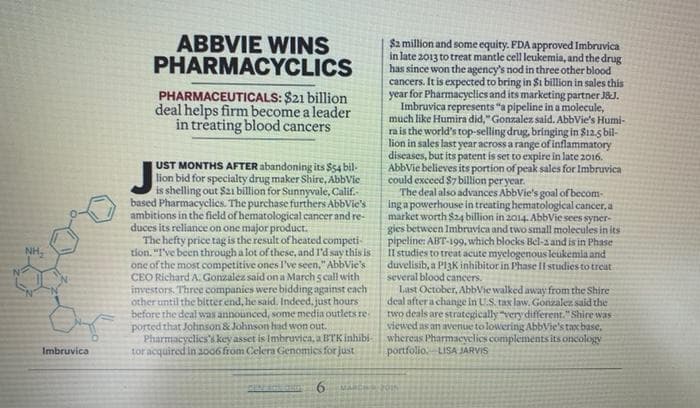

A) For what condition did the FDA approve this drug? B) How many aromatic rings does this drug contain? C) How many "true" lone pairs does this drug contain? D) How many aromatic pi electrons does this drug contain?

Reactive Intermediates

In chemistry, reactive intermediates are termed as short-lived, highly reactive atoms with high energy. They rapidly transform into stable particles during a chemical reaction. In specific cases, by means of matrix isolation and at low-temperature reactive intermediates can be isolated.

Hydride Shift

A hydride shift is a rearrangement of a hydrogen atom in a carbocation that occurs to make the molecule more stable. In organic chemistry, rearrangement of the carbocation is very easily seen. This rearrangement can be because of the movement of a carbocation to attain stability in the compound. Such structural reorganization movement is called a shift within molecules. After the shifting of carbocation over the different carbon then they form structural isomers of the previous existing molecule.

Vinylic Carbocation

A carbocation where the positive charge is on the alkene carbon is known as the vinyl carbocation or vinyl cation. The empirical formula for vinyl cation is C2H3+. In the vinyl carbocation, the positive charge is on the carbon atom with the double bond therefore it is sp hybridized. It is known to be a part of various reactions, for example, electrophilic addition of alkynes and solvolysis as well. It plays the role of a reactive intermediate in these reactions.

Cycloheptatrienyl Cation

It is an aromatic carbocation having a general formula, [C7 H7]+. It is also known as the aromatic tropylium ion. Its name is derived from the molecule tropine, which is a seven membered carbon atom ring. Cycloheptatriene or tropylidene was first synthesized from tropine.

Stability of Vinyl Carbocation

Carbocations are positively charged carbon atoms. It is also known as a carbonium ion.

Step by step

Solved in 4 steps