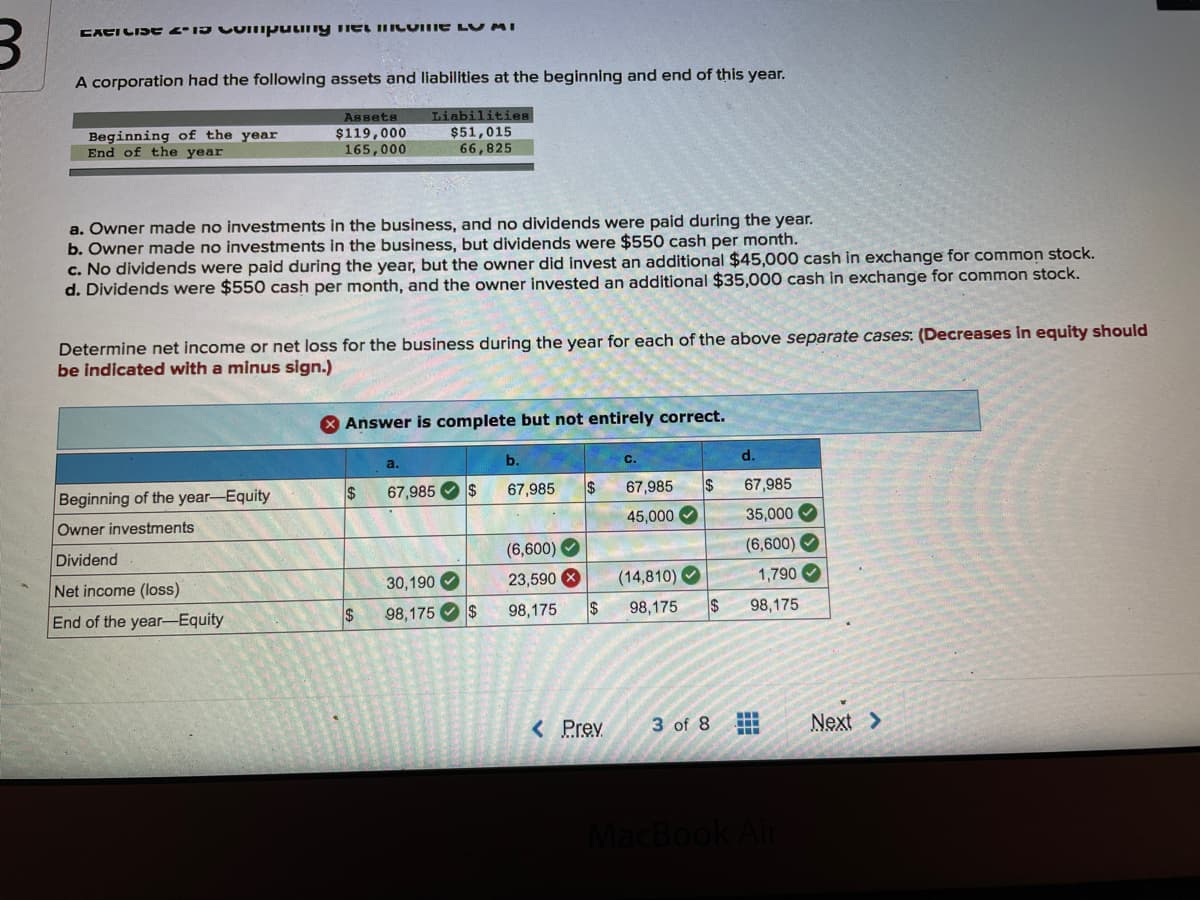

A corporation had the following assets and liabilities at the beginning and end of this year. Assets Liabilities Beginning of the year End of the year $119,000 165,000 $51,015 66,825 a. Owner made no investments in the business, and no dividends were paid during the year. b. Owner made no investments in the business, but dividends were $550 cash per month. c. No dividends were paid during the year, but the owner did invest an additional $45,000 cash in exchange for common stock. d. Dividends were $550 cash per month, and the owner invested an additional $35,000 cash in exchange for common stock. Determine net income or net loss for the business during the year for each of the above separate cases: (Decreases in equity should be indicated with a minus sign.) X Answer is complete but not entirely correct. a. b. d. Beginning of the year-Equity 67,985 O s 67,985 67,985 67,985 Owner investments 45,000 35,000 Dividend (6,600) O (6,600) O Net income (loss) 30,190 O 23,590 X (14,810) 1,790 End of the year-Equity 98,175 O s 98,175 98,175 98,175

A corporation had the following assets and liabilities at the beginning and end of this year. Assets Liabilities Beginning of the year End of the year $119,000 165,000 $51,015 66,825 a. Owner made no investments in the business, and no dividends were paid during the year. b. Owner made no investments in the business, but dividends were $550 cash per month. c. No dividends were paid during the year, but the owner did invest an additional $45,000 cash in exchange for common stock. d. Dividends were $550 cash per month, and the owner invested an additional $35,000 cash in exchange for common stock. Determine net income or net loss for the business during the year for each of the above separate cases: (Decreases in equity should be indicated with a minus sign.) X Answer is complete but not entirely correct. a. b. d. Beginning of the year-Equity 67,985 O s 67,985 67,985 67,985 Owner investments 45,000 35,000 Dividend (6,600) O (6,600) O Net income (loss) 30,190 O 23,590 X (14,810) 1,790 End of the year-Equity 98,175 O s 98,175 98,175 98,175

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter1: Accounting And The Financial Statements

Section: Chapter Questions

Problem 65BPSB: Problem 1-65B Relationships Among Financial Statements Leno Corporation reported the following...

Related questions

Question

Transcribed Image Text:CACILIS t 2-15 CUImputig net mLOmE L MI

A corporation had the following assets and liabilities at the beginning and end of this year.

ASsets

Liabilities

Beginning of the year

End of the year

$119,000

165,000

$51,015

66,825

a. Owner made no investments in the business, and no dividends were paid during the year.

b. Owner made no investments in the business, but dividends were $550 cash per month.

c. No dividends were paid during the year, but the owner did invest an additional $45,000 cash in exchange for common stock.

d. Dividends were $550 cash per month, and the owner invested an additional $35,000 cash in exchange for common stock.

Determine net income or net loss for the business during the year for each of the above separate cases: (Decreases in equity should

be indicated with a minus sign.)

Answer is complete but not entirely correct.

a.

b.

C.

d.

Beginning of the year-Equity

$

67,985

$

67,985

67,985

67,985

Owner investments

45,000 O

35,000 O

Dividend

(6,600) O

(6,600) O

Net income (loss)

30,190 O

23,590 X

(14,810) O

1,790 O

End of the year-Equity

98,175

$

98,175

2$

98,175

24

98,175

< Prev

3 of 8

...

...

Next >

cBook Air

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning