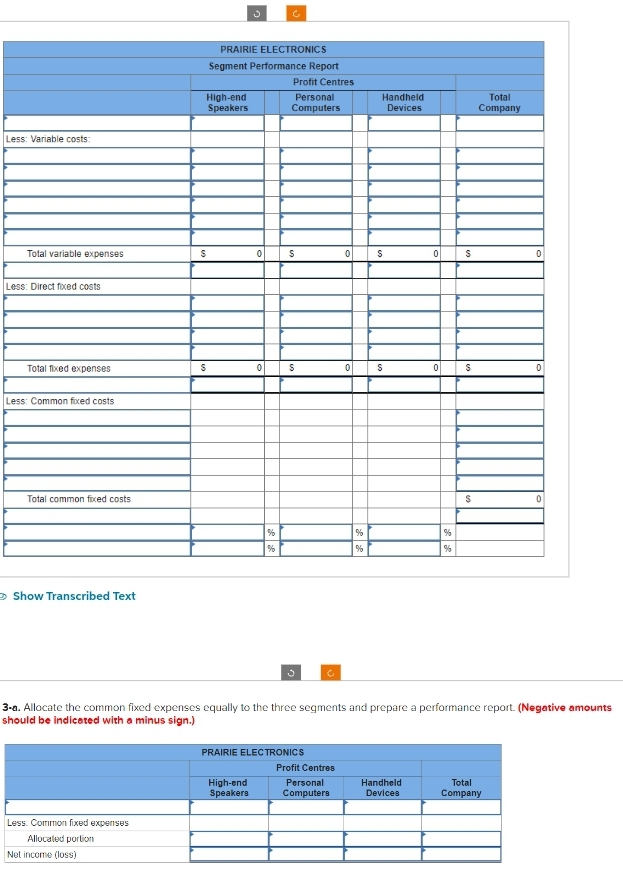

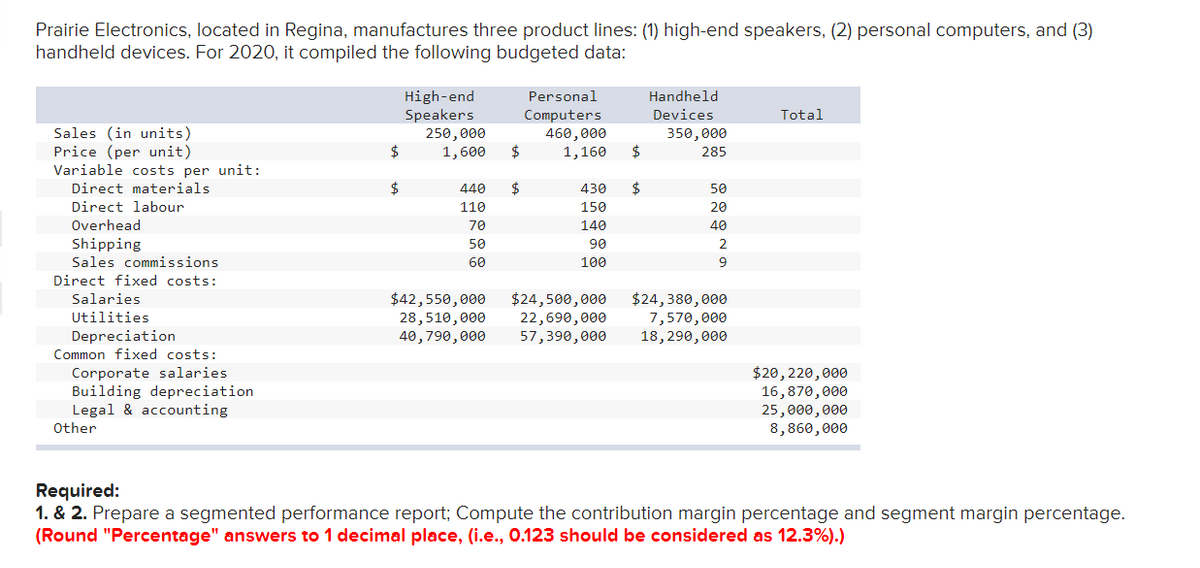

Prairie Electronics, located in Regina, manufactures three product lines: (1) high-end speakers, (2) personal computers, and (3) handheld devices. For 2020, it compiled the following budgeted data: Sales (in units) Price (per unit) Variable costs per unit: Direct materials. Direct labour Overhead Shipping Sales commissions Direct fixed costs: Salaries Utilities Depreciation Common fixed costs: Corporate salaries Building depreciation Legal & accounting Other $ $ High-end Speakers 250,000 1,600 440 110 70 50 60 $ $ Personal Computers 460,000 1,160 $ 430 $ 150 140 90 100 $42,550,000 $24,500,000 28,510,000 22,690,000 40,790,000 Handheld Devices 350,000 285 50 20 40 2 9 $24,380,000 7,570,000 57,390,000 18, 290,000 Total $20,220,000 16,870,000 25,000,000 8,860,000 Required: 1. & 2. Prepare a segmented performance report; Compute the contribution margin percentage and segment margin percentage. (Round "Percentage" answers to 1 decimal place, (i.e., 0.123 should be considered as 12.3%).)

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Y.13.

Step by step

Solved in 4 steps with 4 images