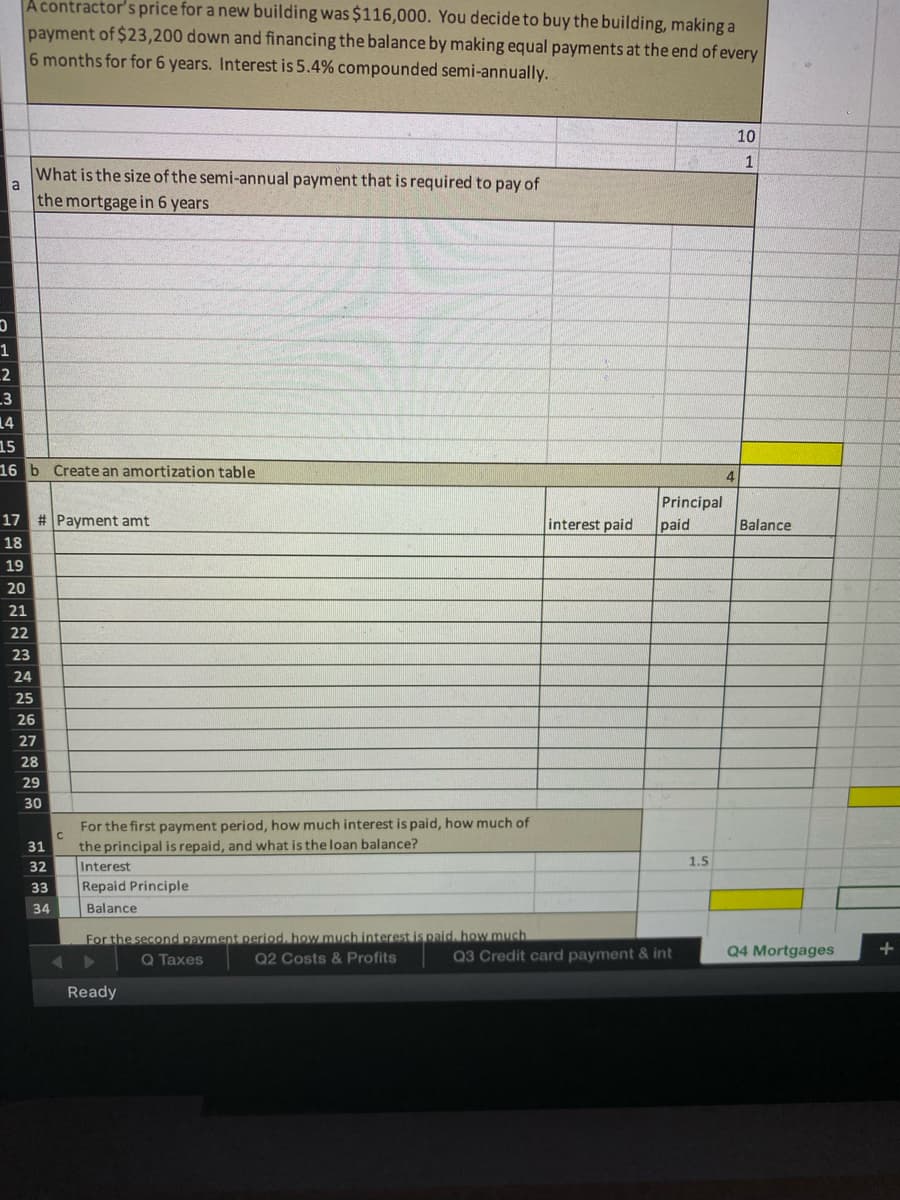

A contractor's price for a new building was $116,000. You decide to buy the building, making a payment of $23,200 down and financing the balance by making equal payments at the end of every 6 months for for 6 years. Interest is 5.4% compounded semi-annually. 10 1 What is the size of the semi-annual payment that is required to pay of the mortgage in 6 years 4 .5 6 b Create an amortization table 4 Principal paid 17 #Payment amt interest paid Balance 18 19 20 21 22 23 24 25 26 27 28 29 30 For the first payment period, how much interest is paid, how much of the principal is repaid, and what is the loan balance? 31 1.5 32 Interest 33 Repaid Principle 34 Balance For the second pavment period, how much interest is paid, how much Q Taxes Q3 Credit card payment & int Q4 Mortgages Q2 Costs & Profits Ready

A contractor's price for a new building was $116,000. You decide to buy the building, making a payment of $23,200 down and financing the balance by making equal payments at the end of every 6 months for for 6 years. Interest is 5.4% compounded semi-annually. 10 1 What is the size of the semi-annual payment that is required to pay of the mortgage in 6 years 4 .5 6 b Create an amortization table 4 Principal paid 17 #Payment amt interest paid Balance 18 19 20 21 22 23 24 25 26 27 28 29 30 For the first payment period, how much interest is paid, how much of the principal is repaid, and what is the loan balance? 31 1.5 32 Interest 33 Repaid Principle 34 Balance For the second pavment period, how much interest is paid, how much Q Taxes Q3 Credit card payment & int Q4 Mortgages Q2 Costs & Profits Ready

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter10: Property, Plant And Equipment: Acquisition And Subsequent Investments

Section: Chapter Questions

Problem 3MC: Electro Corporation bought a new machine and agreed to pay for it in equal annual installments of...

Related questions

Question

Transcribed Image Text:A contractor's price for a new building was $116,000. You decide to buy the building, making a

payment of $23,200 down and financing the balance by making equal payments at the end of every

6 months for for 6 years. Interest is 5.4% compounded semi-annually.

10

What is the size of the semi-annual payment that is required to pay of

the mortgage in 6 years

1

2

_3

14

15

16 b Create an amortization table

Principal

17

# Payment amt

interest paid

paid

Balance

18

19

20

21

22

23

24

25

26

27

28

29

30

For the first payment period, how much interest is paid, how much of

the principal is repaid, and what is the loan balance?

Interest

31

1.5

32

33

Repaid Principle

34

Balance

For the second pavment period, how much interest is paid, how much

Q2 Costs & Profits

Q Taxes

Q3 Credit card payment & int

Q4 Mortgages

Ready

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning