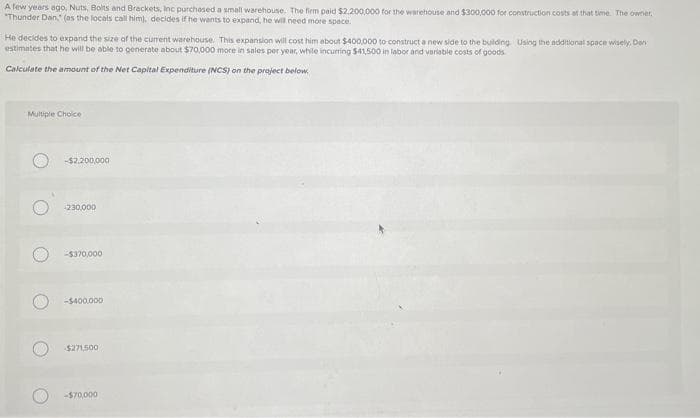

A few years ago, Nuts, Bolts and Brackets, Inc purchased a small warehouse. The firm paid $2.200,000 for the warehouse and $300,000 for construction costs at that time. The owner, "Thunder Dan," (as the locals call him), decides if he wants to expand, he will need more space. He decides to expand the size of the current warehouse. This expansion will cost him about $400,000 to construct a new side to the building. Using the additional space wisely, Dan estimates that he will be able to generate about $70,000 more in sales per year, while incurring $41,500 in labor and variable costs of goods Calculate the amount of the Net Capital Expenditure (NCS) on the project below. Multiple Choice -$2,200,000 230,000 -$370,000 -$400.000 $271,500 -$70,000

A few years ago, Nuts, Bolts and Brackets, Inc purchased a small warehouse. The firm paid $2.200,000 for the warehouse and $300,000 for construction costs at that time. The owner, "Thunder Dan," (as the locals call him), decides if he wants to expand, he will need more space. He decides to expand the size of the current warehouse. This expansion will cost him about $400,000 to construct a new side to the building. Using the additional space wisely, Dan estimates that he will be able to generate about $70,000 more in sales per year, while incurring $41,500 in labor and variable costs of goods Calculate the amount of the Net Capital Expenditure (NCS) on the project below. Multiple Choice -$2,200,000 230,000 -$370,000 -$400.000 $271,500 -$70,000

Chapter12: Nonrecognition Transactions

Section: Chapter Questions

Problem 59DC

Related questions

Question

Transcribed Image Text:A few years ago, Nuts, Bolts and Brackets, Inc purchased a small warehouse. The firm paid $2.200,000 for the warehouse and $300,000 for construction costs at that time. The owner.

"Thunder Dan," (as the locals call him), decides if he wants to expand, he will need more space.

He decides to expand the size of the current warehouse. This expansion will cost him about $400,000 to construct a new side to the building. Using the additional space wisely, Dan

estimates that he will be able to generate about $70,000 more in sales per year, while incurring $41,500 in labor and variable costs of goods

Calculate the amount of the Net Capital Expenditure (NCS) on the project below.

Multiple Choice

-$2,200,000

-230,000

-$370,000

-$400,000

$271,500

-$70,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College