(a), determine the present value of the debt.

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 17P

Related questions

Question

Please Explain Proper Step by Step and Do Not Give Solution In Image Format And Fast Answering Please & Thanks In Advance

Transcribed Image Text:ů

Ĉ

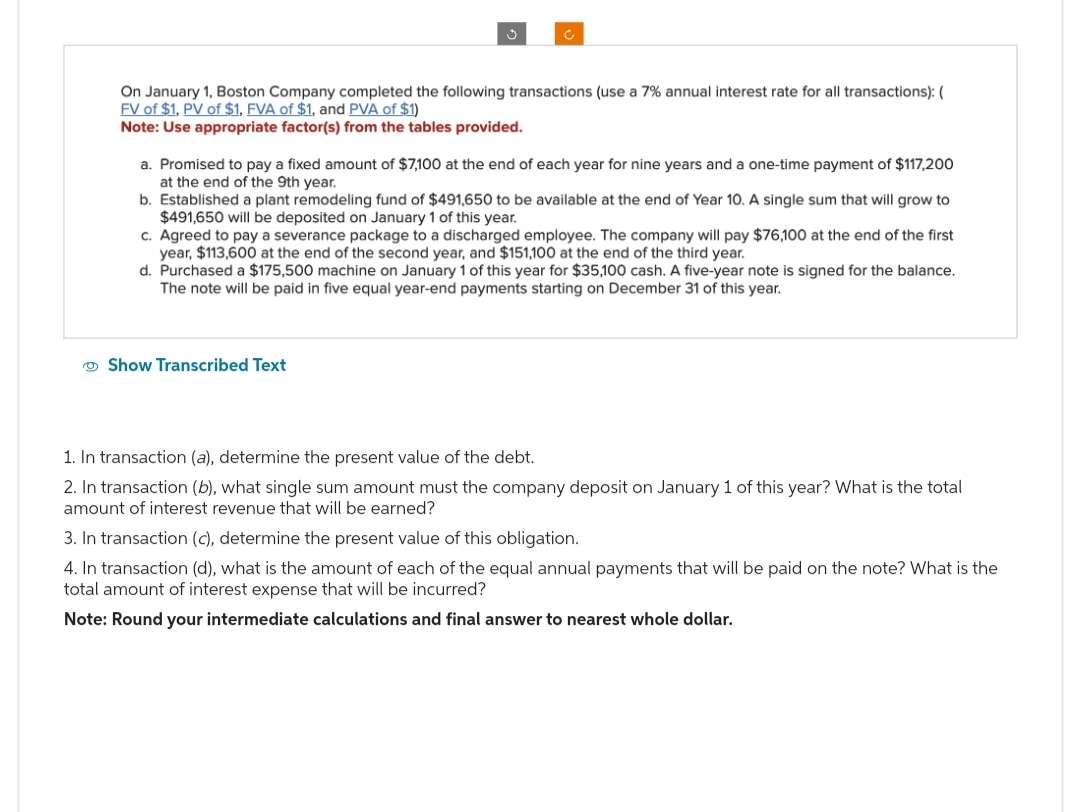

On January 1, Boston Company completed the following transactions (use a 7% annual interest rate for all transactions): (

FV of $1, PV of $1, FVA of $1, and PVA of $1)

Note: Use appropriate factor(s) from the tables provided.

a. Promised to pay a fixed amount of $7,100 at the end of each year for nine years and a one-time payment of $117,200

at the end of the 9th year.

Show Transcribed Text

b. Established a plant remodeling fund of $491,650 to be available at the end of Year 10. A single sum that will grow to

$491,650 will be deposited on January 1 of this year.

c. Agreed to pay a severance package to a discharged employee. The company will pay $76,100 at the end of the first

year, $113,600 at the end of the second year, and $151,100 at the end of the third year.

d. Purchased a $175,500 machine on January 1 of this year for $35,100 cash. A five-year note is signed for the balance.

The note will be paid in five equal year-end payments starting on December 31 of this year.

1. In transaction (a), determine the present value of the debt.

2. In transaction (b), what single sum amount must the company deposit on January 1 of this year? What is the total

amount of interest revenue that will be earned?

3. In transaction (c), determine the present value of this obligation.

4. In transaction (d), what is the amount of each of the equal annual payments that will be paid on the note? What is the

total amount of interest expense that will be incurred?

Note: Round your intermediate calculations and final answer to nearest whole dollar.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning