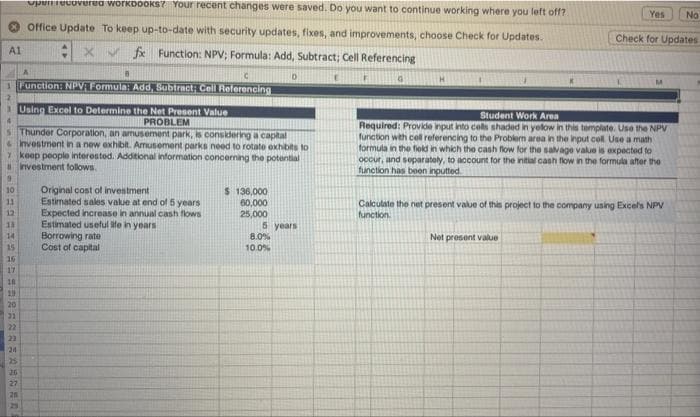

Thunder Corporation, an amusement park, is considering a capital nvestment in a new exhibit. Amusement parks need to rotate exhibits to keep people interested. Additional information concerning the potential investment follows. Original cost of investment Estimated sales value at end of 5 years Expected increase in annual cash flows Estimated useful life in years Borrowing rate Cost of capital $ 136,000 60,000 25,000 5 years 8.0% 10.0%

Thunder Corporation, an amusement park, is considering a capital nvestment in a new exhibit. Amusement parks need to rotate exhibits to keep people interested. Additional information concerning the potential investment follows. Original cost of investment Estimated sales value at end of 5 years Expected increase in annual cash flows Estimated useful life in years Borrowing rate Cost of capital $ 136,000 60,000 25,000 5 years 8.0% 10.0%

Accounting Information Systems

10th Edition

ISBN:9781337619202

Author:Hall, James A.

Publisher:Hall, James A.

Chapter15: Auditing It Controls Part Ii: Security And Access

Section: Chapter Questions

Problem 12P

Related questions

Question

Transcribed Image Text:open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off?

Office Update To keep up-to-date with security updates, fixes, and improvements, choose Check for Updates.

X✔ fx Function: NPV; Formula: Add, Subtract; Cell Referencing

C

1 Function: NPV: Formula: Add, Subtract; Cell Referencing

A1

13

14

15

16

ASARANASANGARR

Thunder Corporation, an amusement park, is considering a capital

& Investment in a new exhibit. Amusement parks need to rotate exhibits to

7 keep people interested. Additional information concerning the potential

investment follows.

17

18

19

20

21

22

23

24

25

26

27

B

20

Using Excel to Determine the Net Present Value

PROBLEM

Original cost of investment

Estimated sales value at end of 5 years

Expected increase in annual cash flows.

Estimated useful life in years

Borrowing rate

Cost of capital

D

$ 136,000

60,000

25,000

5 years

8.0%

10.0%

G

H

Yes No

Check for Updates

Student Work Area

Required: Provide input into cells shaded in yelow in this template. Use the NPV

function with cell referencing to the Problem area in the input cell. Use a math

formula in the field in which the cash flow for the salvage value is expected to

occur, and separately, to account for the initial cash flow in the formula after the

function has been inputted

Net present value

Calculate the net present value of this project to the company using Excel's NPV

function.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Essentials Of Business Analytics

Statistics

ISBN:

9781285187273

Author:

Camm, Jeff.

Publisher:

Cengage Learning,

Pkg Acc Infor Systems MS VISIO CD

Finance

ISBN:

9781133935940

Author:

Ulric J. Gelinas

Publisher:

CENGAGE L

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Essentials Of Business Analytics

Statistics

ISBN:

9781285187273

Author:

Camm, Jeff.

Publisher:

Cengage Learning,

Pkg Acc Infor Systems MS VISIO CD

Finance

ISBN:

9781133935940

Author:

Ulric J. Gelinas

Publisher:

CENGAGE L

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning