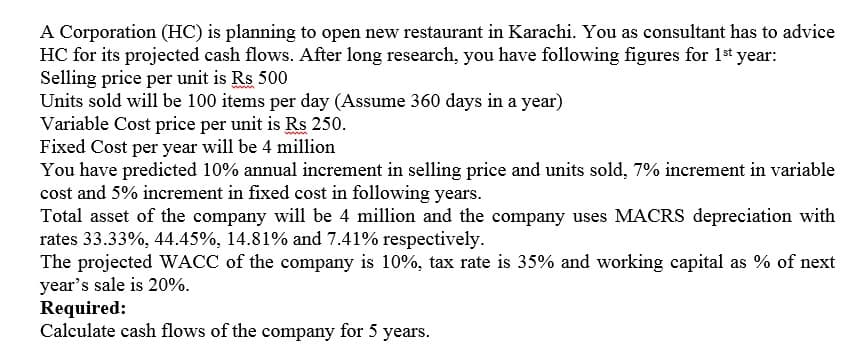

A Corporation (HC) is planning to open new restaurant in Karachi. You as consultant has to advice HC for its projected cash flows. After long research, you have following figures for 1st year: Selling price per unit is Rs 500 Units sold will be 100 items per day (Assume 360 days in a year) Variable Cost price per unit is Rs 250. Fixed Cost per year will be 4 million You have predicted 10% annual increment in selling price and units sold, 7% increment in variable cost and 5% increment in fixed cost in following years. Total asset of the company will be 4 million and the company uses MACRS depreciation with rates 33.33%, 44.45%, 14.81% and 7.41% respectively. The projected WACC of the company is 10%, tax rate is 35% and working capital as % of next year’s sale is 20%. Required: Calculate cash flows of the company for 5 years.

A Corporation (HC) is planning to open new restaurant in Karachi. You as consultant has to advice HC for its projected

Selling price per unit is Rs 500

Units sold will be 100 items per day (Assume 360 days in a year)

Variable Cost price per unit is Rs 250.

Fixed Cost per year will be 4 million

You have predicted 10% annual increment in selling price and units sold, 7% increment in variable cost and 5% increment in fixed cost in following years.

Total asset of the company will be 4 million and the company uses MACRS

The projected WACC of the company is 10%, tax rate is 35% and

Required:

Calculate cash flows of the company for 5 years.

Step by step

Solved in 2 steps