Chapter7: Losses—deductions And Limitations

Section: Chapter Questions

Problem 92TPC

Related questions

Question

What is the balance of Gabriella’s $3000 after 8 years?

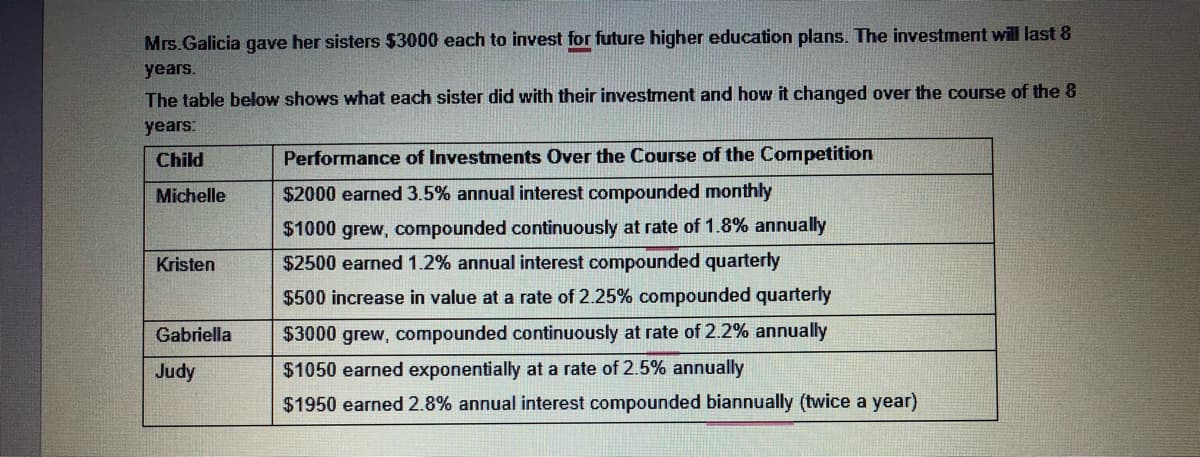

Transcribed Image Text:Mrs.Galicia gave her sisters $3000 each to invest for future higher education plans. The investment will last 8

years.

The table below shows what each sister did with their investment and how it changed over the course of the 8

years:

Child

Performance of Investments Over the Course of the Competition

Michelle

$2000 earned 3.5% annual interest compounded monthly

$1000 grew, compounded continuously at rate of 1.8% annualy

$2500 earned 1.2% annual interest compounded quarterly

Kristen

$500 increase in value at a rate of 2.25% compounded quarterly

Gabriella

$3000 grew, compounded continuously at rate of 2.2% annually

Judy

$1050 earned exponentially at a rate of 2.5% annually

$1950 earned 2.8% annual interest compounded biannually (twice a year)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning