A corporate bond indenture will usually include the following types of restrictive covenants except: O limit on acquisitions O limit of subsequent borrowing minimum leverage minimum liquidity O limited restricted payments restriction on sale of assets

A corporate bond indenture will usually include the following types of restrictive covenants except: O limit on acquisitions O limit of subsequent borrowing minimum leverage minimum liquidity O limited restricted payments restriction on sale of assets

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter7: Financial Activities

Section: Chapter Questions

Problem 8QE

Related questions

Question

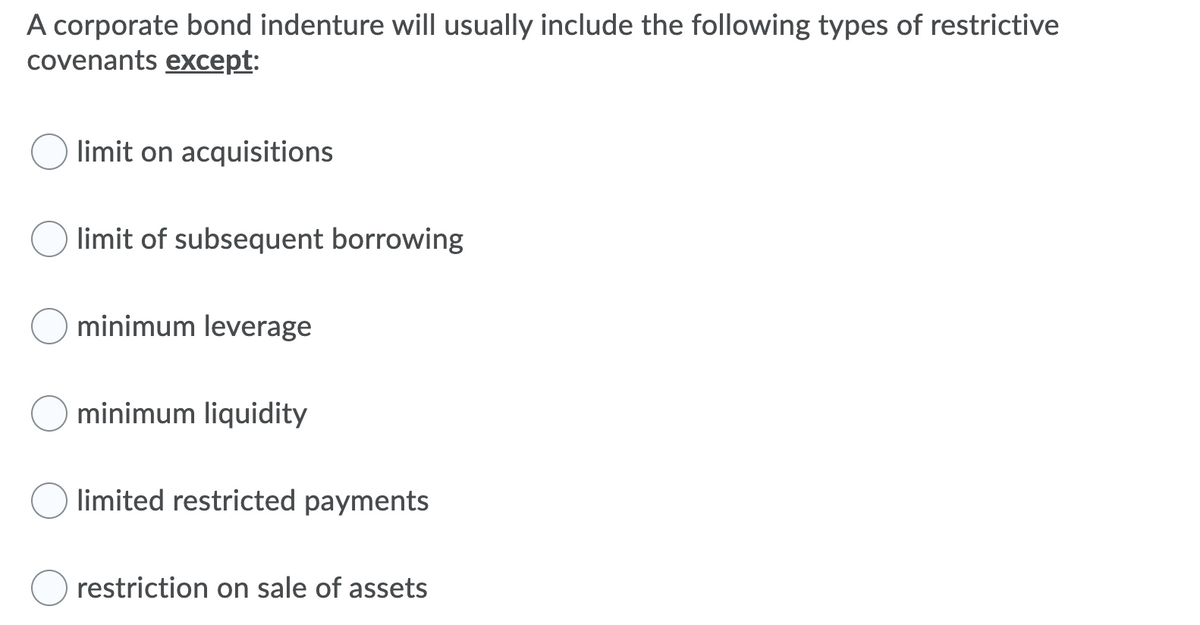

Transcribed Image Text:A corporate bond indenture will usually include the following types of restrictive

covenants except:

limit on acquisitions

limit of subsequent borrowing

minimum leverage

minimum liquidity

limited restricted payments

restriction on sale of assets

Expert Solution

Step 1

Bond covenant - it is a term of agreement between issuer of bond and holder of bonds and such agreement is legally binding on both the parties i.e. issuer and holder.

Restrictive covenants restricts a company from engaging in certain actions and affirmative covenants require the issuing company to meet specific requirements with a aim to ensure that bond interest payment and principal payment are through without the risk of default.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning