(a) If Pena Company requires a 9% return on its investments, what is the net present value of this investment? (PV of $1. FV of $1. PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your present value factor to 4 decimals.) (b) Based on net present value, should Pena Company make this investment?

(a) If Pena Company requires a 9% return on its investments, what is the net present value of this investment? (PV of $1. FV of $1. PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your present value factor to 4 decimals.) (b) Based on net present value, should Pena Company make this investment?

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 13E: Buena Vision Clinic is considering an investment that requires an outlay of 600,000 and promises a...

Related questions

Question

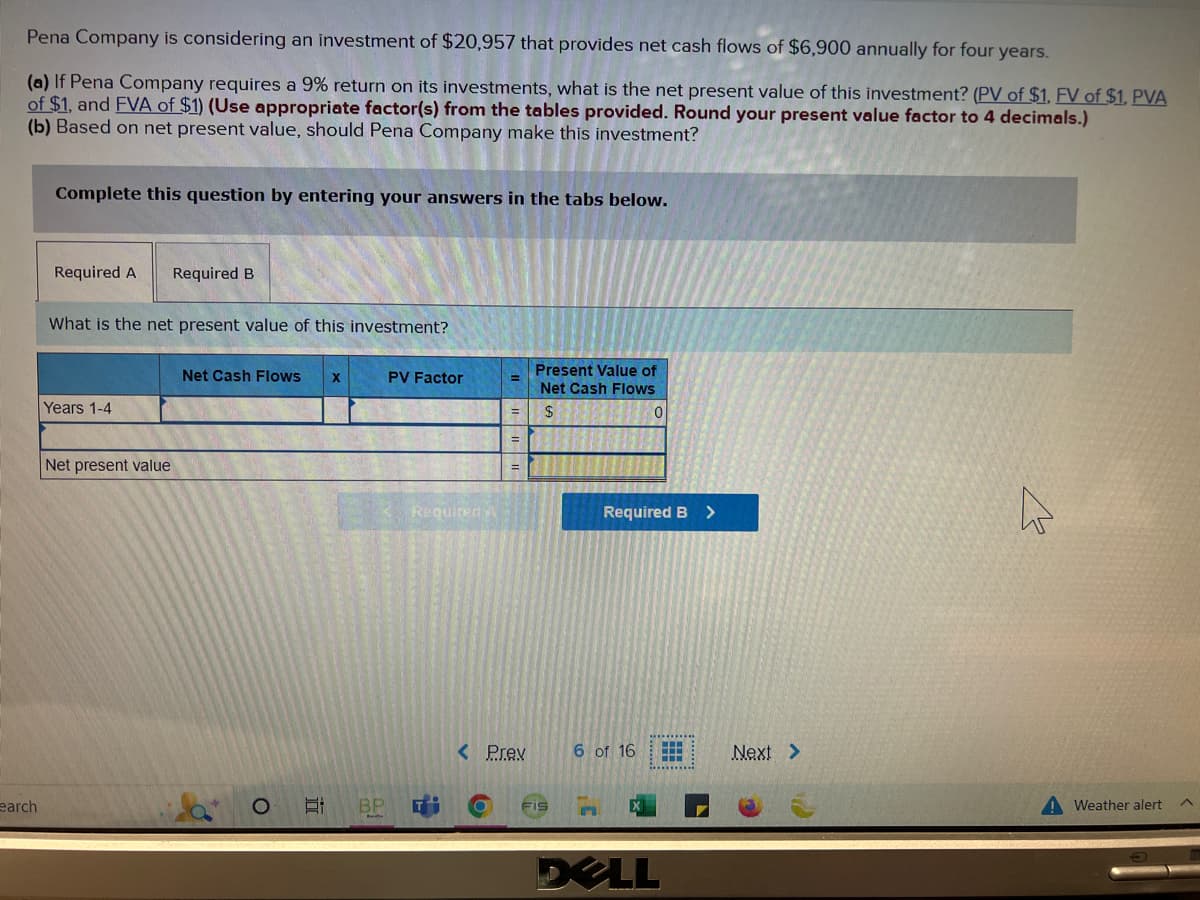

Pena company is considering an investment of $20,957 that provides net cash flows of $6900 annually for four years.

Transcribed Image Text:Pena Company is considering an investment of $20,957 that provides net cash flows of $6,900 annually for four years.

(a) If Pena Company requires a 9% return on its investments, what is the net present value of this investment? (PV of $1, FV of $1. PVA

of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your present value factor to 4 decimals.)

(b) Based on net present value, should Pena Company make this investment?

earch

Complete this question by entering your answers in the tabs below.

Required A

What is the net present value of this investment?

Years 1-4

Required B

Net present value

Net Cash Flows

O Et

X

BP

PV Factor

Required

< Prev

Present Value of

Net Cash Flows

$

FIS

0

n

Required B >

6 of 16 www

DELL

Next >

K

A Weather alert

Transcribed Image Text:oped

Book

Mc

Graw

Hill

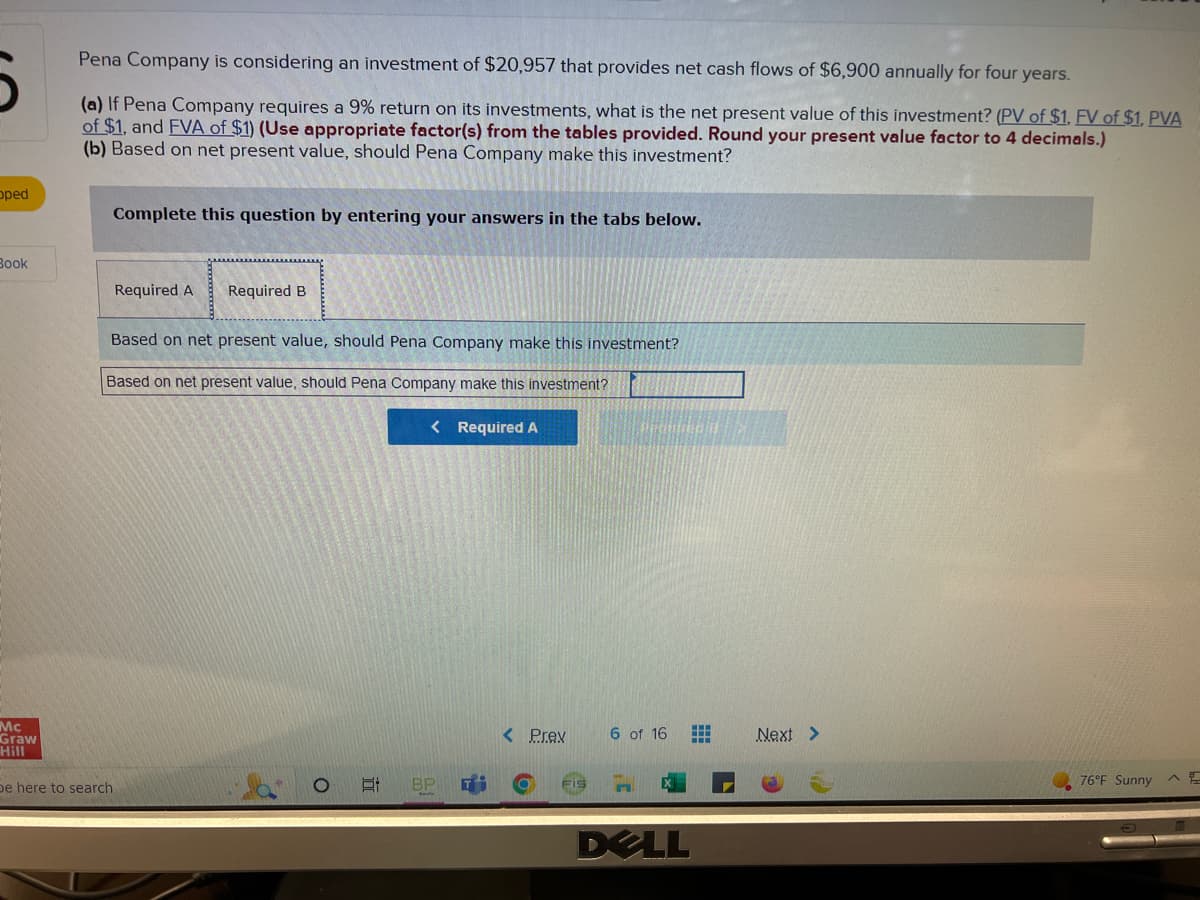

Pena Company is considering an investment of $20,957 that provides net cash flows of $6,900 annually for four years.

(a) If Pena Company requires a 9% return on its investments, what is the net present value of this investment? (PV of $1. FV of $1. PVA

of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your present value factor to 4 decimals.)

(b) Based on net present value, should Pena Company make this investment?

Complete this question by entering your answers in the tabs below.

be here to search

Required A Required B

Based on net present value, should Pena Company make this investment?

Based on net present value, should Pena Company make this investment?

Et

< Required A

BP

< Prev

FIS

6 of 16

DELL

Next >

76°F Sunny

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT