Inventory Valuation is a Method of Calculation of Value of Inventory at the End…

Q: Unific Manufacturing Inc. is a biscuit manufacturer and produces different types of biscuits. With…

A: Labor variance refers to the difference between the actual cost of labor incurred in a production…

Q: The Central Valley Company is a manufacturing firm that produces and sells a single product. The…

A: The break even sales are the sales where business earns no profit no loss during the period. The…

Q: Lovell Variety Seeds mass produces wildflower seed packs. Relevant information used for the process…

A: Concept of equivalent units is used in process costing where cost per equivalent unit is calculated.…

Q: www.daveramsey.com’s Financial Peace University (FPU), Dave recommends Seven Baby Steps. One of…

A: Effective interest rate is interest rate after considering the impact of compounding on the interest…

Please do not give solution in image format thanku

Step by step

Solved in 2 steps

- Refer to the data given in Exercise 10.8. Required: 1. Compute the residual income for each of the opportunities. (Round to the nearest dollar.) 2. Compute the divisional residual income (rounded to the nearest dollar) for each of the following four alternatives: a. The Espresso-Pro is added. b. The Mini-Prep is added. c. Both investments are added. d. Neither investment is made; the status quo is maintained. Assuming that divisional managers are evaluated and rewarded on the basis of residual income, which alternative do you think the divisional manager will choose? 3. Based on your answer in Requirement 2, compute the profit or loss from the divisional managers investment decision. Was the correct decision made?Communication The Norse Division of Gridiron Concepts Inc. experienced significant revenue and profit growth from 20Y4 to 20Y6 as shown in the following divisional income statements: There are no support department allocations, and the division operates as an investment center that must maintain a 15% return on invested assets. Determine the profit margin, investment turnover, and return on investment for the Norse Division for 20Y420Y6. Based on your computations, write a brief memo to the president of Gridiron Concepts Inc., Knute Holz, evaluating the divisions performance.Katayama Company produces a variety of products. One division makes neoprene wetsuits. The divisions projected income statement for the coming year is as follows: Required: 1. Compute the contribution margin per unit, and calculate the break-even point in units. Repeat, using the contribution margin ratio. 2. The divisional manager has decided to increase the advertising budget by 140,000 and cut the average selling price to 200. These actions will increase sales revenues by 1 million. Will this improve the divisions financial situation? Prepare a new income statement to support your answer. 3. Suppose sales revenues exceed the estimated amount on the income statement by 612,000. Without preparing a new income statement, determine by how much profits are underestimated. 4. How many units must be sold to earn an after-tax profit of 1.254 million? Assume a tax rate of 34 percent. (Round your answer up to the next whole unit.) 5. Compute the margin of safety in dollars based on the given income statement. 6. Compute the operating leverage based on the given income statement. (Round to three significant digits.) If sales revenues are 20 percent greater than expected, what is the percentage increase in profits?

- In 20X1, Don Blackburn, president of Price Electronics, received a report indicating that quality costs were 31% of sales. Faced with increasing pressures from imported goods. Don resolved to take measures to improve the overall quality of the companys products. After hiring a consultant in 20X1, the company began an aggressive program of total quality control. At the end of 20X5, Don requested an analysis of the progress the company had made in reducing and controlling quality costs. The accounting department assembled the following data: Required: 1. Compute the quality costs as a percentage of sales by category and in total for each year. 2. Prepare a multiple-year trend graph for quality costs, both by total costs and by category. Using the graph, assess the progress made in reducing and controlling quality costs. Does the graph provide evidence that quality has improved? Explain. 3. Using the 20X1 quality cost relationships (assume all costs are variable), calculate the quality costs that would have prevailed in 20X4. By how much did profits increase in 20X4 because of the quality improvement program? Repeat for 20X5.Suspicious Acquisition of Data, Ethical Issues Bill Lewis, manager of the Thomas Electronics Division, called a meeting with his controller, Brindon Peterson, and his marketing manager, Patty Fritz. The following is a transcript of the conversation that took place during the meeting: Bill: Brindon, the variable costing system that you developed has proved to be a big plus for our division. Our success in winning bids has increased, and as a result our revenues have increased by 25%. However, if we intend to meet this years profit targets, we are going to need something extraam I right, Patty? Patty: Absolutely. While we have been able to win more bids, we still are losing too many, particularly to our major competitor, Kilborn Electronics. If we knew more about their bidding strategy, we could be more successful at competing with them. Brindon: Would knowing their variable costs help? Patty: Certainly. It would give me their minimum price. With that knowledge, Im sure that we could find a way to beat them on several jobs, particularly on those jobs where we are at least as efficient. It would also help us to identify where we are not cost competitive. With this information, we might be able to find ways to increase our efficiency. Brindon: Well, I have good news. Ive been talking with Carl Penobscot, Kilborns assistant controller. Carl doesnt feel appreciated by Kilborn and wants to make a change. He could easily fit into our team here. Plus, Carl has been preparing for a job switch by quietly copying Kilborns accounting files and records. Hes already given me some data that reveal bids that Kilborn made on several jobs. If we can come to a satisfactory agreement with Carl, hell bring the rest of the information with him. Well easily be able to figure out Kilborns prospective bids and find ways to beat them. Besides, I could use another accountant on my staff. Bill, would you authorize my immediate hiring of Carl with a favorable compensation package? Bill: I know that you need more staff, Brindon, but is this the right thing to do? It sounds like Carl is stealing those files, and surely Kilborn considers this information confidential. I have real ethical and legal concerns about this. Why dont we meet with Laurie, our attorney, and determine any legal problems? Required: 1. Is Carls behavior ethical? What would Kilborn think? 2. Is Bill correct in supposing that there are ethical and/or legal problems involved with the hiring of Carl? (Reread the section on corporate codes of conduct in Chapter 1.) What would you do if you were Bill? Explain.Sales Revenue Approach, Variable Cost Ratio, Contribution Margin Ratio Arberg Companys controller prepared the following budgeted income statement for the coming year: Required: 1. What is Arbergs variable cost ratio? What is its contribution margin ratio? 2. Suppose Arbergs actual revenues are 30,000 more than budgeted. By how much will operating income increase? Give the answer without preparing a new income statement 3. How much sales revenue must Arberg earn to break even? Prepare a contribution margin income statement to verify the accuracy of your answer. 4. What is Arbergs expected margin of safety? 5. What is Arbergs margin of safety if sales revenue is 380,000?

- The management of Hartman Company is trying to determine the amount of each of two products to produce over the coming planning period. The following information concerns labor availability, labor utilization, and product profitability: a. Develop a linear programming model of the Hartman Company problem. Solve the model to determine the optimal production quantities of products 1 and 2. b. In computing the profit contribution per unit, management does not deduct labor costs because they are considered fixed for the upcoming planning period. However, suppose that overtime can be scheduled in some of the departments. Which departments would you recommend scheduling for overtime? How much would you be willing to pay per hour of overtime in each department? c. Suppose that 10, 6, and 8 hours of overtime may be scheduled in departments A, B, and C, respectively. The cost per hour of overtime is 18 in department A, 22.50 in department B, and 12 in department C. Formulate a linear programming model that can be used to determine the optimal production quantities if overtime is made available. What are the optimal production quantities, and what is the revised total contribution to profit? How much overtime do you recommend using in each department? What is the increase in the total contribution to profit if overtime is used?Evaluating selling and administrative cost allocations Gordon Gecco Furniture Company has two major product lines with the following characteristics: Commercial office furniture: Few large orders, little advertising support, shipments in full truckloads, and low handling complexity Home office furniture: Many small orders, large advertising support, shipments in partial truckloads, and high handling complexity The company produced the following profitability report for management: The selling and administrative expenses are allocated to the products on the basis of relative sales dollars. Evaluate the accuracy of this report and recommend an alternative approach.Forchen, Inc., provided the following information for two of its divisions for last year: Required: 1. For the Small Appliances Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 2. For the Cleaning Products Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 3. What if operating income for the Small Appliances Division was 2,000,000? How would that affect average operating assets? Margin? Turnover? ROI? Calculate any changed ratios (round to four significant digits).

- Bolger and Co. manufactures large gaskets for the turbine industry. Bolgers per-unit sales price and variable costs for the current year are as follows: Bolgers total fixed costs aggregate to 360,000. Bolgers labor agreement is expiring at the end of the year, and management is concerned about the effects of a new labor agreement on its break-even point in units. The controller performed a sensitivity analysis to ascertain the estimated effect of a 10-per-unit direct labor increase and a 10,000 reduction in fixed costs. Based on these data, the break-even point would: a. decrease by 1,000 units. b. decrease by 125 units. c. increase by 375 units. d. increase by 500 units.Contribution margin, break-even sales, cost-volume-profit chart, margin of safety, and operating leverage Belmain Co. expects to maintain the same inventories at the end of 20Y7 as at the beginning of the year. The total of all production costs for the year is therefore assumed to be equal to the cost of goods sold. With this in mind, the various department heads were asked to submit estimates of the costs for their departments during the year. A summary report of these estimates is as follows: It is expected that 12,000 units will be sold at a price of 240 a unit. Maximum sales within the relevant range are 18,000 units. Instructions 1. Prepare an estimated income statement for 20Y7. 2. What is the expected contribution margin ratio? 3. Determine the break-even sales in units and dollars. 4. Construct a cost-volume-profit chart indicating the break-even sales. 5. What is the expected margin of safety in dollars and as a percentage of sales? (Round to one decimal place.) 6. Determine the operating leverage.Boxer Production, Inc., is in the process of considering a flexible manufacturing system that will help the company react more swiftly to customer needs. The controller, Mick Morrell, estimated that the system will have a 10-year life and a required return of 10% with a net present value of negative $500,000. Nevertheless, he acknowledges that he did not quantify the potential sales increases that might result from this improvement on the issue of on-time delivery, because it was too difficult to quantify. If there is a general agreement that qualitative factors may offer an additional net cash flow of $150,000 per year, how should Boxer proceed with this Investment?