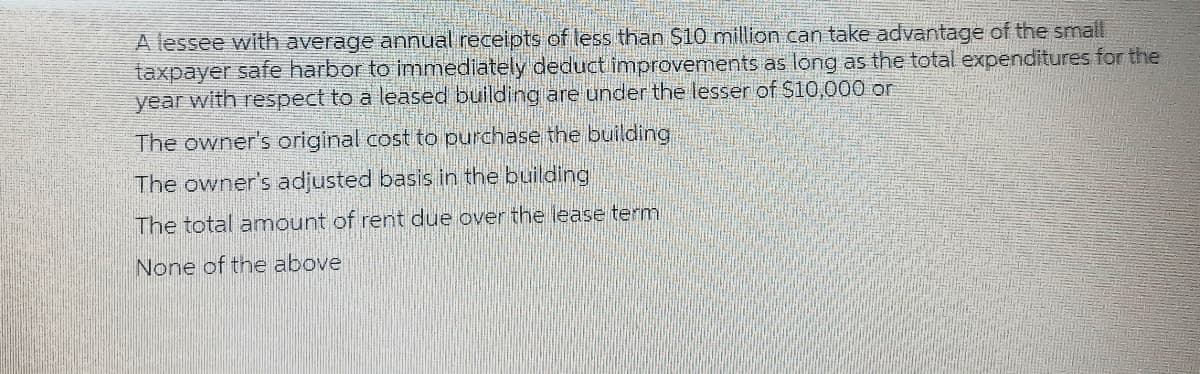

A lessee with average annual receipts of less than S10 million can take advantage of the small taxpayer safe harbor to immediately deduct improvements as long as the total expenditures for the year with respect to a leased building are under the lesser of S10,000 or The owner's original cost to purchase the building The owner's adjusted basis in the building The total amount of rent due over the lease term None of the above

A lessee with average annual receipts of less than S10 million can take advantage of the small taxpayer safe harbor to immediately deduct improvements as long as the total expenditures for the year with respect to a leased building are under the lesser of S10,000 or The owner's original cost to purchase the building The owner's adjusted basis in the building The total amount of rent due over the lease term None of the above

Chapter4: Gross Income: Concepts And Inclusions

Section: Chapter Questions

Problem 40P

Related questions

Question

100%

Please Solve In 15mins I will Thumbs-up

Transcribed Image Text:A lessee with average annual receipts of less than $10 million can take advantage of the small

taxpayer safe harbor to immediately deduct improvements as long as the total expenditures for the

year with respect to a leased building are under the lesser of $10,000 or

The owner's original cost to purchase the building

The owner's adjusted basis in the building

The total amount of rent due over the lease term

None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT