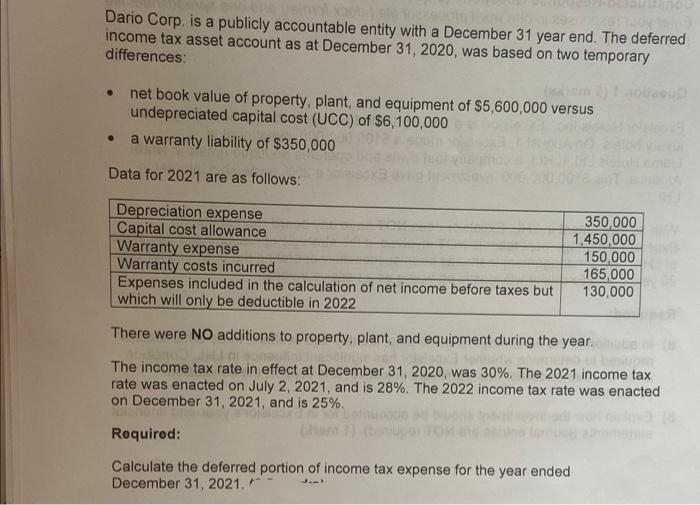

Dario Corp. is a publicly accountable entity with a December 31 year end. The deferred income tax asset account as at December 31, 2020, was based on two temporary differences: ● net book value of property, plant, and equipment of $5,600,000 versus undepreciated capital cost (UCC) of $6,100,000 ● a warranty liability of $350,000 Data for 2021 are as follows: 350,000 1,450,000 Depreciation expense Capital cost allowance Warranty expense Warranty costs incurred 150,000 165,000 130,000 Expenses included in the calculation of net income before taxes but which will only be deductible in 2022 There were NO additions to property, plant, and equipment during the year. The income tax rate in effect at December 31, 2020, was 30%. The 2021 income tax rate was enacted on July 2, 2021, and is 28%. The 2022 income tax rate was enacted on December 31, 2021, and is 25%. Required: Calculate the deferred portion of income tax expense for the year ended December 31, 2021.

Dario Corp. is a publicly accountable entity with a December 31 year end. The deferred income tax asset account as at December 31, 2020, was based on two temporary differences: ● net book value of property, plant, and equipment of $5,600,000 versus undepreciated capital cost (UCC) of $6,100,000 ● a warranty liability of $350,000 Data for 2021 are as follows: 350,000 1,450,000 Depreciation expense Capital cost allowance Warranty expense Warranty costs incurred 150,000 165,000 130,000 Expenses included in the calculation of net income before taxes but which will only be deductible in 2022 There were NO additions to property, plant, and equipment during the year. The income tax rate in effect at December 31, 2020, was 30%. The 2021 income tax rate was enacted on July 2, 2021, and is 28%. The 2022 income tax rate was enacted on December 31, 2021, and is 25%. Required: Calculate the deferred portion of income tax expense for the year ended December 31, 2021.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter18: Accounting For Income Taxes

Section: Chapter Questions

Problem 5MC: At the beginning of 2019, Conley Company purchased an asset at a cost of 10,000. For financial...

Related questions

Question

5

Transcribed Image Text:Deimol xapb

Thow

Dario Corp. is a publicly accountable entity with a December 31 year end. The deferred

income tax asset account as at December 31, 2020, was based on two temporary

differences:

UD

net book value of property, plant, and equipment of $5,600,000 versus

undepreciated capital cost (UCC) of $6,100,000

● a warranty liability of $350,000

Data for 2021 are as follows:

350,000

Depreciation expense

Capital cost allowand

Warranty expense

Warranty costs incurred

1,450,000

150,000

165,000

130,000

Expenses included in the calculation of net income before taxes but

which will only be deductible in 2022

There were NO additions to property, plant, and equipment during the year.

The income tax rate in effect at December 31, 2020, was 30%. The 2021 income tax

rate was enacted on July 2, 2021, and is 28%. The 2022 income tax rate was enacted

on December 31, 2021, and is 25%.

TOR

Required:

Calculate the deferred portion of income tax expense for the year ended

December 31, 2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning