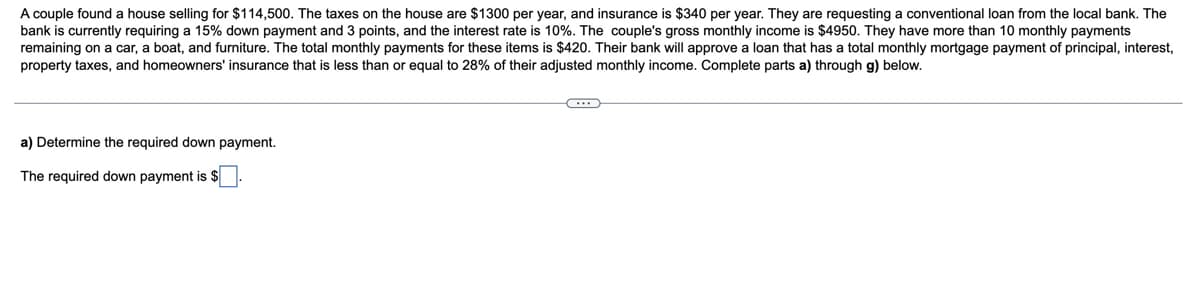

A couple found a house selling for $114,500. The taxes on the house are $1300 per year, and insurance is $340 per year. They are requesting a conventional loan from the local bank. The bank is currently requiring a 15% down payment and 3 points, and the interest rate is 10%. The couple's gross monthly income is $4950. They have more than 10 monthly payments remaining on a car, a boat, and furniture. The total monthly payments for these items is $420. Their bank will approve a loan that has a total monthly mortgage payment of principal, interest, property taxes, and homeowners' insurance that is less than or equal to 28% of their adjusted monthly income. Complete parts a) through g) below. a) Determine the required down payment. The required down payment is $

A couple found a house selling for $114,500. The taxes on the house are $1300 per year, and insurance is $340 per year. They are requesting a conventional loan from the local bank. The bank is currently requiring a 15% down payment and 3 points, and the interest rate is 10%. The couple's gross monthly income is $4950. They have more than 10 monthly payments remaining on a car, a boat, and furniture. The total monthly payments for these items is $420. Their bank will approve a loan that has a total monthly mortgage payment of principal, interest, property taxes, and homeowners' insurance that is less than or equal to 28% of their adjusted monthly income. Complete parts a) through g) below. a) Determine the required down payment. The required down payment is $

Chapter4: Time Value Of Money

Section: Chapter Questions

Problem 25PROB

Related questions

Question

4 . Please answer the whole answer there is more than one answer that needs to be answered

Transcribed Image Text:A couple found a house selling for $114,500. The taxes on the house are $1300 per year, and insurance is $340 per year. They are requesting a conventional loan from the local bank. The

bank is currently requiring a 15% down payment and 3 points, and the interest rate is 10%. The couple's gross monthly income is $4950. They have more than 10 monthly payments

remaining on a car, a boat, and furniture. The total monthly payments for these items is $420. Their bank will approve a loan that has a total monthly mortgage payment of principal, interest,

property taxes, and homeowners' insurance that is less than or equal to 28% of their adjusted monthly income. Complete parts a) through g) below.

a) Determine the required down payment.

The required down payment is $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning