A local car dealer is advertising a standard 24-month lease of $900 per month for its new XT 3000 series sports car. The standard lease requires a down payment of $3, initial deposit now. The first lease payment is due at the beginning of month 1. In addition, the company offers a 24-month lease plan that has a single up-front payment initial deposit of $800. Under both options, the initial deposit will be refunded at the end of month 24. Assume an interest rate of 6% compounded monthly. With the pres option is preferred? The present worth of the standard lease option is $ . (Round to the nearest dollar.)

A local car dealer is advertising a standard 24-month lease of $900 per month for its new XT 3000 series sports car. The standard lease requires a down payment of $3, initial deposit now. The first lease payment is due at the beginning of month 1. In addition, the company offers a 24-month lease plan that has a single up-front payment initial deposit of $800. Under both options, the initial deposit will be refunded at the end of month 24. Assume an interest rate of 6% compounded monthly. With the pres option is preferred? The present worth of the standard lease option is $ . (Round to the nearest dollar.)

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 1P

Related questions

Question

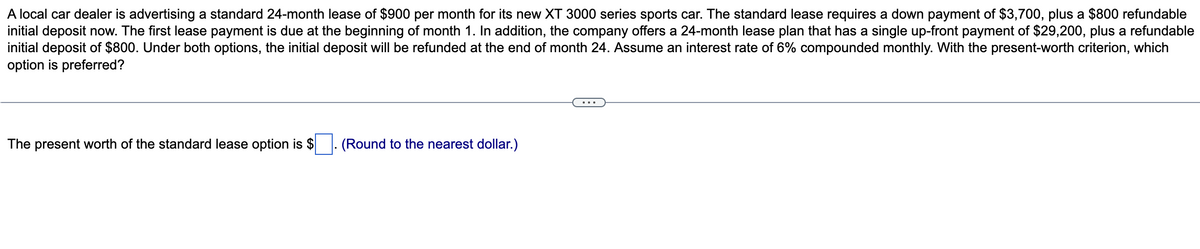

Transcribed Image Text:A local car dealer is advertising a standard 24-month lease of $900 per month for its new XT 3000 series sports car. The standard lease requires a down payment of $3,700, plus a $800 refundable

initial deposit now. The first lease payment is due at the beginning of month 1. In addition, the company offers a 24-month lease plan that has a single up-front payment of $29,200, plus a refundable

initial deposit of $800. Under both options, the initial deposit will be refunded at the end of month 24. Assume an interest rate of 6% compounded monthly. With the present-worth criterion, which

option is preferred?

The present worth of the standard lease option is $

(Round to the nearest dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning