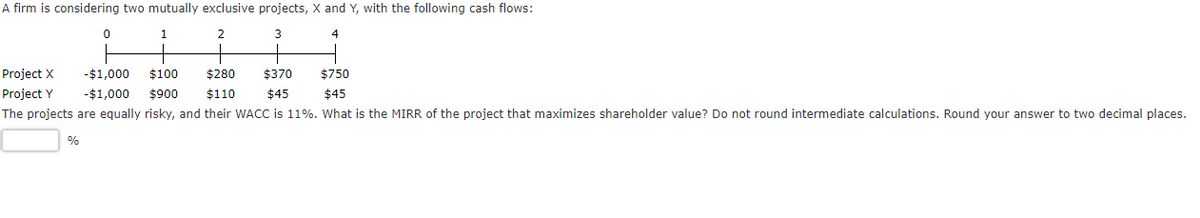

A firm is considering two mutually exclusive projects, X and Y, with the following cash flows: 1 2 3 4 0 Project X -$1,000 $100 $280 $370 $750 Project Y -$1,000 $900 $110 $45 $45 The projects are equally risky, and their WACC is 11%. What is the MIRR of the project that maximizes shareholder value? Do not round intermediate calculations. Round your answer to two decimal places. %

Q: You are considering an investment in a mutual fund with a 4% load and an expense ratio of 0.5%. You…

A: In order to invest in mutual fund, the investor has to pay the front end load fees. Such fees are…

Q: Chris Seals has just given an insurance company $62,525. In return, she will receive an annuity of…

A: Investment amount (PV)=$62,525 Annuity amount (PMT)=$7,458 Time period (N)=12 years Future value=$0…

Q: Byron Books Inc. recently reported $18 million of net income. Its EBIT was $34.3 million, and its…

A: Here,Net Income = $18,000,000EBIT = $34,300,000Tax rate = 25%To Find:Interest expense =?

Q: of Assume Evco, Inc. has a current stock price of $48.64 and will pay a $2.25 dividend in one year;…

A: We need to use one-period dividend discount model to calculate selling price of stock at end of…

Q: Assume the Black-Scholes framework. Let S be a stock such that S(0) = 21, the dividend rate is δ =…

A: An option is a type of financial instrument that is based on the value of underlying securities,…

Q: 5. An individual borrows £15,000 to be repaid in 10 years with monthly payments at the end of each…

A: EMI= LOAN AMOUNT/ Present value annuity factor @r%,n periodsEMI= 15000/103.56 =144.84

Q: Find the APR, or stated rate, in each of the following cases (Do not round intermediate calculations…

A: APR = [(1+EAR)1/m -1]*mWhere,m = number of timesEAR = Effective rate

Q: King Medical Supplies has issued preferred stock that pays a yearly dividend of $4 per share. This…

A: In the given case, we have provided the annual preferred stock dividend per share and the current…

Q: Reference rate is 6-month Treasury bill (182 days to maturity). The FRA settles in 270 days. The…

A: To calculate the amount of compensation that must be paid under the agreement at settlement, we need…

Q: Suppose you can afford $500 monthly payments and you will be able to pay $9000 as a balloon payment…

A: Balloon payments refer to the lump sum amount that is to be paid at the end of the period of the…

Q: Give typing answer with explanation and conclusion YG Corporation recently issued 270-day commercial…

A: The effective annual rate (EAR) is a measure used to calculate the annual interest rate, taking into…

Q: Financial analysis is more meaningful if the ratios can be compared to an appropriate benchmark such…

A: Ratio Analysis is used to compare the performance of the firm with others. Some of the parameters on…

Q: You buy a house for $190000, and take out a 30-year mortgage at 7% interest. For simplicity, assume…

A: In a growing annuity, the periodic annuity amount may increase at a fixed rate. The present value of…

Q: On April 1, $10,000.00 364-day treasury bills were auctioned off to yield 3.2 a) What is the price…

A: Hi, since you have posted a question with multiple sub-parts, we will answer the first three as per…

Q: Brian owns a tanning salon that is expected to produce annual cash flows forever. The tanning salon…

A: A perpetuity is a security that generates an endless source of cash flow.It is effectively an…

Q: Cost Accumulated depreciation Remaining life Current salvage value Salvage value in 8 years Annual…

A: Cost of New machine $40,800 Salvage value of old machine $10,280 Annual cash operating cost of…

Q: Consider an adjustable rate mortgage (ARM) of $190,000 with a maturity of 30 years and monthly…

A: Adjustable Rate Mortgage ( ARM)= $190,000 Time period = 30 Years of maturity Payments=monthly…

Q: (Corporate income tax) Meyer Inc. has taxable income (earnings before taxes) of $319,000. Calculate…

A: Taxable Income = $319,000

Q: Exactly 10 years ago a loan was taken out that was to be repaid by level annual instalments made in…

A: Here, Particulars Values Annual payment of loan (PMT) £ 1,043.05 Effective annual interest…

Q: Andrew took a handful of change out of his pocket and noticed that he was only holding dimes and…

A: Data given:No. of coins=22Total amount=$4Required: No. of quarters & no. of dimes

Q: Suppose you have a student loan of $35,000 with an APR of 6% for 40 years. Comp parts (a) through…

A: When the lender lends a loan to the borrower, he charges a rate of interest on the borrowed amount.…

Q: Bond prices and yields Assume that the Financial Management Corporation's $1,000-par-value bond has…

A: Current yield of a bond is the annual interest earned on the bond divided by its price. It helps in…

Q: 12 13 Coyne Corporation is evaluating a capital investment opportunity. This project would require…

A: The problem requires the application of the net present value (NPV) method to find out the wealth…

Q: Suppose you have a revolving credit account at an annual percentage rate of 12%, and your previous…

A: Here,Previous Monthly Balance is $389.79Purchases are $109.08 and $31.37Payment made in the month is…

Q: Tamarisk Inc. is considering modernizing its production facility by investing in new equipment and…

A: Cost of New machine $40,800 Salvage value of old machine $10,280 Annual cash operating cost of…

Q: Mexico's Cada Seis Años. Mexico was famous-or infamous-for many years in having two things every six…

A: Percentage devaluation refers to the proportion of the exchange rate which decreases the currency's…

Q: Assume both portfolios A and B are well diversified, that E(rA) = 12.6% and E(rB) = 13.6%. If the…

A: Risk-free rate refers to the rate that are being offered by the investment at the point where the…

Q: Find the present values of these ordinary annuities. Discounting occurs once a year. Do not round…

A: Present value is the estimation of the current value of future cash value which is likely to be…

Q: You wish to retire after 22 years; at which time you want to have accumulated enough money to…

A:

Q: ative contract On January 1, 2015, Nathan Co paid P6,000 cash to acquire a put foreign exchange…

A: The intrinsic value of the option refers to the amount by which the option is in-the-money at the…

Q: Sulzer Metco Corp purchased a new coating machine to improve performance of its power supply panels.…

A: The required rate of return, also known as the hurdle rate or minimum acceptable rate of return, is…

Q: If you put up $30,000 today in exchange for a 8.75 percent, 12-year annuity, what will the annual…

A: Present Value of Annuity = pv = $30,000Interest rate = r = 8.75%Time = t = 12 years

Q: Suppose you invest Php 100,000 today to: Buy 40 PLDT stocks at Php 1,500 per share Purchase 400…

A: Shares and securities pay returns in the form of dividends and the investor can also earn profits in…

Q: You have $329,866 in an investment account earning 5% compounded semi-annually. a) Starting one…

A: An…

Q: Consider a home mortgage of $200,000 at a fixed APR of 6% for 30 years. a. Calculate the monthly…

A: Here, Mortgage Amount (PV) is $200,000 APR (r) is 6% Time Period (n) is 30 years Compounding Period…

Q: 1. Assume an entrepreneur has two projects to choose. Both require $100 investment. Assume the…

A: As per the given information: Investment required - $100Safe project:Returns - $140 for sureRisky…

Q: Give only typing answer with explanation and conclusion You are considering investing in a bank…

A: Future value (FV)=$325,000Annual Interest rate=7%Monthly interest rate (r)=7%/12=0.5833%Periodic…

Q: A stock is expected to pay a dividend of $0.75 at the end of the year. The required rate of return…

A: Next Year dividend = d1 = $0.75 Required Rate of Return = r = 10.5% Growth Rate = g = 3%

Q: rate. Four years ago, ZXY deposited $2,820 in an account that has earned and will earn 15.00 percent…

A: 1. Compound interest. F = A × ( 1+r)n Where, F =future value including compound interest. A =…

Q: You want to create a portfolio equally as risky as the market, and you have $500,000 to invest.…

A: Beta shows the risk relative to the overall risk of the market, the beta of the portfolio depends on…

Q: $22,000, 5.4% bond redeemable at par is purchased 9.5 years before maturity to yield 5.1% compounded…

A: Compound = semiannually = 2Face value = fv = $22,000Coupon rate = 5.4 / 2 = 2.7% Time = t = 9.5 * 2…

Q: Create the amortization schedule for a loan of $5,000, paid monthly over two years using an 8…

A: Here,Loan Amount is $5,000Time Period of Loan is 2 yearsInterest Rate on Loan is 8%Compounding…

Q: Which one of the factors is most likely to be associated with an increase in the US trade deficit:…

A: A trade deficit is a situation which is said to be not good situation to be in , these are said to…

Q: A book sold 31.500 copies in its first month of release. Suppose this represents 9.2% of date. How…

A: Total number of copies have been sold can be calculated by dividing the number copies sold in first…

Q: Selected financial data for Amberjack Corporation follows. Sales Cost of goods sold Net income Cash…

A: Ratio analysis is a financial analysis technique used to evaluate the performance, liquidity,…

Q: 2. Let i denote the nominal interest rate, r denote the real interest rate, and INF denote…

A: In this question, we are examining the investment options available to an individual with $10,000 to…

Q: Alberto's bank guarantees him a return rate of 7.40% in year 2031, 8.40% in year 2032, 4.20% in year…

A: Here, Year Interest rate 2031 7.40% 2032 8.40% 2033 4.20% 2034 6.20% Year Investment…

Q: gages, loans taken to purchase a property, involve regular payments at fixed intervals and are…

A: Loans are paid by fixed equal monthly payments and these payments carry the payment for interest and…

Q: (Corporate income tax) G. R. Edwin Inc. had sales of $5.83 million during the past year. The cost of…

A: Tax liability refers to the amount of money a taxpayer or entity owes to the government based on…

Q: The Company KNV is in the construction industry and has outstanding debts valued at €4 million and…

A: Here,Value of Debt is €4 million Value of equity is €6 million Risk Free Rate is 4%Expected Risk…

277.

Subject : -

Finance

Step by step

Solved in 3 steps with 3 images

- A firm is considering two mutually exclusive projects, X and Y, with the following cash flows: 0 1 2 3 4 Project X -$1,000 $90 $320 $430 $700 Project Y -$1,000 $1,000 $100 $45 $55 The projects are equally risky, and their WACC is 10%. What is the MIRR of the project that maximizes shareholder value? Do not round intermediate calculations. Round your answer to two decimal places.Finance A firm is considering two mutually exclusive projects, X and Y, with the following cash flows: 0 1 2 3 4 Project X -$1,000 $110 $280 $430 $750 Project Y -$1,000 $900 $110 $55 $50 The projects are equally risky, and their WACC is 9%. What is the MIRR of the project that maximizes shareholder value? Do not round intermediate calculations. Round your answer to two decimal places. %Queens Soliderate is considering two mutually exclusive projects. The firm, which has a 12% cost of capital, has estimated its cash flows as shown in the following table. Project A Project B Initial investment (CF0) $130,000 $85,000 Year (t) Cash inflows (CFt) 1 $25,000 $40,000 2 35,000 35,000 3 45,000 30,000 4 50,000 10,000 5 55,000 5,000 a. Calculate the NPV of each project, and assess its acceptability. b. Calculate the IRR for each project, and assess its acceptability. Required to answer. Single line text.

- A firm has two mutually exclusive investment projects to evaluate. The projects have the following cash flows: Time Cash Flow Cash Flow Y C $95,000 -$70.000 35,000 40.000 55,000 40,000 3 60.000 40.000 40.000 10.000 9% , what is the EAA of the project that adds the most value to the firm? Do not round intermediate calculations, Round vour answer Proiects and Y are equally risky and may be reneated indefinitely, If the firm's WACC. the nearest dollar , whose EAA -s Choose Project -Select-The Webex Corporation is trying to choose between the following two mutually exclusive designprojects: Year Net Cash Flow Project - I($) Net Cash Flow Project - II($) 0 (53,000) (16,000) 1 27000 9100 2 27000 9100 3 27000 9100 (a) If the required return is 10% and the company applies the Profitability Index decision rule,which project should the firm accept?(b) If the company applies the Net Present Value decision rule, which project should it take?(c) Explain why your answers in (a) and (b) are different(d) Calculate the Internal Rate of Return of both projects.A firm has two mutually exclusive investment projects to evaluate. The projects have the following cash flows: Time After-tax Cash Flow X After-tax Cash Flow Y 0 -$100,000 -$75,000 1 30,000 40,000 2 50,000 40,000 3 60,000 40,000 4 - 40,000 5 - 5,000 Projects X and Y are equally risky and may be repeated indefinitely. If the firm’s WACC is 12%, what is the EAA of the project that adds the most value to the firm? Do not round intermediate calculations. Round your answer to the nearest dollar. Choose Project , whose EAA = $

- Thomas Company is considering two mutually exclusive projects. The firm, which has a cost of capital of 14%, has estimated its cash flows as shown in the following table: Project A Project B Initial investment (CF0) $150,000 $83,000 Year (t) Cash inflows (CFt) 1 $20,000 $45,000 2 $35,000 $25,000 3 $40,000 $35,000 4 $50,000 $10,000 5 $70,000 $15,000 a. Calculate the NPV of each project, and assess its acceptability. b. Calculate the IRR for each project, and assess its acceptability.A company is analyzing two mutually exclusive projects, S and L, with the following cash flows: Project S -$1,000 $899.96 $240 $15 $5 Project L -$1,000 $10 $250 $380 $843.66 The company's WACC is 10.0%. What is the IRR of the better project? (Hint: The better project may or may not be the one with the higher IRR.) Round your answer to two decimal places.A firm has 10 million shares outstanding with a current market price of P20 per share. There is one investment project available to the firm. The initial investment of the project is P20 million, and the NPV of the project is P10 million. What will be the firm’s stock price if capital markets fully reflect the value of undertaking the project? a.P19b.P20c.P21d.P22

- A firm has two mutually exclusive investment projects to evaluate. The projects have the following cash flows: Time Cash Flow X Cash Flow Y 0 -$80,000 -$70,000 1 30,000 35,000 2 55,000 35,000 3 70,000 35,000 4 - 35,000 5 - 5,000 Projects X and Y are equally risky and may be repeated indefinitely. If the firm’s WACC is 7%, what is the EAA of the project that adds the most value to the firm? Do not round intermediate calculations. Round your answer to the nearest dollar. Choose Project , whose EAA = $A firm is considering two mutually exclusive projects, X and Y, with the following cash flows: 0 1 2 3 4 Project X -$1,000 $90 $320 $430 $700 Project Y -$1,000 $1,000 $100 $45 $55 The projects are equally risky, and their WACC is 10%. What is the MIRR, Payback Period or Discount Payback Period of project X and project Y. Note: DO NOT SOLVE ON EXCELA company is considering mutually exclusive projects. The free cash flows associated with these projects are as follows: Project A Project B Initial outlay -$100,000 -$100,000 Year 1 $32,000 $0 Year 2 $32,000 $0 Year 3 $32,000 $0 Year 4 $32,000 $0 Year 5 $32,000 $200,000 The required rate of return on these projects is 11%. They are of equal risk. What is each project’s MIRR? Which project should be chosen? Is it possible for conflicts to exist between NPV and IRR when independent projects are being evaluated? Explain your answer