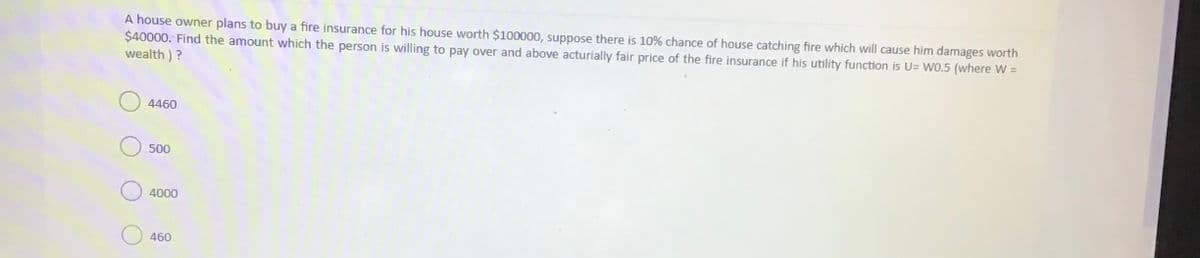

A house owner plans to buy a fire insurance for his house worth $100000, suppose there is 10% chance of house catching fire which will cause him damages worth $40000. Find the amount which the person is willing to pay over and above acturially fair price of the fire insurance if his utility function is U= W0.5 (where W = wealth )? 4460 500 O 4000 460

A house owner plans to buy a fire insurance for his house worth $100000, suppose there is 10% chance of house catching fire which will cause him damages worth $40000. Find the amount which the person is willing to pay over and above acturially fair price of the fire insurance if his utility function is U= W0.5 (where W = wealth )? 4460 500 O 4000 460

Chapter14: Property Transactions: Determination Of Gain Or Loss And Basis Considerations

Section: Chapter Questions

Problem 32P

Related questions

Question

Asap....

Transcribed Image Text:A house owner plans to buy a fire insurance for his house worth $100000, suppose there is 10% chance of house catching fire which will cause him damages worth

$40000. Find the amount which the person is willing to pay over and above acturially fair price of the fire insurance if his utility function is U= WO.5 (where W =

wealth )?

4460

500

4000

460

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning