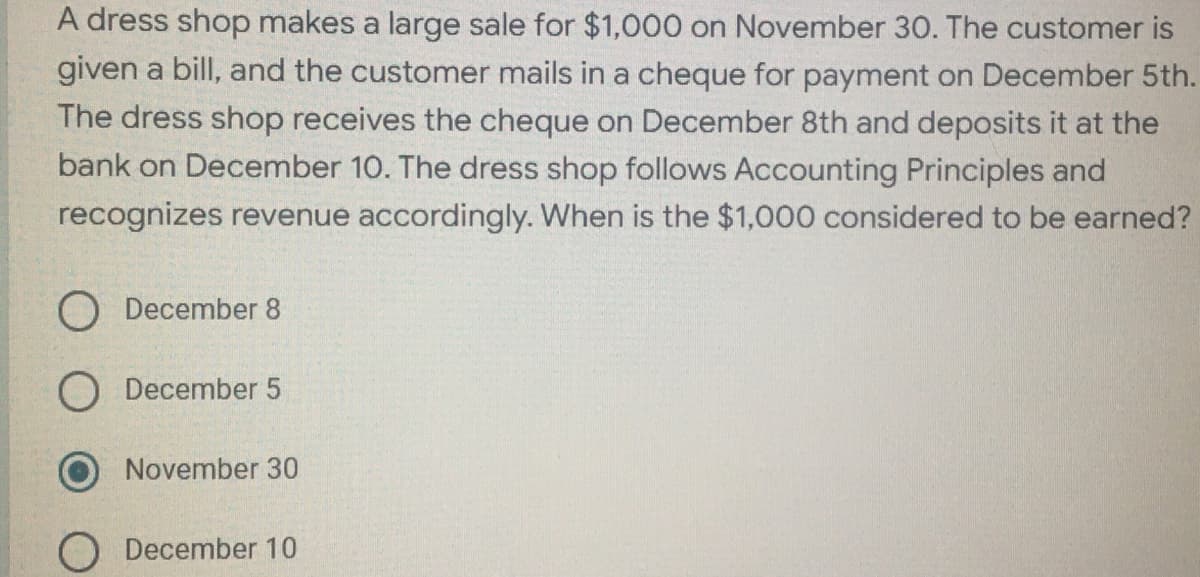

iven a bill, and the customer mails in a cheque for payment on December 5th. he dress shop receives the cheque on December 8th and deposits it at the ank on December 10. The dress shop follows Accounting Principles and ecognizes revenue accordingly. When is the $1,000 considered to be earned? December 8 December 5 November 30 December 10

Q: Greek Manufacturing Company produces and sells a line of product that are sold usually all year roun...

A: We can calculate the contribution margin as follows Contribution margin = Seling Price - Variable ex...

Q: Walnut has received a special order for 2,400 units of its product at a special price of $240. The p...

A: Answer) If the company accepts the offer, it will incur variable expenses like Direct Materials c...

Q: The management of Mecca Copy, a photocopying center located on University Avenue, has compiled the f...

A: Mecca Company Budgeted Balance Sheet Assets Current Assets: Cash $ 19,400 Acc...

Q: In the liquidation of a partnership, a loan from a partner a. Will be paid off at the same time as p...

A: Partnership characteristics includes: Existence of an agreement Existence of business Sharing of pr...

Q: Exercise 8-11 (Algo) Trade and purchase discounts; the gross method and the net method compared [LO8...

A: Introduction journal entries are the recording of business transaction in a journal with a modern ac...

Q: During 2021, Odyssey Company is the defendant in a patent infringement lawsuit. The entity's lawyers...

A: As per IAS 37, provisions are created when it is most likely probably to occur. Once a provision is ...

Q: Ques 2:( On April 1, 2021, ABC Company issued a 5-year, 10%, OMR 100,893 face value bond at 102 (2% ...

A:

Q: George transfers the following (assume it is a 351), what is his stock basis? Land (basis $40,000 an...

A: Non-taxable transaction under Section 351 (i.e., no gain or loss is recognized) (only if all the con...

Q: Jacob is a member of WCC (an LLC taxed as a partnership). Jacob was allocated $150,000 of business i...

A: The correct answer for the above mentioned question is given in the following steps for your referen...

Q: Prepare journal entries for Titanic Company in the year 2022 and 2023

A: Purchasing of shares means that the buyer or the acquirer have made an investment by the purchasing ...

Q: Q1: Randall receives a $4,200 monthly payment from a registered annuity. He calculates that 65.2% of...

A: Return of Capital: Return of capital alludes to head installments once again to "capital proprietors...

Q: If a check correctly written and paid by the bank for $484 is incorrectly recorded on the company's ...

A: Bank reconciliation: It is a statement drawn up by the business to verify the cash book balance with...

Q: Calculate the total cost to D Ski Resort for Greg's paycheck being deposited Wages Plus taxes FICA T...

A: Payroll Taxes: The significance of payroll tax is that it is a duty that is paid by an organization,...

Q: 1. A resident citizen taxpayer sold a vacant lot (held as investment) in the Philippines. Other data...

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any ...

Q: Which of the following statements is false? O The Home Office - Current account is presented in the...

A: Head office Current account is capital account for branch. Following is the correct option relating ...

Q: Childers Company, which uses a perpetual inventory system, has an established petty cash fund in the...

A: Petty cash: Petty cash fund is established to pay small expenses like office supplies, postage etc. ...

Q: In testing controls over cash disbursements, an auditor most likely would determine that the person ...

A: The question is related to Auditingbof Cash disbursement.

Q: 1. Calculate monthly costs 2. Calculate invoices value 3. Calculate total project cost and price

A: As per our protocol we provide solution to the one question only or to the first three sub-parts onl...

Q: hich of the following statements is false? Group of answer choices Branches generally maintain a com...

A: The answer is stated below:

Q: . X invited Y to a partnership interest in his business. Accounts in the ledger of X on January 1, 2...

A: Calculation of Adjusted Capital of Y X as contributed P 1,175,200 for 2/3 share. Therefore, total ca...

Q: Required: Use the variance formulas to compute the following variances. (Indicate the effect of each...

A: Variable-overhead spending variance $54,000 U Variable-overhead efficiency variance $42,000 U ...

Q: 15,300 16,388 The level of fixed costs in the Maintenance Department is determined by peak-period re...

A: Here question related with the calculation of maintenance cost which are charged to forming departme...

Q: Worth Company reported the following year-end information: beginning work in process inventory, $180...

A: The Cost of Goods Sold estimates the "direct cost" of producing any goods or services (COGS). It is ...

Q: Senior Inc. owns 85 percent of Junior Inc. During 20X8, Senior sold goods with a 25 percent gross pr...

A: The correct Answer in the given question is: No Adjustment is necessary

Q: onsidered in item 4. 1. The company did not accrue sales commissions payable at the end of each of ...

A: Journal entry: The act of recording or keeping track of any financial or non-financial action is kn...

Q: Input validation includes field interrogation that examines the data in individual fields. List four...

A: Before processing, the input controls, also known as validation controls, conduct a test on transact...

Q: Spanish Manufacturing Company produces and sells a line of products that are sold usually all year r...

A: Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question...

Q: ABC Company reported the following data for the current year: 1. How much is the gross profit? 2. ...

A: Gross Profit = Net Sales - Cost of Goods Sold Net Sales = Sales - Sales Discount Administrative Expe...

Q: true or false. A radio broadcasting company opted to be taxed using VAT. 5 years later, since their ...

A: If the threshold limit falls down then VAT registration is not required.

Q: The corporate charter of Reilly Corporation allows the issuance of a maximum of 10,000,000 shares of...

A: GIVEN The corporate charter of Reilly Corporation allows the issuance of a maximum of 10, 000, 000...

Q: Bartow Photographic Services takes wedding and graduation photographs. At December 31, theend of Bar...

A: Reconciliation journals are entries in the company's general ledger created at the end of an account...

Q: X a partner in the XY partnership, is entitled to 35% of the profits and losses. During the year, X ...

A: X's Capital account had a balance of P 40,000 (P35,000 + P5,000) at the end of the year. X's share o...

Q: Starbucks is today the world’s leading roaster and retailer of specialty coffee. The company purchas...

A: Financial ratios Financial ratios are helpful in assessing the profitability, leverage, liquidity, e...

Q: Jason has credit card with the monthly interest rate of 1.3%. His statement from October 10 to Novem...

A: Monthly interest rate = 1.3 % 1. Opening balance = 1,132 Interest will be charged for whole 32 days...

Q: The credit manager of Montour Fuel has gathered the following information about the company's accoun...

A: A journal entry is a type of accounting entry used to document a business transaction in a company's...

Q: A company has the following assets: Buildings and Equipment, less accumulated depreciation of $5,000...

A: Property, plant, and equipment (PP&E) are long-term resources that are essential to a firm's man...

Q: QUESTION 3 A retailer, Lewis John constructed a new store at cost of RM50 million over 6 months from...

A: Borrowing Cost are the costs that are directly attributable to the acquisition, construction or prod...

Q: Spanish Manufacturing Company produces and sells a line of products that are sold usually all year r...

A: Sales revenue: The amount obtained by a company after disposing of their manufactured goods is calle...

Q: Antuan Company set the following standard costs per unit for its product. Direct materials (4.0 poun...

A: Direct material cost variance: The direct material variance is the difference between the standard ...

Q: LOGIC COMPANY Comparative Income Statement For Years Ended December 31, 2017 and 2018 ...

A: The acid test ratio is also called as quick ratio. It is found to analyze whether a company is able ...

Q: A machine costing $450,000 with a four-year life and an estimated $30,000 salvage value is installed...

A: Given: Cost of Machine - $450,000 Estimated salvage value - $30,000 Production Estimate - 1,050,000...

Q: Pasta acquired 100% of Sauce for $200. At acquisition date Sauce had equity of $170, comprise...

A: Goodwill refers to the intangible asset that arises generally at the time of purcahse or sale of bus...

Q: D

A: The income statement explains the financial performance of the company for a particular period of ti...

Q: Greek Manufacturing Company produces and sells a line of product that are sold usually all year roun...

A: Maximum Production Capacity 100000 Units Per Unit Sales 50 Production Cost D...

Q: Q7-1. What is interest? Explain.

A: Interest is a financial term regularly used when money is lent or received as loan

Q: Serene Stereos has the following inventory data: Nov. 1 Inventory 30 units @ $6.00 each Purchase 120...

A: The cost of goods sold is the total amount paid by your company as a cost directly related to the sa...

Q: Which of the following manipulations would understate accounts payable on the financial statements? ...

A: Account payable means the amount owed by business to outsider for the goods received and services r...

Q: Prepare a classified balance sheet Be careful as this is a classified financial statement All accoun...

A: Assets that are subject to limitations imposed by the donor externally is known as a net asset with ...

Q: Required: What are the advantages and disadvantages of the scattergram method as compared to the hig...

A: The scattergraph (or dissipate diagram) strategy is a visual method utilized in representing isolati...

Q: Mr. Jhonny bought a car worth P900,000 last January 1, 2000, and intend to sell it for P300,000 afte...

A: given, Cost of asset=9,00,000 Resale value=3,00,000 Life of Asset=10 years

Step by step

Solved in 3 steps

- Your company paid rent of $1,000 for the month with check number 1245. Which journal would the company use to record this? A. sales journal B. purchases journal C. cash receipts journal D. cash disbursements journal E. general journalIf a customer owed your company $100 on the first day of the month, then purchased $200 of goods on credit on the fifth and paid you $50 on fifteenth, the customers ending balance for the month would show a (debit or credit) of how much?Review the following transactions, and prepare any necessary journal entries. A. On July 16, Arrow Corp. purchases 200 computers (Equipment) at $500 per computer from a supplier, on credit. Terms of the purchase are 4/10, n/50 from the invoice date of July 16. B. On August 10, Hondo Inc. receives advance cash payment from a client for legal services in the amount of $9,000. Hondo had yet to provide legal services as of August 10. C. On September 22, Jack Pies sells thirty pies for $25 cash per pie. The sales tax rate is 8%. D. On November 8, More Supplies paid a portion of their noncurrent note in the amount of $3,250 cash.

- Review the following transactions and prepare any necessary journal entries. A. On January 5, Bunnet Co. purchases 350 aprons (Supplies) at $25 per apron from a supplier, on credit. Terms of the purchase are 3/10, n/30 from the invoice date of January 5. B. On February 18, Melon Construction receives advance cash payment from a client for construction services in the amount of $20,000. Melon had yet to provide construction services as of February 18. C. On March 21, Noonan Smoothies sells 875 smoothies for $4 cash per smoothie. The sales tax rate is 6.5%. D. On June 7, Organic Methods paid a portion of their noncurrent note in the amount of $9,340 cash.On June 1, Lupita Candy Supplies sells 1,250 candy buckets to a local school at a sales price of $10 per bucket. The cost to Lolita is $2 per bucket. The terms of the sale are 2/10, n/60, with an invoice date of June 1. Create the journal entries for Lupita to recognize the following transactions. A. the initial sale B. the subsequent customer payment on July 12Review the following transactions and prepare any necessary journal entries for Tolbert Enterprises. A. On April 7, Tolbert Enterprises contracts with a supplier to purchase 300 water bottles for their merchandise inventory, on credit, for $10 each. Credit terms are 2/10, n/60 from the invoice date of April 7. B. On April 15, Tolbert pays the amount due in cash to the supplier.

- The following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Hammond Auto Supply does not track cash sales by customer. Jan. 2Issued Ck. No. 6981 to JSS Management Company for monthly rent, 775. 2J. Hammond, the owner, invested an additional 3,500 in the business. 4Bought merchandise on account from Valencia and Company, invoice no. A691, 2,930; terms 2/10, n/30; dated January 2. 4Received check from Vega Appliance for 980 in payment of 1,000 invoice less discount. 4Sold merchandise on account to L. Paul, invoice no. 6483, 850. 6Received check from Petty, Inc., 637, in payment of 650 invoice less discount. 7Issued Ck. No. 6982, 588, to Fischer and Son, in payment of invoice no. C1272 for 600 less discount. 7Bought supplies on account from Doyle Office Supply, invoice no. 1906B, 108; terms net 30 days. 7Sold merchandise on account to Ellison and Clay, invoice no. 6484, 787. 9Issued credit memo no. 43 to L. Paul, 54, for merchandise returned. 11Cash sales for January 1 through January 10, 4,863.20. 11Issued Ck. No. 6983, 2,871.40, to Valencia and Company, in payment of 2,930 invoice less discount. 14Sold merchandise on account to Vega Appliance, invoice no. 6485, 2,050. Jan. 18Bought merchandise on account from Costa Products, invoice no. 7281D, 4,854; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to the invoice, 147 (total 5,001). 21Issued Ck. No. 6984, 194, to M. Miller for miscellaneous expenses not recorded previously. 21Cash sales for January 11 through January 20, 4,591. 23Issued Ck. No. 6985 to Forbes Freight, 96, for freight charges on merchandise purchased on January 4. 23Received credit memo no. 163, 376, from Costa Products for merchandise returned. 29Sold merchandise on account to Bruce Supply, invoice no. 6486, 1,835. 31Cash sales for January 21 through January 31, 4,428. 31Issued Ck. No. 6986, 53, to M. Miller for miscellaneous expenses not recorded previously. 31Recorded payroll entry from the payroll register: total salaries, 6,200; employees federal income tax withheld, 872; FICA Social Security tax withheld, 384.40, FICA Medicare tax withheld, 89.90. 31Recorded the payroll taxes: Social Security tax, 384.40, FICA Medicare tax, 89.90; state unemployment tax, 334.80; federal unemployment tax, 37.20. 31Issued Ck. No. 6987, 4,853.70, for salaries for the month. 31J. Hammond, the owner, withdrew 1,000 for personal use, Ck. No. 6988. Required 1. Record the transactions for January using a sales journal, page 73; a purchases journal, page 56; a cash receipts journal, page 38; a cash payments journal, page 45; and a general journal, page 100. Assume the periodic inventory method is used. 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily those entries involving the Other Accounts columns and the general journal to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Add the columns of the special journals and prove the equality of the debit and credit totals. 6. Post the appropriate totals of the special journals to the general ledger. 7. Prepare a trial balance. 8. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?The following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Hammond Auto Supply does not track cash sales by customer. Jan. 2Issued Ck. No. 6981 to JSS Management Company for monthly rent, 775. 2J. Hammond, the owner, invested an additional 3,500 in the business. 4Bought merchandise on account from Valencia and Company, invoice no. A691, 2,930; terms 2/10, n/30; dated January 2. 4Received check from Vega Appliance for 980 in payment of 1,000 invoice less discount. 4Sold merchandise on account to L. Paul, invoice no. 6483, 850. 6Received check from Petty, Inc., 637, in payment of 650 invoice less discount. 7Issued Ck. No. 6982, 588, to Fischer and Son, in payment of invoice no. C1272 for 600 less discount. 7Bought supplies on account from Doyle Office Supply, invoice no. 1906B, 108; terms net 30 days. 7Sold merchandise on account to Ellison and Clay, invoice no. 6484, 787. 9Issued credit memo no. 43 to L. Paul, 54, for merchandise returned. 11Cash sales for January 1 through January 10, 4,863.20. 11Issued Ck. No. 6983, 2,871.40, to Valencia and Company, in payment of 2,930 invoice less discount. 14Sold merchandise on account to Vega Appliance, invoice no. 6485, 2,050. Jan. 18Bought merchandise on account from Costa Products, invoice no. 7281D, 4,854; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to the invoice, 147 (total 5,001). 21Issued Ck. No. 6984, 194, to M. Miller for miscellaneous expenses not recorded previously. 21Cash sales for January 11 through January 20, 4,591. 23Issued Ck. No. 6985 to Forbes Freight, 96, for freight charges on merchandise purchased on January 4. 23Received credit memo no. 163, 376, from Costa Products for merchandise returned. 29Sold merchandise on account to Bruce Supply, invoice no. 6486, 1,835. 31Cash sales for January 21 through January 31, 4,428. 31Issued Ck. No. 6986, 53, to M. Miller for miscellaneous expenses not recorded previously. 31Recorded payroll entry from the payroll register: total salaries, 6,200; employees federal income tax withheld, 872; FICA Social Security tax withheld, 384.40, FICA Medicare tax withheld, 89.90. 31Recorded the payroll taxes: Social Security tax, 384.40, FICA Medicare tax, 89.90; state unemployment tax, 334.80; federal unemployment tax, 37.20. 31Issued Ck. No. 6987, 4,853.70, for salaries for the month. 31J. Hammond, the owner, withdrew 1,000 for personal use, Ck. No. 6988. Required 1. Record the transactions in the general journal for January. If you are using Working Papers, start with page 1 in the journal. Assume the periodic inventory method is used. The chart of accounts is as follows: 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily the general journal entries to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Prepare a trial balance. 6. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?Post the following July transactions to T-accounts for Accounts Receivable, Sales Revenue, and Cash, indicating the ending balance. Assume no beginning balances in these accounts. A. on first day of the month, sold products to customers for cash, $13,660 B. on fifth day of month, sold products to customers on account, $22,100 C. on tenth day of month, collected cash from customer accounts, $18,500

- Catherines Cookies has a beginning balance in the Accounts Payable control total account of $8,200. In the cash disbursements journal, the Accounts Payable column has total debits of $6,800 for November. The Accounts Payable credit column in the purchases journal reveals a total of $10,500 for the current month. Based on this information, what is the ending balance in the Accounts Payable account in the general ledger?Review the following transactions and prepare any necessary journal entries for Lands Inc. A. On December 10, Lands Inc. contracts with a supplier to purchase 450 plants for its merchandise inventory, on credit, for $12.50 each. Credit terms are 4/15, n/30 from the invoice date of December 10. B. On December 28, Lands pays the amount due in cash to the supplier.Lavender Company started its business on April 1, 2019. The following are the transactions that happened during the month of April. Prepare the journal entries in the journal on Page 1. A. The owners invested $7,500 from their personal account to the business account. B. Paid rent $600 with check #101. C. Initiated a petty cash fund $250 check #102. D. Received $350 cash for services rendered. E. Purchased office supplies for $125 with check #103. F. Purchased computer equipment $1,500, paid $500 with check #104, and will pay the remainder in 30 days. G. Received $750 cash for services rendered. H. Paid wages $375, check #105. I. Petty cash reimbursement Office Supplies $50, Maintenance Expense $80, Miscellaneous Expense $60. Cash on hand $8. Check #106. J. Increased Petty Cash by $70, check #107.