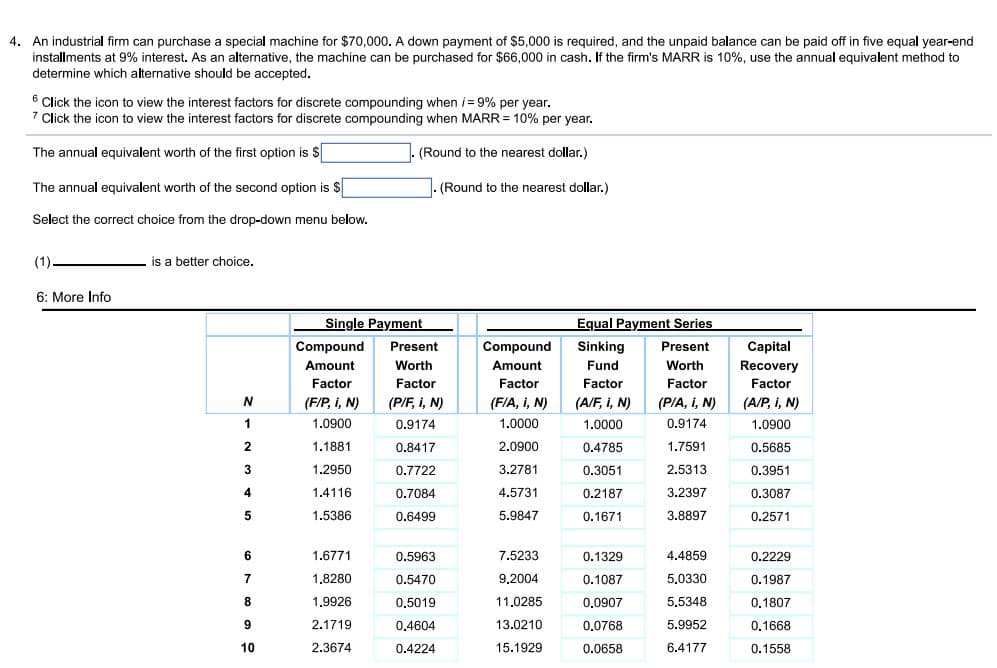

An industrial firm can purchase a special machine for $70,000. A down payment of $5,000 is required, and the unpaid balance can be paid off in five equal year-end installments at 9% interest. As an alternative, the machine can be purchased for $66,000 in cash. If the firm's MARR is 10%, use the annual equivalent method to determine which alternative should be accepted. 6 Click the icon to view the interest factors for discrete compounding when i= 9% per year. 7 Click the icon to view the interest factors for discrete compounding when MARR = 10% per year. The annual equivalent worth of the first option is S (Round to the nearest dollar.) The annual equivalent worth of the second option is S -(Round to the nearest dollar.) Select the correct choice from the drop-down menu below. (1). - is a better choice.

An industrial firm can purchase a special machine for $70,000. A down payment of $5,000 is required, and the unpaid balance can be paid off in five equal year-end installments at 9% interest. As an alternative, the machine can be purchased for $66,000 in cash. If the firm's MARR is 10%, use the annual equivalent method to determine which alternative should be accepted. 6 Click the icon to view the interest factors for discrete compounding when i= 9% per year. 7 Click the icon to view the interest factors for discrete compounding when MARR = 10% per year. The annual equivalent worth of the first option is S (Round to the nearest dollar.) The annual equivalent worth of the second option is S -(Round to the nearest dollar.) Select the correct choice from the drop-down menu below. (1). - is a better choice.

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter12: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 10P: Dauten is offered a replacement machine which has a cost of 8,000, an estimated useful life of 6...

Related questions

Question

Transcribed Image Text:4. An industrial firm can purchase a special machine for $70,000. A down payment of $5,000 is required, and the unpaid balance can be paid off in five equal year-end

installments at 9% interest. As an alternative, the machine can be purchased for $66,000 in cash. If the firm's MARR is 10%, use the annual equivalent method to

determine which alternative should be accepted.

6

6 Click the icon to view the interest factors for discrete compounding when i= 9% per year.

7 Click the icon to view the interest factors for discrete compounding when MARR = 10% per year.

The annual equivalent worth of the first option is $

(Round to the nearest dollar.)

The annual equivalent worth of the second option is $

(Round to the nearest dollar.)

Select the correct choice from the drop-down menu below.

(1).

is a better choice.

6: More Info

Single Payment

Equal Payment Series

Compound

Present

Compound

Sinking

Present

Capital

Amount

Worth

Amount

Fund

Worth

Recovery

Factor

Factor

Factor

Factor

Factor

Factor

(F/P, i, N)

(P/F, i, N)

(F/A, i, N)

(A/F, i, N)

(PIA, I, N)

(A/P, i, N)

1

1.0900

0.9174

1.0000

1.0000

0.9174

1.0900

1.1881

0.8417

2.0900

0.4785

1.7591

0.5685

3

1.2950

0.7722

3.2781

0.3051

2.5313

0.3951

4

1.4116

0.7084

4.5731

0.2187

3.2397

0.3087

1.5386

0.6499

5.9847

0.1671

3.8897

0.2571

1.6771

0.5963

7.5233

0.1329

4.4859

0.2229

7

1.8280

0.5470

9,2004

0.1087

5.0330

0.1987

8

1.9926

0,5019

11,0285

0,0907

5.5348

0,1807

2.1719

0.4604

13.0210

0,0768

5.9952

0.1668

10

2.3674

0.4224

15.1929

0.0658

6.4177

0.1558

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning