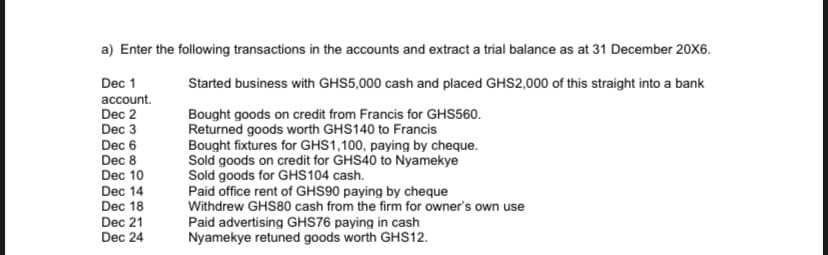

a) Enter the following transactions in the accounts and extract a trial balance as at 31 December 20X6. Dec 1 account. Dec 2 Dec 3 Dec 6 Dec 8 Dec 10 Dec 14 Dec 18 Dec 21 Dec 24 Started business with GHS5,000 cash and placed GHS2,000 of this straight into a bank Bought goods on credit from Francis for GHS560. Returned goods worth GHS140 to Francis Bought fixtures for GHS1,100, paying by cheque. Sold goods on credit for GHS40 to Nyamekye Sold goods for GHS104 cash. Paid office rent of GHS90 paying by cheque Withdrew GHS80 cash from the firm for owner's own use Paid advertising GHS76 paying in cash Nyamekye retuned goods worth GHS12.

a) Enter the following transactions in the accounts and extract a trial balance as at 31 December 20X6. Dec 1 account. Dec 2 Dec 3 Dec 6 Dec 8 Dec 10 Dec 14 Dec 18 Dec 21 Dec 24 Started business with GHS5,000 cash and placed GHS2,000 of this straight into a bank Bought goods on credit from Francis for GHS560. Returned goods worth GHS140 to Francis Bought fixtures for GHS1,100, paying by cheque. Sold goods on credit for GHS40 to Nyamekye Sold goods for GHS104 cash. Paid office rent of GHS90 paying by cheque Withdrew GHS80 cash from the firm for owner's own use Paid advertising GHS76 paying in cash Nyamekye retuned goods worth GHS12.

Chapter3: Analyzing And Recording Transactions

Section: Chapter Questions

Problem 18PA: Post the following July transactions to T-accounts for Accounts Receivable, Sales Revenue, and Cash,...

Related questions

Topic Video

Question

Transcribed Image Text:a) Enter the following transactions in the accounts and extract a trial balance as at 31 December 20X6.

Dec 1

Started business with GHS5,000 cash and placed GHS2,000 of this straight into a bank

account.

Dec 2

Dec 3

Dec 6

Bought goods on credit from Francis for GHS560.

Returned goods worth GHS140 to Francis

Bought fixtures for GHS1,100, paying by cheque.

Sold goods on credit for GHS40 to Nyamekye

Sold goods for GHS104 cash.

Paid office rent of GHS90 paying by cheque

Withdrew GHS80 cash from the firm for owner's own use

Paid advertising GHS76 paying in cash

Nyamekye retuned goods worth GHS12.

Dec 8

Dec 10

Dec 14

Dec 18

Dec 21

Dec 24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning