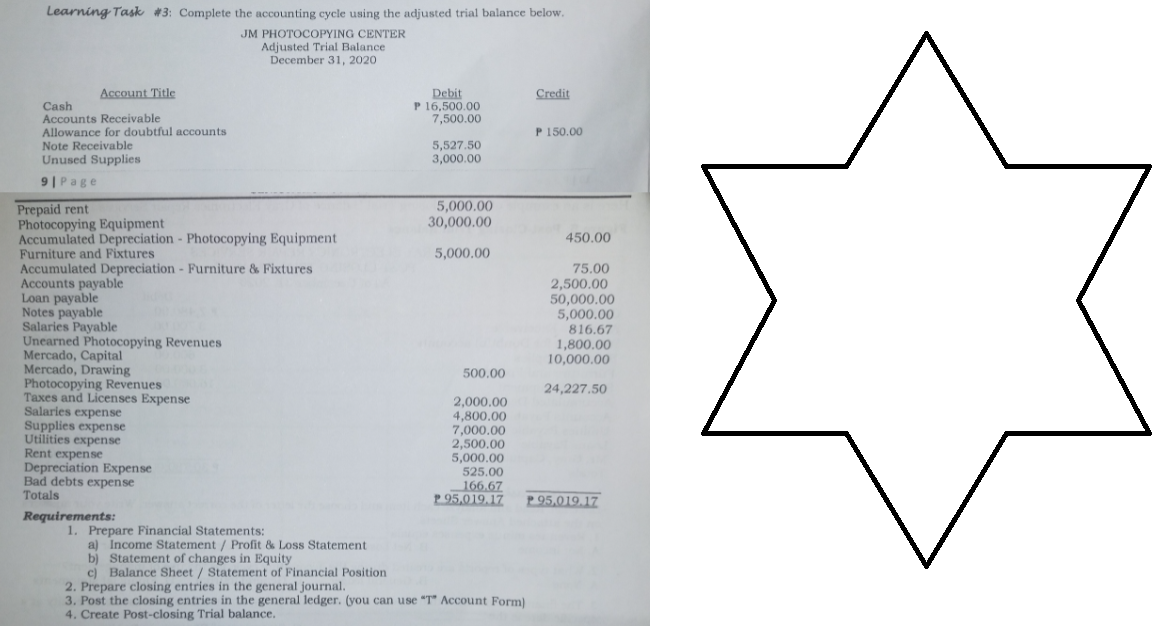

Learning Task #3: Complete the accounting cycle using the adjusted trial balance below. JM PHOTOCOPYING CENTER Adjusted Trial Balance December 31, 2020 Account Title Debit Credit P 16,500.00 Cash Accounts Receivable 7,500.00 Allowance for doubtful accounts. P 150.00 Note Receivable 5,527.50 Unused Supplies 3,000.00 9| Page Prepaid rent 5,000.00 Photocopying Equipment 30,000.00 Accumulated Depreciation - Photocopying Equipment Furniture and Fixtures 5,000.00 Accumulated Depreciation - Furniture & Fixtures Accounts payable Loan payable Notes payable Salaries Payable Unearned Photocopying Revenues Mercado, Capital Mercado, Drawing Photocopying Revenues Taxes and Licenses Expense Salaries expense Supplies expense Utilities expense Rent expense Depreciation Expense Bad debts expense Totals Requirements: 450.00 75.00 2,500.00 50,000.00 5,000.00 816.67 1,800.00 10,000.00 500.00 24,227.50 2,000.00 4,800.00 7,000.00 2,500.00 5,000.00 525.00 166.67 P95,019.17 P95.019.17 1. Prepare Financial Statements: a) Income Statement / Profit & Loss Statement b) Statement of changes in Equity c) Balance Sheet / Statement of Financial Position 2. Prepare closing entries in the general journal. 3. Post the closing entries in the general ledger. (you can use "T" Account Form)

Learning Task #3: Complete the accounting cycle using the adjusted trial balance below. JM PHOTOCOPYING CENTER Adjusted Trial Balance December 31, 2020 Account Title Debit Credit P 16,500.00 Cash Accounts Receivable 7,500.00 Allowance for doubtful accounts. P 150.00 Note Receivable 5,527.50 Unused Supplies 3,000.00 9| Page Prepaid rent 5,000.00 Photocopying Equipment 30,000.00 Accumulated Depreciation - Photocopying Equipment Furniture and Fixtures 5,000.00 Accumulated Depreciation - Furniture & Fixtures Accounts payable Loan payable Notes payable Salaries Payable Unearned Photocopying Revenues Mercado, Capital Mercado, Drawing Photocopying Revenues Taxes and Licenses Expense Salaries expense Supplies expense Utilities expense Rent expense Depreciation Expense Bad debts expense Totals Requirements: 450.00 75.00 2,500.00 50,000.00 5,000.00 816.67 1,800.00 10,000.00 500.00 24,227.50 2,000.00 4,800.00 7,000.00 2,500.00 5,000.00 525.00 166.67 P95,019.17 P95.019.17 1. Prepare Financial Statements: a) Income Statement / Profit & Loss Statement b) Statement of changes in Equity c) Balance Sheet / Statement of Financial Position 2. Prepare closing entries in the general journal. 3. Post the closing entries in the general ledger. (you can use "T" Account Form)

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter5: Accounting Systems

Section: Chapter Questions

Problem 1PA: Sage Learning Centers was established on July 20, 2016, to provide educational services. The...

Related questions

Question

Follow the instructions. Typewritten for an upvote. No upvote for handwritten. PLEASE SKIP IF YOU HAVE ALREADY DONE THIS. Thank you

Transcribed Image Text:Learning Task #3: Complete the accounting cycle using the adjusted trial balance below.

JM PHOTOCOPYING CENTER

Adjusted Trial Balance

December 31, 2020

Account Title

Debit

Credit

Cash

P 16,500.00

Accounts Receivable

7,500.00

Allowance for doubtful accounts

P 150.00

Note Receivable

5,527.50

Unused Supplies

3,000.00

9| Page

Prepaid rent

5,000.00

Photocopying Equipment

30,000.00

Accumulated Depreciation - Photocopying Equipment

Furniture and Fixtures.

5,000.00

Accumulated Depreciation - Furniture & Fixtures

Accounts payable

Loan payable

Notes payable

Salaries Payable

Unearned Photocopying Revenues

Mercado, Capital

Mercado, Drawing

Photocopying Revenues

Taxes and Licenses Expense

Salaries expense

Supplies expense

Utilities expense

Rent expense

Depreciation Expense

Bad debts expense

Totals

Requirements:

450.00

75.00

2,500.00

50,000.00

5,000.00

816.67

1,800.00

10,000.00

24,227.50

P95.019.17

500.00

2,000.00

4,800.00

7,000.00

2,500.00

5,000.00

525.00

166.67

P95,019.17

1. Prepare Financial Statements:

a) Income Statement / Profit & Loss Statement

b) Statement of changes in Equity

c) Balance Sheet / Statement of Financial Position

2. Prepare closing entries in the general journal.

3. Post the closing entries in the general ledger. (you can use "T" Account Form)

4. Create Post-closing Trial balance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning