Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter1: Introduction And Goals Of The Firm

Section: Chapter Questions

Problem 2.5CE: Energy entrepreneur T. Boone Pickens has proposed converting the trucking fleet in the United States...

Related questions

Question

Can you show to do this

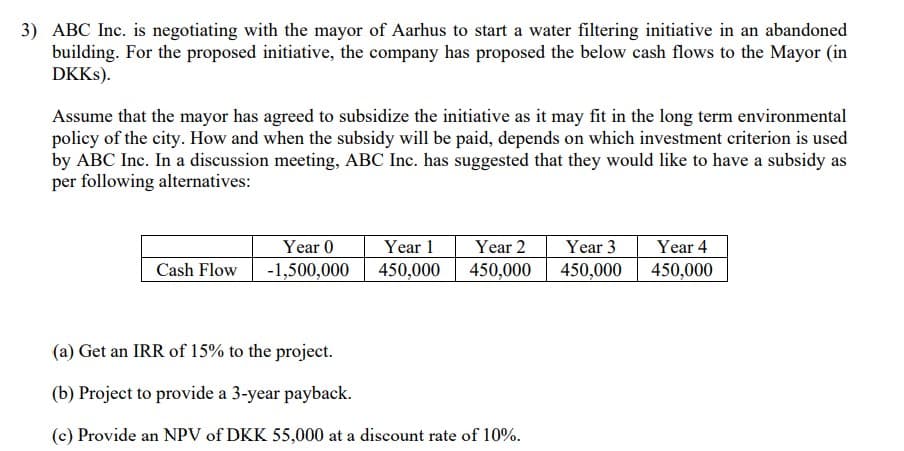

Transcribed Image Text:3) ABC Inc. is negotiating with the mayor of Aarhus to start a water filtering initiative in an abandoned

building. For the proposed initiative, the company has proposed the below cash flows to the Mayor (in

DKKS).

Assume that the mayor has agreed to subsidize the initiative as it may fit in the long term environmental

policy of the city. How and when the subsidy will be paid, depends on which investment criterion is used

by ABC Inc. In a discussion meeting, ABC Inc. has suggested that they would like to have a subsidy as

per following alternatives:

Year 0

Year 1

Year 2

Year 3

Year 4

Cash Flow

-1,500,000

450,000

450,000

450,000

450,000

(a) Get an IRR of 15% to the project.

(b) Project to provide a 3-year payback.

(c) Provide an NPV of DKK 55,000 at a discount rate of 10%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning