a) Determine the equation that models this population. b) Calculate the number of people after year 11. c) Suppose at year 15, the James children decided to sell and needed a valuation report where the constant rate of 12.32% has been causing a decline of house value due to a recession, i. write a differential equation that models this scenario. ii. determine the value of the house after the next 12 years.

a) Determine the equation that models this population. b) Calculate the number of people after year 11. c) Suppose at year 15, the James children decided to sell and needed a valuation report where the constant rate of 12.32% has been causing a decline of house value due to a recession, i. write a differential equation that models this scenario. ii. determine the value of the house after the next 12 years.

Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 9P

Related questions

Question

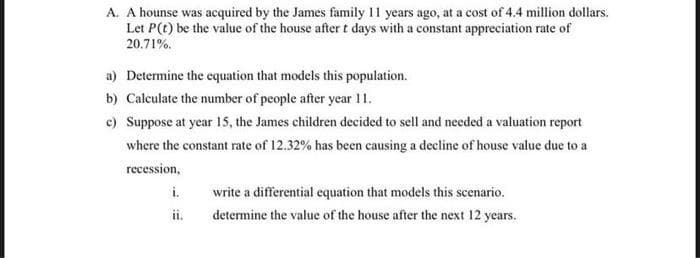

Transcribed Image Text:A. A hounse was acquired by the James family 11 years ago, at a cost of 4.4 million dollars.

Let P(t) be the value of the house after t days with a constant appreciation rate of

20.71%.

a) Determine the equation that models this population.

b) Calculate the number of people after year 11.

c) Suppose at year 15, the James children decided to sell and needed a valuation report

where the constant rate of 12.32% has been causing a decline of house value due to a

recession,

i.

write a differential equation that models this scenario.

ii.

determine the value of the house after the next 12 years.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT