Q1: Randall receives a $4,200 monthly payment from a registered annuity. He calculates that 65.2% of the payment is a return of capital and the rest is interest. What portion of the payments would be taxable? Q2: Tony earned $80,000 last year, and there was a $4,800 pension adjustment. He will earn $84 000 this vear How much can he contribute.

Q1: Randall receives a $4,200 monthly payment from a registered annuity. He calculates that 65.2% of the payment is a return of capital and the rest is interest. What portion of the payments would be taxable? Q2: Tony earned $80,000 last year, and there was a $4,800 pension adjustment. He will earn $84 000 this vear How much can he contribute.

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter11: Individuals As Employees And Proprietors

Section: Chapter Questions

Problem 2BCRQ

Related questions

Question

Transcribed Image Text:Accounting

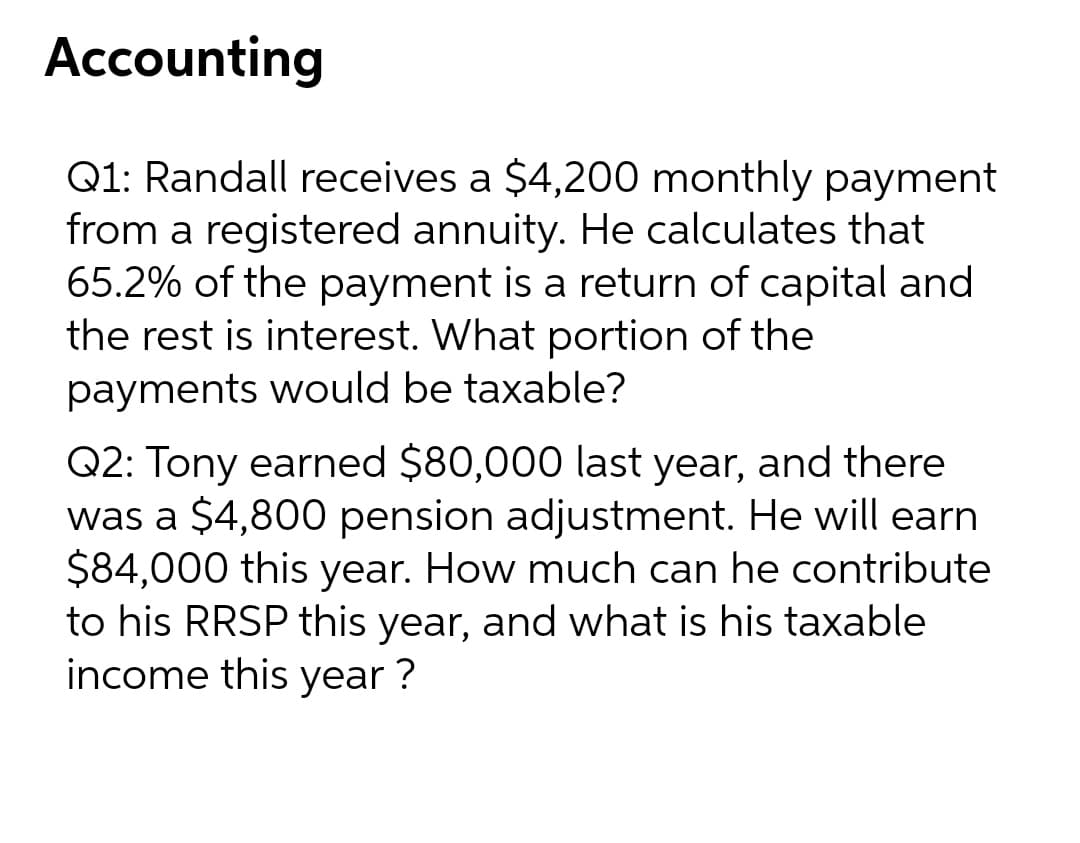

Q1: Randall receives a $4,200 monthly payment

from a registered annuity. He calculates that

65.2% of the payment is a return of capital and

the rest is interest. What portion of the

payments would be taxable?

Q2: Tony earned $80,000 last year, and there

was a $4,800 pension adjustment. He will earn

$84,000 this year. How much can he contribute

to his RRSP this year, and what is his taxable

income this year ?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you