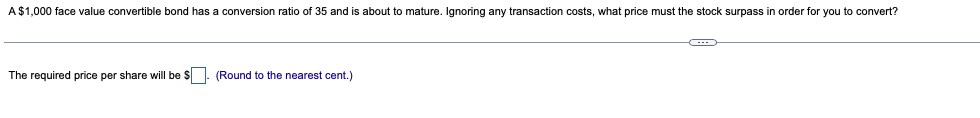

A $1,000 face value convertible bond has a conversion ratio of 35 and is about to mature. Ignoring any transaction costs, what price must the stock surpass in order for you to convert? The required price per share will be $ (Round to the nearest cent.)

Q: In the same credit card, for the month of December, the customer plans to purchase on Dec 05 an item…

A: December 5, 2020 was Saturday There are 4 Monday after December 5,2020 i.e., 7th, 14th, 21st and…

Q: Fujita, Incorporated, has no debt outstanding and a total market value of $332,100. Earnings before…

A: Earning Per Share: It indicates company's profitability. It is calculated by dividing company's net…

Q: What is the rate (in %) compounded semi-annually if 132511 accumulates to $398053 in 9 years and 3…

A: Given, Amount deposited 132511 Amount accumulated 398053 Term is 9 years and 3 months which is 9.25…

Q: The value of an investment can be defined in numerous ways. Which is FALSE? a. It is the value…

A: There are many different types valuation method of the investment some depends on the cash flow or…

Q: Your company wants to create a scholarship program that will cost $17,000 dollars a year. They will…

A: To calculate the investment amount required today we will use the below formula Investment amount…

Q: 1.1) For $20,000, you can purchase a five-year annuity that will pay $5000 per year for five years.…

A: Here, Details of 1.1 Present Value (PV) is $20,000 Annuity Payment (PMT) is $5,000 Time Period…

Q: Nadia is Future Years Financial Planners' most productive employee. She is not satisfied with how…

A: Trade secrets are the processes and practices that are the secrets of a business and provide the…

Q: 4. A principal of P27,000 was placed in an investment which gives the interest of 12% compounded…

A: Solution:- When an amount is invested somewhere, it earns interest on it. The amount initially…

Q: Jeff is leasing a car from a local auto retailer. The terms of the lease include a 6.74% (Money…

A: Capitalized cost = MSRP =69287 Residual value = 57.87%*69287 = 40096.39…

Q: Your factory has been offered a contract to produce a part for a new printer. The contract would…

A: Given, The initial cost is $8.02 million Cashflows per years $4.83 million for 3 years Discount rate…

Q: What is the equivalent rate of interest (in %) for a discount rate of 7.9% for 77 days? Round your…

A: Interest rate is referred as the percentage of the principal charged through the lender regarding…

Q: Chapter 4 Assignment Maria is a divorce attorney who practices law in San Francisco. She wants to…

A: Present value of annuity Annuity is a series of equal payment at equal interval over a specified…

Q: The margin requirement on a stock purchase is 30%. You fully use the margin allowed to purchase 200…

A: Calculating an investment's gain or loss as a percentage is crucial since it reveals how much was…

Q: You invested $7,000 at the end of each quarter for 8 years in an investment fund. If t balance in…

A: Solution: An amount deposited at end of every period is known as ordinary annuity. The formula for…

Q: 7 The function of Central Bank of Malaysia are to act as financial advisor, banker and financial…

A: Malaysia's central bank is known as the Central Bank of Malaysia (BNM; Malay: Bank Negara Malaysia).…

Q: Finance . Zinc has beginning equity of $295,000, total revenues of $95,000, and total expenses of…

A: Ending equity means total shareholders equity at the end of the year. Ending equity can be…

Q: vii. List two (2) disadvantages of using the NPV method in evaluating business investments.

A: NPV is a techniques in Capital Budgeting which help in decision making on the basis of future Cash…

Q: What is the amount you would have to deposit today to be able to take out $2070 a year for 2 years…

A: As per Bartleby Honor Code, when multiple questions are asked, the expert is required only to solve…

Q: State Dep Rec Prob 0.1 0.3 Return 0.04 0.18

A: The expected return is the weighted probabilistic rate of return that is realized on stock…

Q: Bank Negara Malaysia was established on ________* A. 26 January 1959 B. 24 January…

A: The position of Bank Negara Malaysia's monetary policy is to uphold price stability while continuing…

Q: inance What are different Anti Merger strategies available to management of firm?

A: Hostile Takeovers/Mergers: It occurs when the management or board of directors of the targeted…

Q: You own a call option on Intuit stock with a strike price of $39. When you purchased the option, it…

A: Explanation : Under Option Market in Foreign Exchange Investor will earn the fix amount of Loss But…

Q: Ami has decided to be cryogenically frozen at the time of her death so that she can be resurrected…

A: Accumulated value: The amount initially invested plus any profit on an investment made at a…

Q: The following cash flow diagram indicates the yearly payments you will make in the future. Assume…

A: The Present Value of money: The value of a cash stream to be received or paid at some time in the…

Q: Your clothing business, FashionV Co has fixed costs of $1,000 per year, depreciation charges of $500…

A: The degree of operating leverage is used to find out the impact of change in sales on the earnings…

Q: Zeda Enterprises has the option to invest in machinery in projects A and B but finance is only…

A: Net Present Value: Net present value (NPV) is the excess of present value of cash inflows over the…

Q: An executive receives an annual salary of P500,000 and his secretary a salary of P160,000 a year. A…

A: Annual salary of executive= P 500,000 No. of hours worked by executive in a year= 3,000 Salary cost…

Q: If money is invested at 13% compounded quarterly, find the present value of P11,200 due at the end…

A: Present value money is the equivalent value of future money that is to be received based on interest…

Q: Calculate the Payback Period of Project A (expressed in years, months and days). 2. Calculate the…

A: The payback period is used for project evaluation as it calculates the time required by the cash…

Q: Mr. Kevin Dates is the owner of an expanding business operating in bakery industry located in…

A: NPV is techniques under Capital budgeting which help in decision making on the basis of positive…

Q: A medical device manufacturer is considering three different methods to manufacture the device that…

A: Net Present Value ( NPV ) is Capital Budgeting techniques which help in choose / Starting of the…

Q: Which ones identify the disadvantages of the payback rule? A. Very simple and easy to apply. B.…

A: Solution: Payback period is one of the decision making criteria in capital budgeting. It measures…

Q: invest 40% in A and 60% in B, what would be the return standard deviation of your portfolio? Enter…

A: First we need to find the standard deviation of individual stocks and their correlation co-efficient…

Q: Filer Manufacturing has 9,986,779 shares of common stock outstanding. The current share price is…

A: Data given: P0= Current share price = $78.51 D0= Current dividend= $0.56 g=Growth rate= 0.05…

Q: 3 These are the examples of non-banking financial intermediaries except:* A. Discount house…

A: Non-banking financial intermediaries: A financial institution that lacks a full banking license and…

Q: I have a question how does the value of i (interest rate) is 0.075 in the example eventhough it said…

A: From the solution, n = 20, i = 7.5% = 0.075 P = 100000 Present value of annuity is =…

Q: What are the roles of venture capitalists and business angel in entreprenurial finance?

A: A venture capitalist (VC) is an investor who lends funding to new firms in return for stock.New…

Q: One of Ed's favorite bands is playing in Philadelphia. Ed purchases a ticket ($50.00) and takes a…

A: The utility derived from any assets depends on the person satisfaction from that assets and value…

Q: Question 2 a. Why municipal bonds are the priority of some investors? Why sometimes do investors…

A: Municipal bonds are the significant bonds, which is defined as the debt obligations that are issued…

Q: Find the future value of $1 000 at 7.8% p.a. simple interest over 14 months.

A: Simple interest does not consider the effect of compounding of interest over the period of time. The…

Q: How much should Bianca have in a savings account that is earning 2.50% compounded monthly, if she…

A: Solution:- When an equal amount is withdrawan each period at end of the period, it is called…

Q: At the end of the year 2020, the common equity was 490,000, and the dividends paid in the year 2021…

A: Free cash flow to equity = Common equity 2021- common equity 2020 - dividends paid

Q: Assume you purchased 200 shares of GE common stock on margin at $100/share using 40% margin. How…

A: Solution:- In equity market, margin means the amount of money borrowed from the broker in order to…

Q: Filer Manufacturing has 6,382,006 shares of common stock outstanding. The current share price is…

A: Equity is the amount that would remain in the hands of a company's shareholders after all of its…

Q: 15 Mudarabah and Musharakah fall under profit and loss sharing transactions and have other risks…

A: Mudarabah and Musharakah fall under profit and loss sharing transactions and have other risks…

Q: howmuch would be the investor’s cash dividend? a. PhP 16,000 b. PhP 12,500 c. PhP 16,500 d. PhP…

A: Cash Dividend: It refers to the distribution of money or funds paid to the shareholders usually as…

Q: You live in the United States and want to try to make some money through interest rate arbitrage…

A: Foreign Exchange Market is that under which we were trading in Foreign Currency we can make the…

Q: find the future value of $1800 in 3 years at 8% interest

A: According to the concept of the time value of money principle, the value of money will fluctuate…

Q: Travis International has a debt payment of $2.24 million that it must make 4 years from today. The…

A: Payment in 4 years = 2,240,000 N = 4*12 = 48 months Interest Rate = 4.83%/12 = 0.4025%

Q: Finance What technique would you choose to forecast the Income Statement in future fiscal years?…

A: In finance we often have to forecast income statement for future years. This is important as we…

round to nearest cent

Step by step

Solved in 2 steps

- A convertible bond can be converted into 1 share of stock. The bond is zero-coupon, i.e., it pays no interest, but matures to a value of $100 in two periods. The stock price is currently $100. In each period the stock can increase in each period by a factor of 1.4, or fall by a factor of 0.8. Each period the stock pays a dividend of 5%, at which point it can be converted. The risk-free rate is 10% and time to maturity is 2-years. Find the price at which the convertible bond can be issuedConsider a convertible bond as follows: par value = $1,000, coupon rate = 8.00%, market price of convertible bond = $1,100, conversion ratio = 18, straight value of bond = $600, yield to maturity of straight bond = 10%, current price of common stock = $45, dividend per share = $3.00/year. A. What is the favorable income differential per bond (not per share)? B. At what stock price, the realized return from investing in the convertible bond becomes zero? In other words, what is the break-even stock price?A convertible bond has a par value of $1,000 and a conversion price of $40. The stockcurrently trades for $30 a share. What are the bond’s conversion ratio and conversionvalue at t =0?

- A $1,000 face value bond has a conversion ratio of 40. You estimate the transaction costs of conversion to be 2.8% of the face value of the bond. What price must the stock reach in order for you to convert?A convertible bond has a par value of $1,000 and a conversion priceof $25. The stock currently trades for $22 a share. What are thebond’s conversion ratio and conversion value at t= 0? (40, $880)Matthews Technology has a $1,000 par value, 20 year convertible bond outstanding with a 10% coupon rate that can be converted into 25 shares of common stock. The common stock is currently selling for $34.00 a share. The convertible bond is selling for $30 more than the conversion value. A competitive, 20 year nonconvertible bond of the same risk class has a 12% annual coupon rate. What is the number of common shares to which the convertible bond can be converted to (Conversion ratio)? Round to the nearest share. Compute the conversion price? Round to 2 decimal places. Compute the conversion value? Round to 2 decimal places. Compute the conversion premium? Round to 2 decimal places. Compute the current selling price of the convertible bond? Round to 2 decimal places. Compute the pure bond value? Round to 2 decimal places. If the common share price goes down to $31.50 and the conversion premium goes up…

- The following data apply to Saunders Corporation's convertible bonds: Maturity: 10 Stock Price: $30.00 Par value: $1,000.00 Conversion price: $35.00 Annual coupon: 5.00% Straight-debt yield: 8.00% What is the bond's straight-debt value? Based on your answers to the three preceding questions, what is the minimum price (or "floor" price) at which the Saunders' bonds should sell? Please solve the problem by using algebra and formulas instead of excel.(Please answer in an equation rather than excel, i dont know excel yet) Given the following information concerning a convertible bond: Principle: $1,000 Coupons: 5 percent Maturity: 15 years Call Price: $1,050 Conversion price: $37 (i.e., 27 shares) Market Price of the Bond: $1040 Common stock $30 D. What is the premium in terms of stock that the investor pays when he or she purchases the convertible bond instead of the stock? E. Nonconvertible bonds are selling with a yield to maturity of 7 percent If this bond lacked the conversion feature, what would the approximate price of the bond be? F. What is the premium in terms of debt that the investor pays when he or she purchases the convertible bond instead of a nonconvertible bond?Please dont answer in excel i dont understand that yet. Given the following information concerning a convertible bond: Principle: $1,000 Coupons: 5 percent Maturity: 15 years Call Price: $1,050 Conversion price: $37 (i.e., 27 shares) Market Price of the Bond: $1040 Common stock $30 D. What is the premium in terms of stock that the investor pays when he or she purchases the convertible bond instead of the stock? E. Nonconvertible bonds are selling with a yield to maturity of 7 percent If this bond lacked the conversion feature, what would the approximate price of the bond be? F. What is the premium in terms of debt that the investor pays when he or she purchases the convertible bond instead of a nonconvertible bond?

- A convertible bond is selling for $800. It has 10 years to maturity, a $1000 face value, and a 10% coupon paid semi-annually. The conversion price, specified at the time the convertible bond is issued, is $50 per share [in other words, if one bond is converted, the number of shares obtained in return equals the face value of the bond divided by this conversion price]. Non-convertible bonds issued by the same firm with the same face value, term to maturity and coupon are priced to yield an effective semi-annual return of 7.2%. The stock currently sells for $31.375 per share. a) What is the value of the convertible bond considered as a straight bond? b) If the bond is converted to shares, how many shares are equivalent to the convertible bond given its face value? What is the value of that share portfolio? c) Calculate the convertible bond’s option value.A convertible bond is selling for $800. It has 10 years to maturity, a $1000 face value, and a 10% coupon paid semi-annually. The conversion price, specified at the time the convertible bond is issued, is $50 per share [in other words, if one bond is converted, the number of shares obtained in return equals the face value of the bond divided by this conversion price]. Non-convertible bonds issued by the same firm with the same face value, term to maturity and coupon are priced to yield an effective semi-annual return of 7.2%. The stock currently sells for $31.375 per share. a) What is the value of the convertible bond considered as a straight bond? b) If the bond is converted to shares, how many shares are equivalent to the convertible bond given its face value? What is the value of that share portfolio?Calculate the market conversion price for a convertible bond with par value of $4000, coupon rate of 5%, market price of $4000, a conversion ratio of 16, and current stock price of $202. 1. Assuming, the issuing company pays an annual dividend of $12 per share, what is the favorable income differential (yield advantage) per share for this bond? 2. Calculate the premium payback period for this bond.