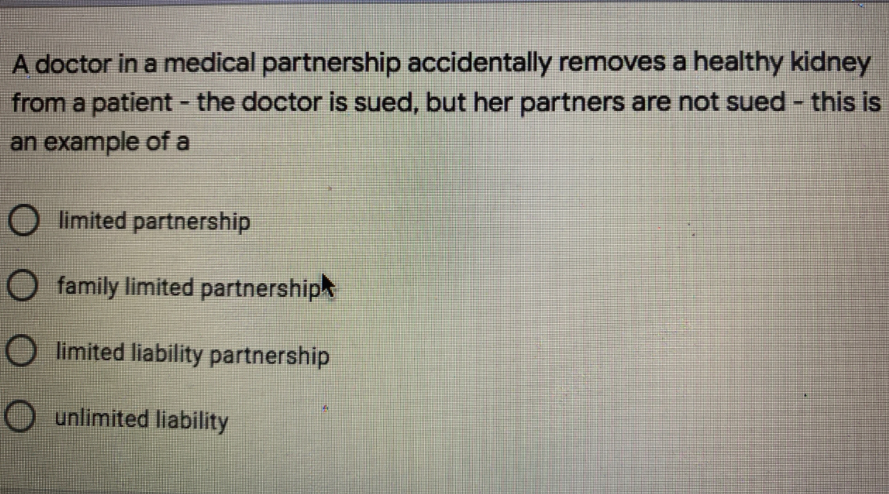

A doctor in a medical partnership accidentally removes a healthy kidney from a patient - the doctor is sued, but her partners are not sued - this is an example of a O limited partnership O family limited partnership O limited liability partnership O unlimited liability

Q: Castelo, a partner in BRC Partnership, assigns his partnership interest to Serrano, who is not made…

A: Since in the given case, Castelo, a partner in BRC Partnership, assigns his partnership interest to…

Q: Castelo, a partner in BRC Partnership, assigns his partnership interest to Serrano, who is not made…

A: Partners may sell or transfer their interest in the partnership without loosing their rights and…

Q: Horn’s Crane Service furnished supplies and services under a written contract to a partnership…

A: Partnership: This is the form of business entity which is formed by an agreement, owned and managed…

Q: Under the Philippine Civil Code, answer the following question: A and B, both are doctors who…

A: A partnership is a form of business in which two or more than two persons agree to share profits and…

Q: Write the word or group of words that identify each of the following statements. 1.The word added…

A: 1) A Limited Partnership is a partnership that exists when 2 or more partners go into the business…

Q: Assess the truth of this statement: In the closing entries for a partnership, the partner's drawing…

A: Partnership: Partnership is a form of business organization in which two or more two individuals…

Q: l partnership business has no legal obligation to keep the books and prepare accounts. Is this true…

A: A partnership is a business agreement signed up of two or more people who share profits and losses.…

Q: Karla retires from Orton Associates, a partnership. The business is continued by the remaining…

A: A partnership agreement is one where two or more people come together to operate a business. The…

Q: Sonia and Fred are partners in a CPA firm that was formed as a Limited Liability Partnership (LLP).…

A: LLP is a form of partnership business where the liability of several or all of the partners is…

Q: am wants to help his brother, Lou, start a new business. Lou is an auto mechanic but has little…

A: Partnership refers to an arrangement of business which involves two or more parties also known as…

Q: There is no impact on the statement of comprehensive income of a partnership when a partner…

A: The drawings are the cash or assets withdrawn by the owner or partner for his personal use. The…

Q: A partnership is an association of three or more persons to carry on as co-owners of a business for…

A: False A partnership is a union of two or more persons. Only two persons can also form a…

Q: Which type of taxpayer cannot be a partner in a partnership? a non-resident alien a C corporation a…

A: Hi student Since there are multiple questions, we will answer only first question.

Q: Castelo, a partner in BRC Partnership, assigns his partnership interest to Serrano, who is not made…

A: Solution: Castelo, a partner in BRC Partnership, assigns his partnership interest to Serrano, who is…

Q: Assume that Amey and Lacey are partners. Lacey dies, and her son claims the right to take his…

A:

Q: B promised that he will deliver a house and lot for the partnership to use for its manufacturing…

A: The partnership act defines a relationship between two or more persons who agrees to share profits…

Q: which type of organization should be formed. Jackie and Susie are starting an accounting firm. They…

A:

Q: Partnership dissolution can be in the following ways except? Select one: a. Wish of any partner…

A: There are two types Dissolution of partnership and dissolution of firm Dissolution of partnership…

Q: Partners who are not legally responsible for unpaid partnership debts. A partnership that protects…

A: Partnership: A partnership is a business entity where two or more persons come together to perform…

Q: A person entoring into a partnership is only liable for debts or eligible for profits from the date…

A: Partnership is one of the agreement between two or more than two persons in which they invest their…

Q: 2. D, E and F entered into a partnership to operate a restaurant business. When the restaurant had…

A: Partnership means where two or more person comes together to do some common business activity and…

Q: If a partner's contribution in kind has been over-valued; upon complain by others, the said partner…

A: If a partner's contribution in kind is over valued, the partner shall contribute the difference…

Q: Ken and his brothers own a construction business. Ken runs out of funds to complete a renovation job…

A: In a partnership, two or more parties agree to operate and manage a business and share the profits…

Q: Instructions: Write “true" if the statement is true and "false" if otherwise. 18. SThes Scommunity$…

A: SOLUTION PARTNERSHIP IS A FORMAL ARRANGEMENT BY TWO OR MORE PARTIES TO MANAGE AND OPERATE A BUSINESS…

Q: When a general partner is unable to pay a capital deficiency: The partner must take out a loan to…

A: The correct answer is:- Both B and D As the deficiency is divided between the remaining partner and…

Q: Usama, Shahid and Hassan are partners in a partnership firm. With an agreement among them, they…

A: The business can be conducted as a sole proprietor where only one person will be the authorized…

Q: It means "choice of the person". Due to this principle, no one can be a member of the partnership…

A: As per the principle of choice of the person, every partner has a right to choose his partner.

Q: When a new partner is admitted, this change in the ownership of a partnership results in a.…

A: To admit a new partner to the firm, all current partners must unanimously agree. The old and new…

Q: 1. Why do you think an industrial partner does not share in the losses of partnership?

A: Hi student Since there are multiple questions, we will answer only first question.

Q: If a new partner acquires partnership interest directly from the partners rather than from the…

A: when a new partner is admitted the existing partners’ capital accounts are reduced and the new…

Q: Which of the following is true about a partnership? The old partnership ends only upon the…

A: The partnership comes into existence when two or more persons agree to do the business and further…

Q: A partner in a limited liability partnership (LLP): 1. has no liability for acts of malfeasance of…

A: Limited liability partnership is partnership under which some or all partners have limited…

Q: Before the allocation of loss, the following items are allocated first, except: A. Salaries to…

A: "Since you have asked multiple questions, we will solve first question for you. If you want any…

Q: The partnership is being dissolved. Unfortunately, the liquidating partner found out that the assets…

A: Limited Partnership (LP)- Under limited partnership, the kind of partners are general partners and…

Q: Which of the following is a disadvantage of general partnerships? ( a) The partners in a general…

A: Under general partnership partners have unlimited liability. Partners of general partnership will be…

Q: Which of the following is a disadvantage of general partnerships? a) A partner who withdraws from a…

A: Partnership is one of the form of business organisation used. This is adopted by two or more than…

Q: Write the word or group of words that identify each of the following statements.…

A: Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: A) X,Y,Z separately tender for a contract to pick up stray cows and dogs from Delhi cantonment area…

A: You have asked two different questions under a single question. As per our protocol we provide…

Q: Emilio Alvarez and Graciela Zavala joined together to form a partnership. Is it possible for them to…

A:

Q: If a partner who retired from the partnership receives less than the capital balance before…

A: Revaluation/impairment of asset need to be done ,so fair settlement take place.

Q: A capital deficiency means that: The partnership has a loss. The partnership has more liabilities…

A: Partnership refers to an agreement where between two or more people come together for a common goal.…

Q: Emilio Alvarez and Graciela Zavala joined together to form a partnership. Is it posible for them to…

A: Partnership firm is formed by the two or more members. These members are called partners and their…

Q: While death of a partner is a cause of partnership dissolution, a partner's incapacity to perform is…

A: The Dissolution refers to the end of a partnership’s existing relationship. When a partnership…

Q: Riff and Raff enter into a partnership agreement. However, the activity that they intend to…

A: In a partnership, two or more parties agree to operate and manage a business and share the profits…

Q: A and B realized that the partnership is hindering them from starting their respective families. Due…

A: Since, in the given case partners by themselves decided to fissolve the partnership. Thus, its a…

Step by step

Solved in 3 steps

- choose the response that correctly the following sentence about an individual partner's outside basis in a partnership. a partner's outside basis? (a) can be less than zero, (b) does not change as long as the partner maintains their partnership interest, (c) is used to apply the basis limitation to losses from a partnership, (d) must be tracked by the partnership.How does a limited liability partnership (LLP) differ from a general partnership? Legal limits have been established regarding the number of people who can participate in the LLP. OLLP partners are liable for some or all of the obligations of the partnership, but have limited liability for the negligence or malpractice of other partners. O LLP partners have limited liability for the obligations of the partnership but unlimited liability for the negligence or malpractice of other partners. Participation in the LLP is limited to members of a regulated profession, such as accounting or health care. Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.Choose the response that correctly completes the following sentence about an individual partner's outside basis in a partnership. A partner's outside basis: A) Cannot be less than zero. B) Does not change as long as the partner maintains their partnership interest. C) Is used to apply the basis limitation to losses from a partnership. D) Must be tracked by the partnership. An S corporation shareholder may carry forward unallowed loss that exceeds the basis of their stock (increased by any loans the shareholder made to the corporation) for what period of time? A) A maximum of two years. B) A maximum of ten years. C) A maximum of twenty years. D) Indefinitely, until they are allowed to deduct the entire amount. The Form 1099-A, Acquisition or Abandonment of Secured Property, gives the taxpayer the information that they need to calculate: A) The amount that they will need to pay to avoid having to give up their property. B) Gain or loss from the sale of the property. C) Their ordinary…

- Which of the following is a disadvantage of general partnerships? ( a) The partners in a general partnership are exposed to double taxation. ( b) Compared to the other forms of ownership, the paperwork and costs involved in forming a general partnership are the most extensive. ( c) A partner who withdraws from a partnership cannot be held liable for any debts the furm had at the time of withdrawal. ( d) All general partners have unlimited liability for the debts and obligations of their business.Which of the following is a disadvantage of general partnerships? a) A partner who withdraws from a partnership cannot be held liable for any debts the firm had at the time of withdrawal. b) Compared to the other forms of ownership, the paperwork and costs involved in forming a general partnership are the most extensive. c) All general partners have unlimited liability for the debts and obligations of their business. d) The partners in a general partnership are exposed to double taxation.I. Write TRUE is the statement is TRUE and write FALSE if the statement is incorrect. 1. A partnership contract should always be prepared regardless of the amount or nature of the contribution. 2. All types of partnerships are subject to income tax. "3. A partner's contribution in the form of industry will require a debit to the account ""Industry"""

- Which of the following is NOT a characteristic of a partnership? a. Partners have mutual agency b. Partners are able to contract on behalf of the partnerships. c.Partnership income is tax free d.Partnerships are easy to formA partnership ________. A. has one owner B. can issue stock C. pays taxes on partnership income D. can have more than one general partnerWhich of the following may not be treated as a partnership for tax purposes? Arnold and Willis operate a restaurant. Thelma and Louise establish an LLP to operate an accounting practice. Lucy and Desi purchase real estate together as a business. Jennifer and Ben form a corporation to purchase and operate a hardware store. All of the above are partnerships.

- A disadvantage that is NOT peculiar to the partnership form of organization includes a.the interest of a partner in the partnership cannot be transferred without the consent of the other partners. b.termination of the partnership agreement, bankruptcy of the firm, or death of one of the partners dissolves the partnership. c.each partner is individually liable for all of the debts of the partnership. d.the partners do not make the decisions that run the business.II. Write the word or group of words that identify each of the following statements. 1. A partnership wherein all the partners have limited liability except or at least one general partner. 2. The contribution of an industrial partner 3. A partner who contributes money, property, and industry. 4. Any partner can act in behalf of the partnership as long as these acts are within the scope of normal partnership activity. 5. A partnership which failed to comply with one or more of the legal requirements for its establishment. 6. An entry prepared when industry is contributed into the partnership. 7. A partnership organized for the purpose of rendering service.…Choose TRUE if the statement is correct, and FALSE if it is wrong. 1. There is no impact on the statement of comprehensive income of a partnership when a partner withdraws from the business. 2. The admission of a partner does not change the composition of the partners’ equity if the new partner purchases the old partner’s interest by paying the old partner directly. 3. A new partner cannot be admitted into a partnership without the consent of all the partners. 4. The dissolution of the partnership discharges the existing liability of any partner. 5. When a newly admitted partner pays a bonus to the existing partners, the new partner’s capital account is debited to record bonus to old partners. 6. Partnership dissolution is synonymous with partnership liqidation. 7. The assets invested into the partnership and not given to the individual partner increase the total assets of the partnership. 8. When a new partner invests more than the proportionate share he receives in the partnership,…