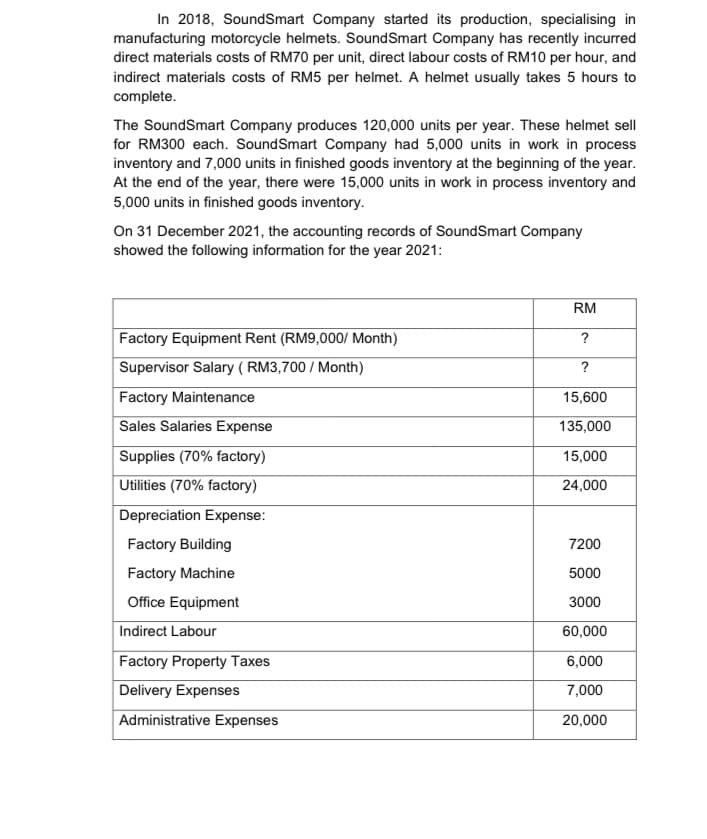

In 2018, SoundSmart Company started its production, specialising in manufacturing motorcycle helmets. SoundSmart Company has recently incurred direct materials costs of RM70 per unit, direct labour costs of RM10 per hour, and indirect materials costs of RM5 per helmet. A helmet usually takes 5 hours to complete. The SoundSmart Company produces 120,000 units per year. These helmet sell for RM300 each. SoundSmart Company had 5,000 units in work in process inventory and 7,000 units in finished goods inventory at the beginning of the year. At the end of the year, there were 15,000 units in work in process inventory and 5,000 units in finished goods inventory. On 31 December 2021, the accounting records of SoundSmart Company showed the following information for the year 2021: RM Factory Equipment Rent (RM9,000/ Month) ? Supervisor Salary ( RM3,700 / Month) ? Factory Maintenance 15,600 Sales Salaries Expense 135,000 Supplies (70% factory) 15,000 Utilities (70% factory) 24,000 Depreciation Expense: Factory Building 7200 Factory Machine 5000 Office Equipment 3000 Indirect Labour 60,000 Factory Property Taxes Delivery Expenses 6,000 7,000 Administrative Expenses 20,000

In 2018, SoundSmart Company started its production, specialising in manufacturing motorcycle helmets. SoundSmart Company has recently incurred direct materials costs of RM70 per unit, direct labour costs of RM10 per hour, and indirect materials costs of RM5 per helmet. A helmet usually takes 5 hours to complete. The SoundSmart Company produces 120,000 units per year. These helmet sell for RM300 each. SoundSmart Company had 5,000 units in work in process inventory and 7,000 units in finished goods inventory at the beginning of the year. At the end of the year, there were 15,000 units in work in process inventory and 5,000 units in finished goods inventory. On 31 December 2021, the accounting records of SoundSmart Company showed the following information for the year 2021: RM Factory Equipment Rent (RM9,000/ Month) ? Supervisor Salary ( RM3,700 / Month) ? Factory Maintenance 15,600 Sales Salaries Expense 135,000 Supplies (70% factory) 15,000 Utilities (70% factory) 24,000 Depreciation Expense: Factory Building 7200 Factory Machine 5000 Office Equipment 3000 Indirect Labour 60,000 Factory Property Taxes Delivery Expenses 6,000 7,000 Administrative Expenses 20,000

Chapter3: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 5EB: Cadre, Inc., sells a single product with a selling price of $120 and variable costs per unit of $90....

Related questions

Question

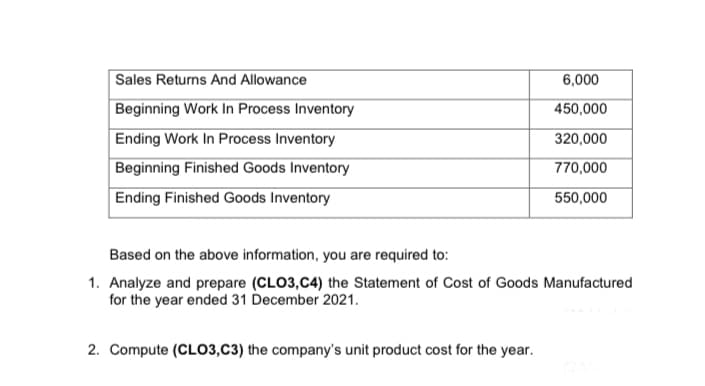

Transcribed Image Text:Sales Returns And Allowance

6,000

Beginning Work In Process Inventory

450,000

Ending Work In Process Inventory

320,000

Beginning Finished Goods Inventory

Ending Finished Goods Inventory

770,000

550,000

Based on the above information, you are required to:

1. Analyze and prepare (CLO3,C4) the Statement of Cost of Goods Manufactured

for the year ended 31 December 2021.

2. Compute (CL03,C3) the company's unit product cost for the year.

Transcribed Image Text:In 2018, SoundSmart Company started its production, specialising in

manufacturing motorcycle helmets. SoundSmart Company has recently incurred

direct materials costs of RM70 per unit, direct labour costs of RM10 per hour, and

indirect materials costs of RM5 per helmet. A helmet usually takes 5 hours to

complete.

The SoundSmart Company produces 120,000 units per year. These helmet sell

for RM300 each. SoundSmart Company had 5,000 units in work in process

inventory and 7,000 units in finished goods inventory at the beginning of the year.

At the end of the year, there were 15,000 units in work in process inventory and

5,000 units in finished goods inventory.

On 31 December 2021, the accounting records of SoundSmart Company

showed the following information for the year 2021:

RM

Factory Equipment Rent (RM9,000/ Month)

Supervisor Salary ( RM3,700 / Month)

?

?

Factory Maintenance

15,600

Sales Salaries Expense

135,000

Supplies (70% factory)

15,000

Utilities (70% factory)

24,000

Depreciation Expense:

Factory Building

7200

Factory Machine

5000

Office Equipment

3000

Indirect Labour

60,000

Factory Property Taxes

6,000

Delivery Expenses

7,000

Administrative Expenses

20,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,